By María Fernanda Viecens1

Sugar: A History of Intervention, Protectionism, and Cartels

The world sugar industry is characterized by strong regulations and protection by the State. These regulations and special protection date back several decades, and can be observed on both sides of the Atlantic. In fact, this sector has often been flagged as being among the most subsidized and distorted of all agricultural markets.2 Calls by the state to intervene in these markets have been conditioned by various public policy goals, where goals such as promoting the sector or supporting small agricultural producers often converge.

This sector also stands out for the number of sanctions, in several jurisdictions, it has accrued over various cartel charges. Prominent examples include Colombia,3 Spain,4,5 and Mexico.6

In Colombia’s case, the Superintendencia de Industria y Comercio (SIC) launched a probe into the sugar industry over a suspected cartel to block sugar imports and to allocate production and supply quotas. The probe led to fines being imposed on three producer associations (ASOCAÑA, CIAMSA, and DICSA) and 12 sugar mills, as well as 14 individuals. The SIC concluded that “the persons investigated conceived and deliberately executed an anticompetitive, illegal, concerted, coordinated, and ongoing strategy aiming to block sugar imports into Colombia generally, in order to prevent an increase in supply and a decrease in domestic prices paid by consumers and businesses.” Charges were presented for forming a business cartel in order to block imports. As for the allocation of production and supply quotas, while the SIC did present cartel charges against ASOCAÑA and the 12 aforementioned sugar mills, the regulator ultimately had to drop the investigation as the conduct had originated in a legal public policy.7

In Mexico’s case, market regulator COFECE imposed fines for engaging in monopolistic practices (cartel formation), totalling $88.8 million pesos (approximately 4.2 million USD) on companies Zucarmex, Ingenio de Huixtla, Proveedora de Alimentos México, Azúcar Dominó de México, Central Motzorongo, Impulsora Azucarera del Trópico, and Promotora Azucarera, as well as 10 individuals, and the National Chamber of Alcohol and Sugar Industries (Cámara Nacional de las Industrias Alcoholera y Azucarera, (CNIAA)) for having participated in and aided the cartelization scheme. COFECE detected that, for 42 days in 2013-2014, this group of companies involved in the production, distribution, and sale of sugar in Mexico had agreed to artificially raise the price of standard and refined sugar, and had forced restrictions on the amount sold.8

Finally, Costa Rica offers a very special case from the standpoint of Competition Law: It is the law itself, (the Organic Law of Agriculture and the Sugar Cane Industry, Law N°7818 (Ley Orgánica de la Agricultura e Industria de la Caña de Azúcar, Ley N°7818)) which establishes a closed, horizontally and vertically integrated organization that coordinates the actions of all players in Costa Rica’s sugar cane industry. This implies that, fundamentally, the sector functions as a production cartel, with coordination between sugar mills and production allocation under a National Production Quota for sugar, leading to consumers paying higher prices. The National Production QUota is calculated by the Industrial Agricultural Sugar Cane League (Liga Agrícola Industrial de la Caña de Azúcar (LAICA)), which also sets prices and implements the production allocations among the sugar mills.

In fact, the OECDs evaluation during Costa Rica’s admission process highlighted that there remain 5 sectors in the country that are specifically excluded from competition laws: sugar cane, rice, coffee, maritime transport, and professional colleges.9 Regarding sugar in particular, the evaluation points out: “the exceptions pertaining to the sugar and rice industries, as well as those related to maritime conferences, are not aligned with the OECD Council’s Recommendations on taking effective actions against intrinsically harmful cartels”.

Ethanol as a Relevant Actor in the Sugar Cane Ecosystem

Players in this sector, along the various stages of the value chain, have defined an ecosystem for the sugar cane business which includes sugar production for end-user consumption and industrial uses, but also for alternative and derivative uses, such as for producing alcohol and bio-fuels (ethanol). Ethanol in particular is obtained through the fermentation of sugars, and as a fuel can be used on its own or in combination with gasoline and can therefore act as a substitute for petroleum-based fuels. Ethanol is produced using both molasses and sugar. When produced with molasses, ethanol and sugar are complementary products, though the amount of ethanol that can be produced is small. If one wished to increase the amount of ethanol, then sugar and ethanol production become substitute products. For example: one ton of sugar cane will produce approximately 110 Kg. of sugar, and the remaining molasses can produce 11 liters of ethanol. In order to increase the amount of ethanol, sugar is used, and from this point onward sugar and ethanol will compete with each other in production. In other words, increasing the sales of one product will reduce the possibility of selling the other, as both rely on the same base resource.10 It is therefore important that public policy decisions in this sector take into account the interdependence that exists between various actors, as well as the regulations pertaining to each product. That is, the interaction between agents and regulations for each product in the ecosystem will determine the way the industry functions as a whole.

Removing Dynamic Inefficiencies and in the Allocation of Resources for the Use of Sugarcane Resources with an Impact on Environmental Sustainability

The functioning of the sugar production sector, analogous to a cartel, creates dynamic inefficiencies and issues with the allocation of sugarcane resources, in addition to the usual inefficiencies in allocation and production. Price distortions affect the opportunity costs of ethanol production, as they artificially raise the price of sugar for end-user consumption. This indicates an inefficient allocation of resources towards increased production of sugar for end consumption, and a decrease in the incentives for producing ethanol (bio-fuels). The monopolistic market and allocation structure distorts price signaling and affects the incentives for investment and innovation (dynamic inefficiencies). To be specific, currently distorted prices might be diminishing the incentives for necessary investment into expanding ethanol production.

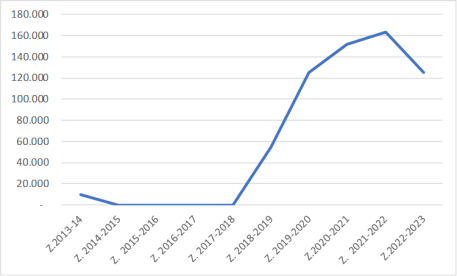

In Costa Rica, the share of sugarcane production destined for Ethanol is very low, although it has enjoyed a growing trend starting in 2018 (Figure 1), with ethanol production taking up 4% of the sugarcane supply.

Figure 1. Sugarcane Production Destined for Ethanol (Tonnes)

Does not include molasses destined for ethanol production.

Source: Market study on the sugarcane sector and its derivatives, by COPROCOM.

International competition in ethanol production is very strong and, relatively speaking, Costa Rica’s production is miniscule. Brazil and the USA account for 82% of global ethanol production, and a major difference between these two major producers is that Brazil (like Costa Rica), makes ethanol from sugarcane, while the USA makes its own from corn. Faced with concerns over climate change, some countries, particularly in Europe, prefer ethanol with a low carbon footprint, where the fuel produced from sugarcane (as in Brazil and Costa Rica) has an advantage over other sources of ethanol, such as corn. Prices change every year, with Brazilian prices sometimes being lower, and sometimes being higher than US prices.

Brazil is the world’s second-largest ethanol producer, and over the last four years its ethanol production has sustained levels of more than 30 million cubic meters per year. In 2022 Brazil exported 2.439.900 m3 of ethanol.11 Sugarcane is the main input in its production, as 89.4% of ethanol is made from sugarcane. Brazil has now been assigning sugar stocks to its ethanol production for several years,12 which has led to a more diverse energy mix in the country, with greater shares accounted for by sugarcane. (Figure 2).

Figure 2. Domestic Supply of Primary Energy Sources in Brazil (1970-2022)

Source: Author’s own, with data from Brazil’s National energy balance: (EPE).

Conclusions

Costa Rica, with its tiny sugarcane production on the global scale and as a price-follower, is greatly limited by the international context. The challenge for its public policy is to face this situation while keeping distortions to a minimum and improve the domestic market’s potential and offer lower prices to Costa Rican consumers, along with incentives for investment and a more efficient allocation of production resources.

With this in mind, the sector’s organization and structure, including the allocation of market shares imposed decades ago, ought to be revised in light of recent changes in demand, environmental goals, and modern competition laws. Currently, the laws governing the sugar industry uphold a structure that would be forbidden to other sectors of the economy by Costa Rica’s own competition laws.

Costa Rica’s case is an example whose conclusions can be of use for any sugar-producing country in the region. At a time when greater consideration is given to public policies that promote environmental sustainability, a subject now included as part of competition policy goals,13 the sugar industry is a prime example that shows how promoting competition can lead to a positive impact on the environment.

Static inefficiencies in the allocation of sugarcane resources, and the dynamic inefficiencies identified above have relevant consequences in terms of missed opportunities. The historic protectionism which characterizes the sugarcane industry, and structures such as those established by Costa Rican law both run against the international trend towards more ecological and sustainable production and fuel consumption, and towards a more diverse energy matrix.

The sugar sector is a clear example where eliminating distortions to competition would have positive environmental impact. Costa Rica and other sugar-producing countries have the chance to boost competition and improve ethanol production, bolster a high added-value industry with growing global demand, and have an important positive impact on environmental sustainability.

Click here for a PDF version of the article

1 The author carried out a Market Study (publicly available) on sugar cane and its derivatives in Costa Rica for that country’s competition regulator (COPROCOM). The conclusions presented in this article include some of the results of that study.

2 OECD (2007), Sugar Policy Reform in the European Union and in World Sugar Markets, 2007.

3 SIC (2015), Por cartelización empresarial para obstruir importaciones, Superindustria sanciona a ASOCAÑA ya 14 empresas del sector azucarero, https://www.sic.gov.co/noticias/por-cartelizacion-empresarial-para-obstruir-importaciones-superindustria-sanciona-a-ASOCANA-ya-14-empresas-del-sector-azucarero.

4 Marcos, F. (2015), Damages’ claims in the Spanish Sugar cartel case, Journal of Antitrust Enforcement 3, 1, 1-21.

5 Marcos, F. (2021), Antitrust Damages Claims in Spain in Rafael Amaro (ed) Private enforcement of competition law in Europe. Directive 2014/104/UE and beyond, Bruyllant, 365-381.

6 COFECE (2016), COFECE sanciona a empresas azucareras por prácticas anticompetitivas, https://www.cofece.mx/wp-content/uploads/2017/11/ReporteMensual_COFECE_JUN_2016.pdf.

7 Supra note 3.

8 Supra note 6.

9 OECD (2020b), Costa Rica: Evaluación del derecho y política de la competencia 2020, www.oecd.org/daf/competition/costa-rica-evaluacion-del-derecho-y-politica-de-la-competencia2020.pdf.

10 Solano Ruiz, R. A. (2019), Análisis de impactos de la apertura comercial en el sector azucarero de Costa Rica, 2008-2018. Fase II: Análisis del contexto internacional del mercado de azúcar.

11 IICA (2023), Estado de los combustibles líquidos en América.

12 Supra note 10.

13 Supra note 9.

Featured News

Pork Industry Faces Legal Challenges as Antitrust Lawsuits Against Seaboard Foods Dismissed

Oct 2, 2024 by

CPI

CMA Strengthens Investigation with Advisory Panel of Veterinary Experts

Oct 2, 2024 by

CPI

US Merchants Sue Visa, Alleging Unfair Dominance in Debit Card Market

Oct 2, 2024 by

CPI

European Commission Appoints New Chief Competition Economist

Oct 2, 2024 by

CPI

EU Commission Requests Information from YouTube, Snapchat, TikTok on Algorithm Usage

Oct 2, 2024 by

CPI

Antitrust Mix by CPI

Antitrust Chronicle® – Refusal to Deal

Sep 27, 2024 by

CPI

Antitrust’s Refusal-to-Deal Doctrine: The Emperor Has No Clothes

Sep 27, 2024 by

Erik Hovenkamp

Why All Antitrust Claims are Refusal to Deal Claims and What that Means for Policy

Sep 27, 2024 by

Ramsi Woodcock

The Aspen Misadventure

Sep 27, 2024 by

Roger Blair & Holly P. Stidham

Refusal to Deal in Antitrust Law: Evolving Jurisprudence and Business Justifications in the Align Technology Case

Sep 27, 2024 by

Timothy Hsieh