Can Buy Now, Pay Later Save Physical Retail?

Can buy now, pay later (BNPL) save department stores, and physical retail in general? It’s a bet that some are making as they look to any and all tactics to drive sales and new traffic into their physical or virtual storefronts.

“Customers, particularly younger ones, were asking for a buy now, pay later option,” Macy’s CEO Jeff Gennette said in a call with analysts last fall. “If we didn’t have it, they might have gone elsewhere,” he added, noting that 40 percent of shoppers using Klarna (which Macy’s invested in and began offering in-store last year) are new to Macy’s, and 45 percent are under 40 years old. By contrast, slightly more than a quarter of existing Macy’s customers are under 40.

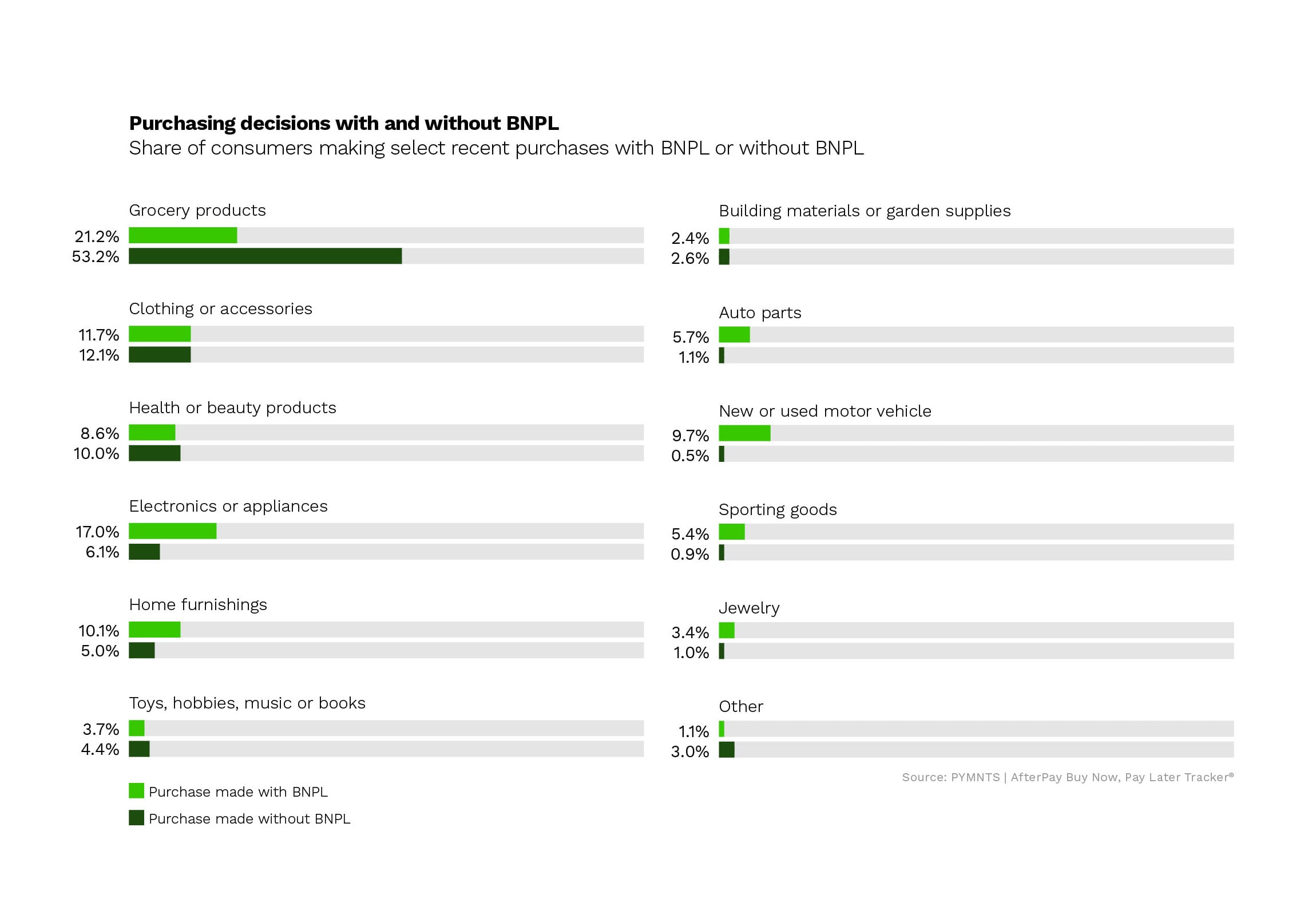

Moreover, a quick glance at the data from PYMNTS’ most recent edition of the Buy Now, Pay Later Tracker clearly shows the payment form factor is rapidly on the rise, as some 48 percent of consumers now report they would not shop with a merchant that did not offer credit or some form of BNPL at the point of sale. And that growing preference is seen most acutely in specific verticals: 71 percent of BNPL purchases on Black Friday last year, for example, were apparel-related. Sporting goods, jewelry, home furnishings and electronics were also areas in which BNPL gained big ground among consumers in 2020.

And a separate PYMNTS study in March of 2020 and September of 2020 of a national sample of 15,000 U.S. consumers demonstrated that BNPL is on a steady incline. By the end of that six-month period, nearly a third of merchants had resolved to add the BNPL option by the end of 2021, as the payment method proved capable of lifting consumer loyalty and conversions by as much as 30 percent.

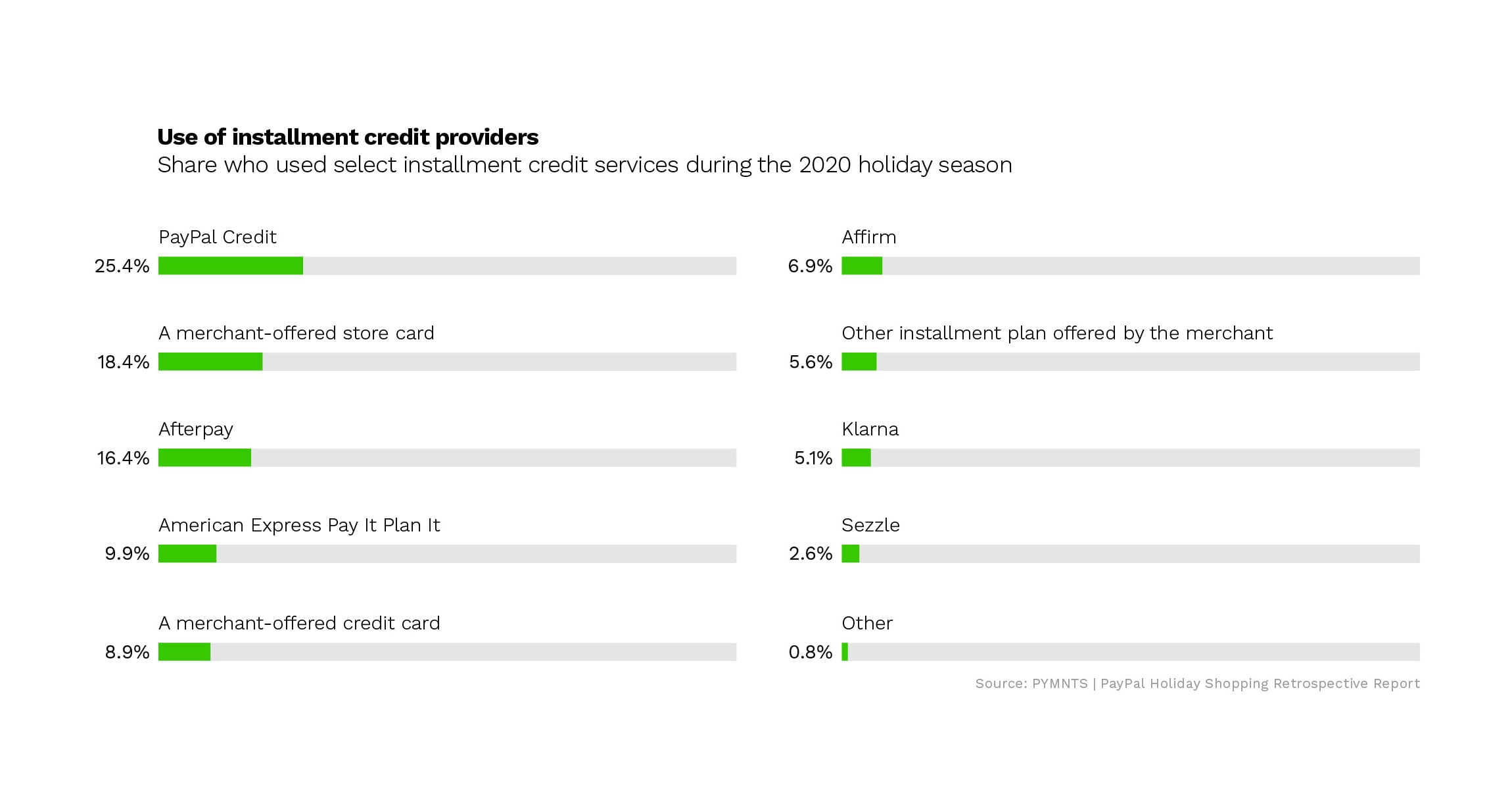

By the ending days of 202o, according to PYMNTS/PayPal’s latest holiday shopping report, 47 percent of consumers had upped their use of installment credit options. Of those BNPL-enthused consumers, 25 percent used PayPal Credit, making it the most popular offering. Merchant-offered cards followed at 18 percent, and Afterpay came next at 16 percent.

By the ending days of 202o, according to PYMNTS/PayPal’s latest holiday shopping report, 47 percent of consumers had upped their use of installment credit options. Of those BNPL-enthused consumers, 25 percent used PayPal Credit, making it the most popular offering. Merchant-offered cards followed at 18 percent, and Afterpay came next at 16 percent.

And BNPL players are increasingly looking to expand their range beyond eCommerce. In a recent conversation with Karen Webster, Afterpay Co-founder Nick Molnar said that over two million users have set up an Afterpay card to shop in stores since the offering went live in the fall of 2020. Moreover, he noted, they have learned that increasing their physical presence poses no risk of channel cannibalization, and in fact enhances usage in the digital channel.

“We are seeing that when someone makes a purchase in-store, they actually spend more in the online channel as a result of that decision,” Molnar noted. “So not only are retailers seeing bigger basket sizes and larger average order values with Afterpay as compared to regular cards, but they’re also seeing an increase in actual spend and lifetime value for that customer when both channels are in the mix.”

Regardless of the channel, the race is on for FinTechs to control the field. On the heels of a strong IPO and its first earnings announcement, BNPL firm Affirm’s latest move is the release of a debit card described by CEO Max Levchin as “the anti-credit card.” The goal, he noted, is to combine the trends of growing debit usage and BNPL interest into a single card product to meet consumers’ needs.

The Affirm Card gives people the option to pay for items using their bank account or the post-purchase BNPL feature. Users can instantly convert eligible transactions into BNPL, essentially allowing customers to tap into the service anyplace they want to shop. The Affirm Card has a waiting list for new users and is planning a rollout in the first half of this year.

And Affirm isn’t the only player looking to broaden its market share. Afterpay recently announced that it has inked a deal with Stripe to enable Stripe merchants to switch on BNPL services within minutes for their consumers. Noah Pepper, Stripe’s business lead for APAC, said the goal is to “make it easy and fast for online businesses to offer their customers buy now, pay later. We’ve seen strong demand from users around the world for flexible payment options, and this partnership gives businesses on Stripe an effective tool for capturing more sales and reaching new customers.”

Meanwhile, Swedish BNPL firm Klarna said on Monday (March 1) that it has raised $1 billion in fresh capital, which will go toward its expansion with more retailers. The funding will lift the firm’s valuation to the $31 billion range amid expectations that it will soon go public. Klarna currently serves more than 90 million consumers at 250,000 retail partners in 17 countries, and facilitated $53 billion in purchases last year. “Consumers want transparent products to help them bank, shop and pay that reflect the way they live their lives, not just outdated traditional models,” Klarna Co-founder and CEO Sebastian Siemiatkowski said in the company’s press release.

And BNPL firm Sezzle recently announced that it has closed the books on a record-breaking 2020, with underlying merchant sales (UMS) up 250.8 percent and total income up 272.1 percent year over year. “We are excited about the momentum in our business reflected in the velocity of signups for both consumers and merchants,” Sezzle Co-founder, Executive Chair and CEO Charlie Youakim said in the earnings announcement. He noted that “2021 is off to a good start,” as the firm’s January UMS of $117.8 million was 65 percent above its 2020 average. “We are also pleased to provide UMS guidance for Sezzle to achieve an annualized run rate UMS of US$2.5 billion by the end of 2021,” he added.”