By Bruce McCulloch, Meredith Mommers, & Tyler Garrett1

I. Increased Antitrust Scrutiny of Labor-Related Issues

It is no secret that labor antitrust issues recently have received more attention from the federal antitrust agencies. Wage-fixing and no-poach enforcement actions made major headlines in 2020 and 2021 when, for the first time, the U.S. Department of Justice (“DOJ”) brought criminal charges in wage-fixing2 and no-poach cases3 and took those cases to trial. Non-competes have also ridden the swell of the renewed antitrust agency vigor and interest. For example, in October 2021, the Federal Trade Commission (“FTC”) approved a transaction on the condition that the acquirer was prohibited from entering into or enforcing employee non-competes.4 This trend of increasing scrutiny and enforcement bears greater examination, and an investigation into whether companies have begun adjusting their behavior to lessen antitrust risk.

II. Non-Competes Historically Have Not Attracted Significant Federal Antitrust Attention

Non-compete agreements can arise either in the M&A or in the HR context, as both contexts can involve labor issues. M&A non-competes typically restrict the seller and its affiliates from competing with the buyer, or from soliciting employees of the buyer (commonly known as “non-solicits”), for a period of time after closing. These M&A non-competes are designed to protect the buyer’s substantial investment in the acquisition by preventing the seller from immediately re-entering the business and re-appropriating the goodwill, intellectual property, talent, and relationships that the buyer purchased. As a result, M&A non-competes are reviewed under the rule of reason, and unchallenged precedent and agency policy long have agreed that many M&A non-compete clauses are lawful.5 M&A non-competes are generally enforced if they meet a legitimate business need and are reasonably tailored in terms of product scope, geographic scope, and duration.6 While these are fact-intensive considerations, best practice is to limit the terms of the M&A non-compete to what is reasonably necessary to protect the goodwill and business of the acquired company.

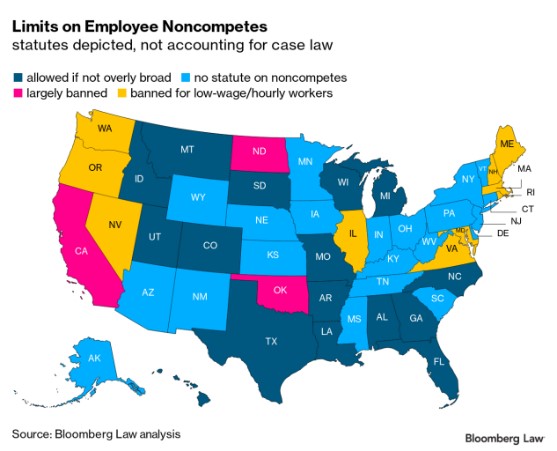

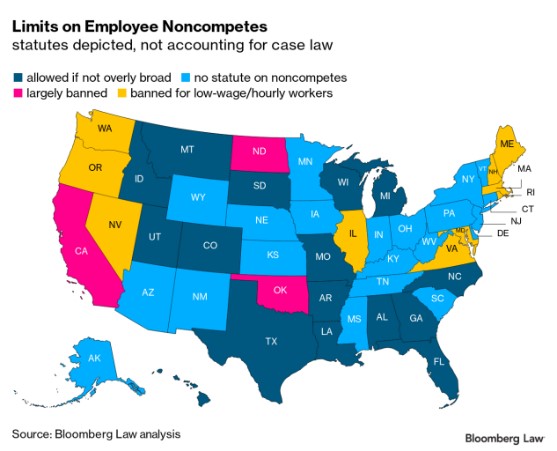

Outside of M&A, non-competes typically take the form of an agreement between an employer and an employee whereby the employee agrees not to work in a similar profession or trade in competition against the employer for a certain period after leaving the company. Common purposes of these HR non-competes are to protect trade secrets or other proprietary information, to protect an employer’s valuable customer relationships, and to preserve the benefits of the costs of employee training.7 HR non-competes are likewise analyzed under the rule of reason8 but carry higher risk of unenforceability under applicable state law—particularly when applied to low-wage workers.9 Neither type of M&A nor HR non-compete has been prosecuted criminally at either the federal or state level.10

Prior to late 2016, labor-focused non-compete agreements and other labor-related antitrust issues did not attract much attention from federal antitrust enforcers. Instead, regulation was often left to the states.11 While most legislative and regulatory actions against HR non-competes continue to occur at the state level, political winds have favored federal pursuit of more aggressive and antitrust-focused policies towards labor-focused non-competes since 2016, when the Trump Administration’s FTC and DOJ issued their Antitrust Guidance for HR Professionals.12 This pursuit has only accelerated since the commencement of the Biden Administration.

III. Recent Federal Enforcement Actions & Policy Statements Suggest Labor-Focused Non-Competes Carry Greater Antitrust Risk

The Biden Administration has repeatedly made it clear that it will scrutinize non-competes closely, in particular as they relate to labor. President Biden himself issued an executive order in 2021 that stressed the importance of using antitrust tools to augment workers’ abilities to switch jobs and negotiate higher salaries.13 The DOJ and FTC, under U.S. Assistant Attorney General (“AAG”) Jonathan Kanter and Chair Lina Khan, have moved in lockstep with this approach. For example, Chair Khan has stated that “the key question is not whether antitrust law and competition policy can or should protect workers as well as consumers, but instead precisely how they can or should do so,” and later answered this question by explaining that the FTC is both “scrutiniz[ing] mergers that may substantially lessen competition in labor markets” and “scrutinizing whether certain terms in employment contracts . . . may violate the law.”14 In addition, recent reports suggest that the FTC will consider a new rule in September 2022 that would prevent companies from implementing and enforcing any HR non-compete—which, if passed, would create a uniform national policy barring HR non-competes.15

AAG Kanter has weighed in as well, explaining that the DOJ’s new partnership with the Department of Labor (and the DOJ’s overall focus on potential labor antitrust violations) came about because “[p]rotecting competition in labor markets is fundamental to the ability of workers to earn just rewards for their work.”16 The Biden Administration’s focus on labor antitrust issues is consistent with the growing movement that does not view consumer welfare as the holy grail of antitrust but favors a more holistic approach—thus considering antitrust a tool to protect workers as well as consumers. As a result, the agencies have set their sights on labor-related non-competes in both the M&A and HR contexts.

On the M&A front, the FTC recently approved a transaction (DaVita-Total Renal Care) under the condition that DaVita was prohibited from entering into or enforcing non-solicit agreements and other employee restrictions.17 In addition, the FTC’s September 2021 study of unreported acquisitions by large technology companies highlighted the prevalence of non-compete clauses in merger agreements, in particular as they relate to founders and key employees of acquired entities,18 and Chair Khan noted that the FTC will increase scrutiny of the use of M&A non-competes in non-reportable transactions.19 And while the DOJ has not recently initiated an enforcement action, in October 2021 then-acting DOJ Antitrust AAG Richard Powers said that the Antitrust Division’s “focus on labor markets extends beyond its cartel program” to “using its civil authority to detect, investigate, and challenge anticompetitive non-compete agreements.”20

The use of HR non-competes, although not yet subject to any notable federal enforcement actions, remains an area of enforcement priority for both agencies. In December 2021, the DOJ and FTC hosted a joint workshop on antitrust in labor markets, where both Chair Khan and AAG Kanter spoke in favor of promoting greater competition in labor markets.21 The workshop’s keynote address came from Tim Wu, President Biden’s top antitrust advisor, in which he emphasized that “President Biden feels very strongly that it’s wrong . . . for any worker, particularly a low wage worker, not to have the freedom to change jobs, look for a better wage” and urged the DOJ and FTC to “take seriously labor markets and the effects of mergers [upon workers].”22 Just two months later, the DOJ filed a statement of interest arguing that the per se rule should be applied to condemn a collection of HR non-competes which prevented a group of anesthesiologists from competing with their employer, the exclusive provider of anesthesiology services to a local hospital.23

IV. Businesses Are Slowly Changing Their Standard Labor-Focused Non-Compete Practices

In light of this greater agency scrutiny of labor antitrust issues, we would expect some companies to have adapted to the increased risk profile associated with labor-focused non-competes and to take one of three approaches: (A) cease including non-solicits in their merger agreements, (B) more narrowly tailor the scope and duration of any labor-focused non-compete provisions to align with procompetitive justifications, or (C) refrain from enforcing existing any such provisions.

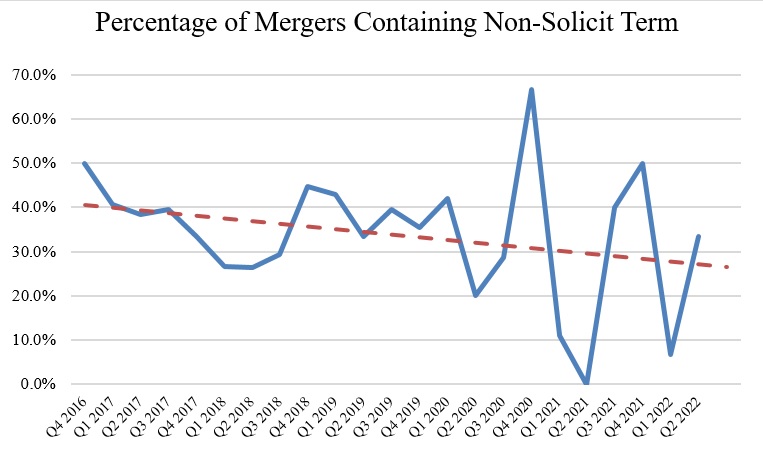

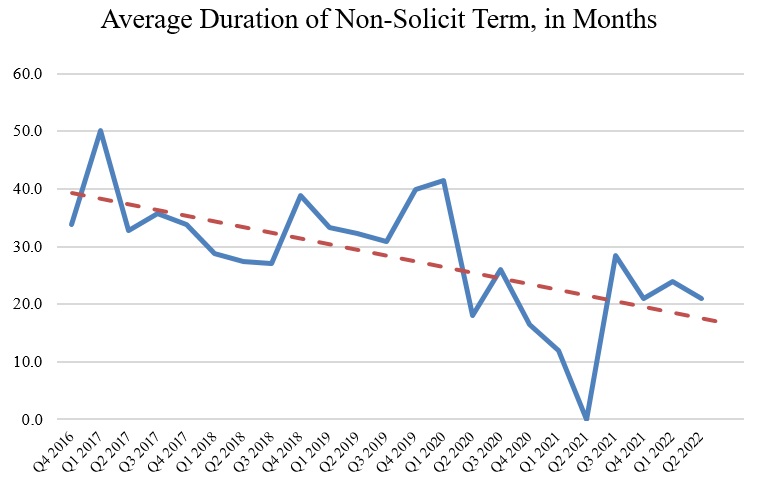

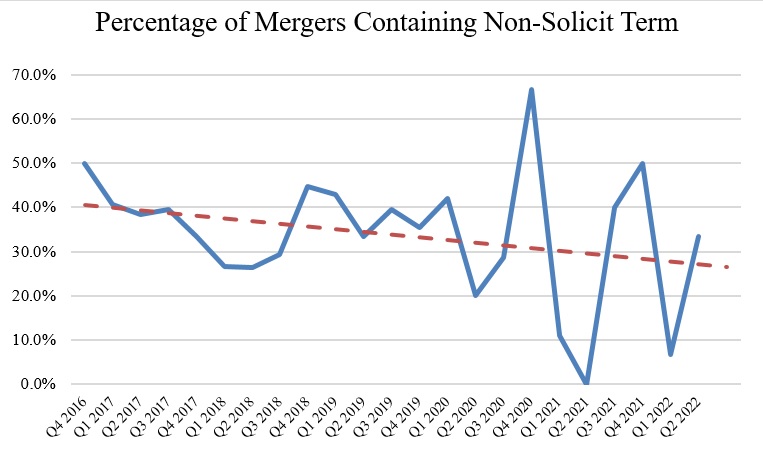

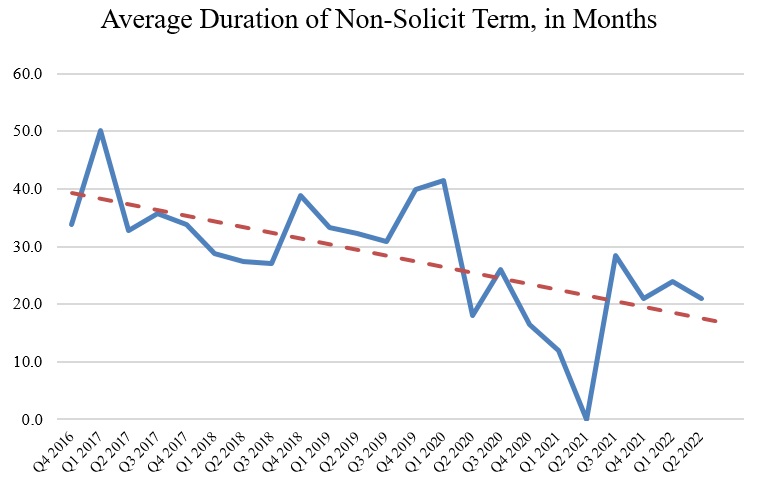

So, how have companies responded? The answer is that firm behavior in the M&A context has shifted slightly away from non-solicits over the 6 years since the DOJ and FTC first promulgated their Antitrust Guidance for HR Professionals in October 2016.24 We gathered data25 from 590 publicly available merger agreements announced on October 1, 2016, through June 30, 2022, where the transaction was a strategic acquisition of a U.S. target with a reported value of greater than the minimum size-of-transaction reportability threshold for the year the transaction was announced.26 The data show that both the percentage of transactions containing a non-solicit term,27 and any such term’s duration, have decreased since 2016.

Although we cannot draw conclusions from this data set about corporate implementation and enforcement of HR non-competes, there is some indication that dominoes are also beginning to fall on non-competes outside the M&A context. In a June 2022 blog post, Microsoft announced it would remove HR non-compete clauses from its U.S. employment agreements for all but its most senior staff and cease enforcing existing non-compete clauses.28 The announcement referenced “concerns that the noncompetition clauses in some U.S. employee agreements . . . feel at odds with our talent principles,”29 and thus the policy change could be as much a public-relations move as an antitrust risk mitigation strategy, but it is unlikely to be a coincidence that Microsoft’s change came amidst increasing federal and state attention on HR non-compete agreements (as well as mounting antitrust scrutiny of big tech generally).

V. Ongoing Antitrust Risk Assessment in Response to Today’s Enforcement Climate Is Essential

Labor antitrust issues, including non-compete agreements, are an enforcement priority for the Biden Administration, and we have seen increased scrutiny over recent years of non-competes in both the M&A and HR contexts. Businesses seem to have taken note, and prevalence of non-solicits in merger agreements is slowly decreasing. Companies will need to continually assess the antitrust risks of including a labor-focused non-compete provision in future M&A and employment agreements in the context of the current enforcement climate. And companies should be prepared to respond to agency concerns about how any non-compete provision is appropriately tailored to the legitimate business objective of the agreement housing the relevant provision.

Click here for a PDF version of the article

1 Bruce McCulloch is a partner in the Antitrust, Competition and Trade and Global Investigations practice groups at Freshfields Bruckhaus Deringer US LLP, where Meredith Mommers is Counsel and Tyler Garrett is an Associate in the Antitrust, Competition and Trade group. All are based in Washington, DC.

2 United States v. Jindal, No. 4:20-cr-00358-ALM-KPJ (E.D. Tex. Dec. 9, 2020).

3 See Superseding Indictment, United States v. Surgical Care Affiliates, LLC (filed July 8, 2021); Indictment, United States v. DaVita, Inc. et al. (filed July 24, 2021, and Nov. 3, 2021).

4 See infra note 17 and accompanying text.

5 See, e.g., Lektro-Vend Corp. v. Vendo Co., 660 F.2d 255, 265 (7th Cir. 1981); Concurring Statement of Christine S. Wilson, In the Matter of DTE Energy Co., Enbridge Inc., and NEXUS Gas Transmission LLC, No. 191-0068 (F.T.C. Sept. 12, 2019), https://www.ftc.gov/system/files/documents/public_statements/1544152/wilson_concurring_statement_dte_9-13-19.pdf.

6 See, e.g., Lektro-Vend Corp., 660 F.2d at 269 (concluding non-compete ancillary to legitimate transaction was lawful because it was reasonable “with respect to time, geographic scope, and product”).

7 See Defiance Hosp. v. Fauster-Cameron, Inc., 344 F. Supp. 2d 1097, 1114 (N.D. Ohio 2004).

8 Like the rule of reason analysis for non-competes ancillary to M&A agreements, non-competes ancillary to employment contracts are generally enforceable under federal law if the restriction is related to a legitimate purpose and is reasonably tailored in the scope of job functions it restricts, its geographic scope, and its duration. See, e.g., Caudill v. Lancaster Bingo Co., 2005 WL 2738930, at *4 (S.D. Ohio Oct. 24, 2005) (citing an “unbroken line” of cases).

9 There is considerable variation in treatment of HR non-competes among the states. For example, California bans HR non-compete clauses except in limited circumstances and 11 other states have banned HR non-competes for low-wage workers, whereas Texas and Florida impose few restrictions on the use of HR non-compete provisions and Alabama considers a restriction of two years or less to be presumptively reasonable. For further detail, see the map below, sourced from Chris Marr, Red State Lawmakers Look at Noncompete Bans for Low-Wage Workers, Bloomberg L. (Feb. 9, 2022), https://news.bloomberglaw.com/daily-labor-report/red-state-lawmakers-look-at-noncompete-bans-for-low-wage-workers.

10 However, we note that Colorado has recently added criminal penalties to its HR non-compete law. See C.R.S. 8-2-113 (2022).

11 For example, in June 2016, the Illinois-based sandwich chain Jimmy John’s announced it would stop including non-compete agreements barring low-level employees from taking jobs with competitors for two years following the employee’s departure. This change in policy was announced a month after the Illinois Attorney General’s Office filed a lawsuit against Jimmy John’s over its non-compete agreements and followed an investigation by the New York Attorney General that began in December 2014. See Sara Whitten, Jimmy John’s drops noncompete clauses following settlement, CNBC (June 22, 2016), https://www.cnbc.com/2016/06/22/jimmy-johns-drops-non-compete-clauses-following-settlement.html.

12 U.S. DEP’T OF JUSTICE & FED. TRADE COMM’N, ANTITRUST GUIDANCE FOR HUMAN RESOURCE PROFESSIONALS (Oct. 2016), https://www.justice.gov/atr/file/903511/download.

13 Exec. Order No. 14,036, 86 Fed. Reg. 36,987 (2021) § 5(g) (“To address agreements that may unduly limit workers’ ability to change jobs, the Chair of the FTC is encouraged to consider working with the rest of the Commission to exercise the FTC’s statutory rulemaking authority under the Federal Trade Commission Act to curtail the unfair use of non-compete clauses and other clauses or agreements that may unfairly limit worker mobility.”).

14 Lina Khan, Remarks of Chair Lina M. Khan at the Joint Workshop of the Federal Trade Commission and the Department of Justice (Dec. 6, 2021), https://www.ftc.gov/system/files/documents/public_statements/1598791/remarks_of_chair_lina_m_khan_at_the_joint_labor_workshop_final_139pm.pdf.

15 FTC Commissioners Expected to Consider Noncompete Rule in September, CAPITOL FORUM (Aug. 25, 2022), https://library.thecapitolforum.com/docs/63dn8fnec2y9?u=51hp5p13k122.

16 Press Release, U.S. Dep’t of Justice, Departments of Justice and Labor Strengthen Partnership to Protect Workers (Mar. 10, 2022), https://www.justice.gov/opa/pr/departments-justice-and-labor-strengthen-partnership-protect-workers. More recently, the FTC and DOJ have each entered into memoranda of understanding with the National Labor Relations Board to work together to promote competitive U.S. labor markets and challenge unfair practices that harm workers. See Memorandum of Understanding Between the Federal Trade Commission (FTC) and the National Labor Relations Board (NLRB) Regarding Information Sharing, Cross-Agency Training, and Outreach in Areas of Common Regulatory Interest (July 19, 2022), https://www.ftc.gov/system/files/ftc_gov/pdf/ftcnlrb%20mou%2071922.pdf; Memorandum of Understanding Between the U.S. Department of Justice and the National Labor Relations Board (July 26, 2022), https://www.justice.gov/opa/press-release/file/1522096/download.

17 Press Release, Fed. Trade Comm’n, FTC Imposes Strict Limits on DaVita, Inc.’s Future Mergers Following Proposed Acquisition of Utah Dialysis Clinics (Oct. 25, 2021), https://www.ftc.gov/legal-library/browse/cases-proceedings/2110013-davita-inc-total-renal-care-inc-matter. The FTC alleged that DaVita’s acquisition of the University of Utah Health’s dialysis clinics would reduce competition in outpatient dialysis services in the Provo, Utah market. Under the consent decree, in addition to divesting three Provo-area dialysis clinics to Sanderling Renal Services and providing one year of transition services to Sanderling, DaVita was prohibited from entering into or enforcing any non-compete agreements with physicians employed by the University that would restrict their ability to work at a clinic operated by a competitor of DaVita, from entering into any agreement that restricts Sanderling from soliciting DaVita’s employees, and from directly soliciting patients who receive services from the divested clinics for two years.

18 Press Release, Fed. Trade Comm’n, FTC Staff Presents Report on Nearly a Decade of Unreported Acquisitions by the Biggest Technology Companies (Sept. 15, 2021), https://www.ftc.gov/news-events/news/press-releases/2021/09/ftc-staff-presents-report-nearly-decade-unreported-acquisitions-biggest-technology-companies.

19 Lina Khan, Remarks of Chair Lina M. Khan Regarding Non-HSR Reported Acquisitions by Select Technology Platforms (Sept. 15, 2021), https://www.ftc.gov/system/files/documents/public_statements/1596332/remarks_of_chair_lina_m_khan_regarding_non-hsr_reported_acquisitions_by_select_technology_platforms.pdf.

20 Richard A. Powers, Acting Assistant Att’y Gen., U.S. Dep’t of Justice Antitrust Div., Remarks at Fordham’s 48th Annual Conference on International Antitrust Law and Policy (Oct. 1, 2021), https://www.justice.gov/opa/speech/acting-assistant-attorney-general-richard-powers-antitrust-division-delivers-remarks.

21 Making Competition Work: Promoting Competition in Labor Markets, Day 1 Transcript at 1–9 (Dec. 6, 2022) (Jonathan Kanter and Lina Khan), https://www.ftc.gov/system/files/documents/public_events/1597830/ftc-doj_day_1_december_6_2021.pdf.

22 Making Competition Work: Promoting Competition in Labor Markets, Day 2 Transcript at 22–26 (Dec. 7, 2022) (Tim Wu), https://www.ftc.gov/system/files/documents/public_events/1597830/ftc_doj_day_2_december_7_2021.pdf.

23 See Statement of Interest of the United States, Samuel Beck v. Pickert Med. Grp., P.C., Case No. 21-cv-02092 (Nev. Dist. filed Feb. 25, 2022). The DOJ argued the non-compete provision was a horizontal agreement among actual and potential competitors and that the per se rule should apply.

24 See supra note 12.

25 We used the Deal Point Data database to collect and refine our data set. Not included in our analysis are any non-compete or non-solicit agreements that may be ancillary to a transaction but were not reflected within the terms of the merger agreement itself.

26 Thus, the minimum thresholds were: $78.2M (2016); $80.8M (2017); $84.4M (2018); $90M (2019); $94M (2020); $92M (2021); and $101M (2022). Although exemptions may apply, it is likely these transactions were notified to the FTC and DOJ pursuant to the Hart-Scott-Rodino Act.

27 Deal Point Data defines a non-solicit term as a term setting forth the number of months following completion of the transaction during which the seller(s) of the target are precluded from soliciting former colleagues to leave the acquirer.

28 Amy Pannoni & Amy Coleman, Microsoft Announces Four New Employee Workforce Initiatives, Microsoft Blog (June 8, 2022), https://blogs.microsoft.com/on-the-issues/2022/06/08/microsoft-announces-four-new-employee-workforce-initiatives/.

29 Id.