Getting away from it all is top of mind for many consumers as the school year comes to a close, and as the summer approaches.

Optimism about airlines and online booking platforms helped those stocks last week, on the heels of positive earnings commentary, boosting the CE100™ “Move” category.

Delta Airlines led the sector, and CE100™ names, up 15% through the past week. The company said in its report that there has been a “rebound” in demand, and noted, too, that March was its best sales month ever.

See also: Travel Recovery Supported by Delta, American Airlines Earning Reports

This is the connected economy, after all, and it makes sense that other companies that make it possible to get away from it all should gain ground, too. Airbnb gained 5% on the week, and Booking Holdings rallied 2.8%.

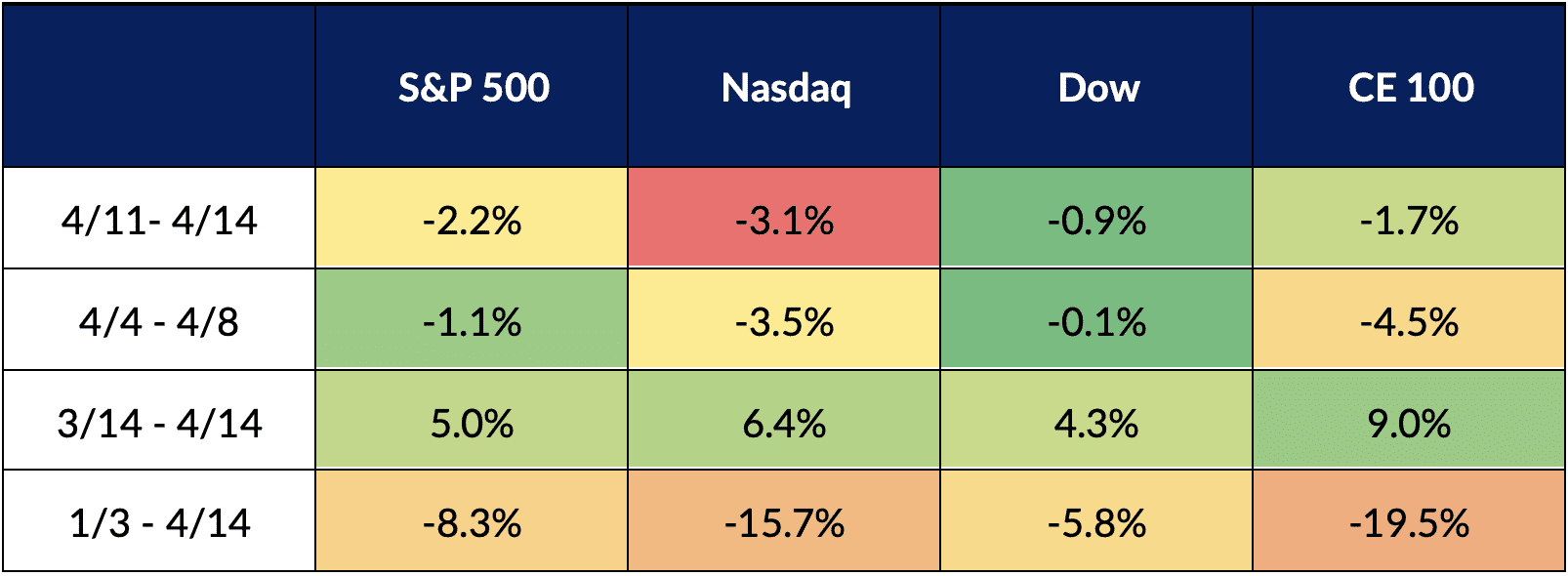

Upward movement in the “movement” names wasn’t enough to keep the overall CE100™ Index from continuing its overall slide, slipping 1.7% for the week.

That negative was slightly better than broader markets’ performances, where the Nasdaq was off a bit more than 3%. Beyond this week of relative outperformance, the CE100™ is down 19.5% for the year.

CE100 Performance Vs. Broader Indices

Source: PYMNTS

Source: PYMNTS

If people are opening up their wallets to book flights and to book rooms (Marriott, a component of the “Have Fun” pillar, was up 10%), they might be pulling back in other areas to do so.

Wary on Consumer Spending

The headwinds continue to mass against consumer spending, for retailers online and off. A pullback here would give consumers the financial wherewithal to make and book and spend on vacations slated for the summer.

Macro headwinds have continued to mass against discretionary spending. As noted in this space in recent days, in the “Digital Economy Payments April 2022 U.S. Edition How Consumers Pay in The Digital World,” P2P payments have dipped a bit. And the share of consumers who shopped for groceries dropped one percentage point to 88% and retail shopping fell two percentage points to 60% as prices rose across the board.

Our own data found, too, that travel services were purchased by 19% of consumers in March — a record since the monthly study series started in December.

See also: Rising Prices Give Consumers Pause Before They Reach for Digital Wallets, P2P Apps

Connecting the dots here, then, shows that the incremental spending on travel comes at the expense of spending in other channels. By extension, the three worst-performing names in the CE100 all depend on consumer spending. Last week saw Sezzle, a name within the “Pay and Be Paid” pillar, sink by more than 20%. Within the “Shop” pillar, Vroom was off by 10.3%, and MercadoLibre lost 8.7% on the week — helping bring this connected economy down 35.8% for the year.

Retailers are, of course, hoping that inflation has peaked, but with everything more expensive, choices have to be made. Leisure and vacation- and travel-related companies are the beneficiaries, but it remains to be seen if the trend is sustainable.