Banking APIs Give Businesses An eCommerce Push

Open banking efforts are live in countries ranging from the United Kingdom to Singapore.

Financial institutions (FIs) following these initiatives make their application programming interfaces (APIs) publicly available, which third-party developers can use to create solutions that draw on banking data from consenting users. This has resulted in business-to-business (B2B)  offerings such as mobile apps that help provide small business owners better overview and management of their companies’ bank accounts, as well as their accounts payable (AP) and accounts receivable (AR).

offerings such as mobile apps that help provide small business owners better overview and management of their companies’ bank accounts, as well as their accounts payable (AP) and accounts receivable (AR).

Not all open banking initiatives are in alignment with each other, however, and some stakeholders are pushing for the financial industry to adopt common bank API standards. This would ensure that developers could more easily work with APIs from different banks and even different countries. This issue is gaining attention, with a recent survey of financial professionals in the Asia-Pacific finding that 45 percent of respondents believe interoperable open banking strategies would be “very” important, for example.

The April “B2B API Tracker®” explores these and other issues relating to how open banking is evolving. The Tracker also investigates how FIs are adopting APIs to support everything from currency conversions to loan disbursements. “

Around The B2B API World

Some financial players are turning to APIs to ease cross-border trade. Deutsche Bank recently released an API that Sri Lankan businesses can use to connect their eCommerce direct sales platforms with the bank’s foreign exchange (FX) offering. The connection lets sellers smoothly access FX services when receiving funds from international partners, rather than having to shoulder the work — and costs — of handling the currency conversion themselves.

APIs are also helping FIs disburse loans. Indian business payment platform Cashfree announced new APIs to help lenders incorporate automatic loan disbursement capabilities into their platforms. The APIs also help lenders conduct loan-related activities, such as account verification and collections management.

CIT Group is focusing on lending, too, and released a new point-of-sale lending platform and accompanying APIs that B2B merchants can use to integrate the tool into their direct sales channels. The integration allows sellers to offer credit request and approval processes in their online checkout experiences. Buyers with limited finances can then quickly get payment plans to afford larger purchases.

CIT Group is focusing on lending, too, and released a new point-of-sale lending platform and accompanying APIs that B2B merchants can use to integrate the tool into their direct sales channels. The integration allows sellers to offer credit request and approval processes in their online checkout experiences. Buyers with limited finances can then quickly get payment plans to afford larger purchases.

For more on these and all the rest of the latest B2B API headlines, download the Tracker.

How APIs Are Helping FIs Power Clients’ eCommerce Journeys

Banks can also offer APIs to bolster clients’ eCommerce transitions and expansions. FIs are providing APIs that their clients can use to underpin payment and settlement functionalities, for example, according to Abdul Raof Latiff, group head of the digital institutional banking group at Singapore-based bank DBS. In this month’s Feature Story, Latiff discussed how banking APIs can facilitate eCommerce, enable governments’ digital tax payments efforts and bolster international trade.

Read the full story in the Tracker.

Deep Dive: Why APIs Help B2B Vendors, Buyers Connect, Despite Different Payment Needs

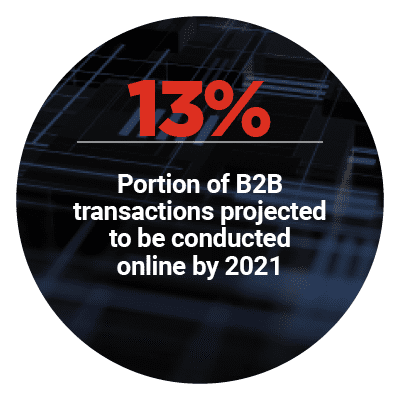

eCommerce is increasingly important to B2B transactions, and vendors must ensure they can offer  convenient purchasing experiences to their clients. That can be difficult, however, because buyers may not share the same preferences with each other. This forces vendors either to onboard with many different platforms or find alternative solutions. This month’s Deep Dive examines how sellers can use APIs to easily integrate various payments services into their B2B eCommerce offerings — thus removing frictions involved in trying to please different customers. Vendors can also use APIs to forge connections between their systems and their buyers’, enabling easy, direct purchasing data transmission.

convenient purchasing experiences to their clients. That can be difficult, however, because buyers may not share the same preferences with each other. This forces vendors either to onboard with many different platforms or find alternative solutions. This month’s Deep Dive examines how sellers can use APIs to easily integrate various payments services into their B2B eCommerce offerings — thus removing frictions involved in trying to please different customers. Vendors can also use APIs to forge connections between their systems and their buyers’, enabling easy, direct purchasing data transmission.

To get the full scoop, download the Tracker.

About The Tracker

The “B2B API Tracker®,” powered by Red Hat, serves as a monthly framework for the space, providing coverage of the most recent news and trends across the B2B API ecosystem.