How Should the CCI Market Its ‘Market Studies’? A Case for Incentivizing Industry Participation

By Abhay Joshi & Tanaya Sethi1

I. Market Studies – A Background

Market studies are gaining importance among competition regulators across jurisdictions, and the Competition Commission of India (“CCI”) is no exception to the trend. In a recent development, the CCI plans to initiate a market study on the film distribution business in India and on the impact of over-the-top-platforms (“OTT”). Going by news reports, the study focuses on certain existing practices within the industry to determine whether they are anti-competitive, such as collaborations between producers, distributors, and exhibitors deciding upon film release dates, etc.2

Market studies are critical tools adopted by market regulators (also referred to as competition enforcement agencies) across jurisdictions to: (a) understand key characteristics and the functioning of the markets; and (b) identify issues that may be relevant from the point of view of competition and consumers interests. The International Competition Network has labelled market studies as “research projects” conducted to gain an in-depth understanding of how sectors, markets, and market practices are working.3

According to the CCI, market studies are a tool for “proactive market supervision” that help identify competition problems emerging from the conduct of business enterprises and/or from structural features of markets.4

Competition agencies may conduct market studies on different markets, with a variety of objectives in mind. As the world we live in becomes more technology-driven, markets across the board are experiencing an irreversible and dynamic impact from technological developments and the disruption they cause. Given the break-neck pace of technological innovation, competition agencies are using these studies to better understand emerging issues that arise from the interaction between technology, businesses, and their consumers. The last decade bears witness to vast changes in the overall business approach and strategy adopted by both new age and traditional industries. Businesses have become more focused on consumers and market share, as opposed to being solely profit driven. These changes have brought about radical changes in the pattern of market behaviour of business enterprises resulting in market regulators seeking a more informed and effective intervention approach.

II. How Are Market Studies Used?

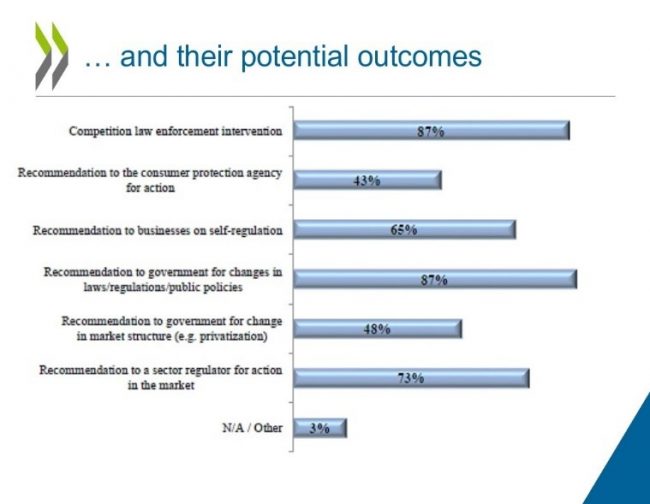

The objective behind conducting market studies, according to the CCI, is to inform its enforcement actions and advocacy efforts.5 Interestingly, according to a 2016 OECD survey6 market studies conducted by participating competition agencies identified the following non-exclusive potential outcomes of such studies:

Source: OECD

The statistics from the OECD study indicate that enforcement actions and recommendations to the government for policy/regulatory changes have been the most common outcomes of market studies. A follow-up study conducted by the OECD in 2018 also confirmed these findings.7 While the outcomes of market studies may vary, they continue to be an important tool for competition agencies to gain domain knowledge and develop a real-time understanding of business practices across various sectors.

III. CCI’s Experience with Market Studies

The CCI has had its own share of experience in conducting market studies. As markets become more dependent on technology, the CCI’s (and every other market regulator’s) focus has understandably moved towards such digital markets.

For instance, after conducting a workshop and several rounds of discussions with stakeholders, the CCI released its e-commerce sector market study report in 2020.8 The e-commerce study was initiated in April 2019 with the following objectives:

- to better understand the functioning of e-commerce in India and its implications for markets and competition; and

- to identify enforcement and advocacy priorities in the e-commerce sector.

Shortly after releasing the e-commerce market study, the CCI initiated an investigation against Amazon and Flipkart for deep discounting practices, and their exclusive arrangements with and preferential listing of certain sellers on their respective platforms. Notably, the CCI had identified these issues to be problematic in its market study, where it had suggested certain self-regulatory measures for the platforms. The focus of the suggested self-regulatory measures was to ensure transparency between platforms and business users to address any imbalance in bargaining power and information asymmetry. It is unclear whether or not, or to what extent, follow-up steps were taken by the CCI to suitably discuss the self-regulatory measures with the stakeholders to address concerns that emerged from its study.

Most recently, the CCI published a discussion paper on blockchain9 which followed a detailed study of the telecom sector.10 The telecom study focused on issues such as data, privacy, and net neutrality. The study identified privacy as a non-price factor of competition. Specifically, the CCI made the following observations:

- Abuse of dominance can take the form of lowering privacy protection, and therefore falls within the ambit of antitrust since low privacy standards imply a lack of consumer welfare.

- Lower data protection can also lead to the standard legal category of exclusionary behavior which undermines the competitive process.

- Tying with other digital products will further strengthen the data advantage enjoyed by the dominant incumbent by cross-linking the data collected across services, creating a vicious circle.

- The antitrust law framework is broad enough to address the exploitative and exclusionary behavior arising out of privacy standards of entities commanding market power.

Unlike the e-commerce study, the CCI did not identify enforcement action as one of its objectives or priorities in the telecom study. However, the CCI’s thought process and its approach to data and privacy related issues became more apparent when the CCI initiated an investigation against WhatsApp over its Privacy Policy Update soon after it published the telecom study report.

The recent trends clearly show a high likelihood of enforcement actions following soon after the conclusion of market studies. Despite suggesting self-governance measures for e-commerce platforms in its e-commerce market study, it seems that the CCI has adopted a more proactive enforcement approach by initiating investigations to deal with the issues, rather than a more staggered approach by first adopting non-enforcement methods. The key questions that arise are – whether market studies are being used more as a tool to justify follow-on enforcement actions; and, in such a scenario, what are the incentives for market participants to engage meaningfully with the CCI during the course of such market studies?

IV. Incentives for industry participation in market studies

Given the almost immediate enforcement efforts upon the conclusion of market studies, it may prima facie appear to market players that these studies are more of a tool to justify the follow-on enforcement actions as opposed to a tool to understand systemic nuances, operational realties, and competition dynamics in the markets that are the subject of such studies. Accordingly, there is likely to be little or no incentives, and heightened suspicion preventing market players from meaningfully participating in these studies. This issue becomes particularly relevant since the CCI, unlike certain other regulators, does not have any powers to mandate participation by market players or any other organization it reaches out to. If this trend continues, it is possible that industry participants will view such market study initiatives from the CCI with a tinge of suspicion, potentially resulting in sub-optimal participation in these studies – or none at all.

In such a scenario, the CCI must reconsider its approach to build confidence in its market study initiatives. This will result in a more meaningful and efficient outcome both for the CCI as a regulator (by way of increased domain knowledge and insight into specific industry dynamics) and for market participants (who can contribute more effectively to present the CCI with a holistic view of their respective industries). In order to build on the overall credibility of the CCI’s commendable efforts to engage constantly with various industries, it is critical to avoid sending a message that is indicative of certain follow-on enforcement outcomes. A more structured approach will incentivize industry participation and feed into the success and effectiveness of market studies. It could be counterproductive for the CCI to spend its resources on a process that neither ensures meaningful market participation nor obligates participants to effectively utilize the guidance prescribed by the CCI through market studies.

V. Way forward – Incentivizing Industry Participation

Market studies provide an opportunity for competition agencies to engage with the industry through a consultative process, drive competition advocacy, and ultimately help develop and maintain market practices that promote healthy competition, prevent appreciable adverse effects on competition in the markets, and protect consumer interests. By virtue of this consultative process, market studies remain a very important tool to go beyond enforcement actions or merger control and to diagnose systemic issues existing in various market sectors/industries. They can be a highly rewarding process both for the CCI as well as for the markets if these are carried out in a more organized and efficient manner and utilized more scientifically, keeping in mind the clear objectives set out in the studies.

- Building Incentives Into the Process of Conducting Market Studies

Effective incentivization and involvement of market participants throughout the market study process is essential for helping the CCI develop appropriate guidance and industry-specific recommendations. Market participants are likely to adhere to and follow the CCI’s guidance/ recommendations where they feel that their views have been suitably considered and reflected in the recommendations issued.

Timing is also a key factor here. Where an agency decides to issue self-regulatory measures based on its market study it should allow an adequate window of opportunity for participants to apply such measures. Immediate follow-on intervention in such cases will most certainly disincentivize market participants for engaging with the agency. This is especially true in relation to newer/ complex markets where understanding of business practices is limited. Using the co-operative strength of market studies as a tool is therefore crucial for achieving compliance.

- An Agency’s Record of Timely and Thoughtful Intervention Acts as an Implicit Incentive

The point is not to suggest that enforcement actions should not follow at all. Well timed and well considered intervention can go a long way reflecting the maturity of a regulatory as well as instilling confidence in the industry. A regulator that has a record of facilitating compliance by market players and intervening in a timely and thoughtful manner can get market participants to engage proactively. One way is to ensure that interventions are timely and carefully deliberated.

Furthermore, it is also important to understand the types of studies being conducted and how these are being utilized across other jurisdictions. For instance, the competition agencies in the U.S and the EU have been conducting retrospective merger studies to develop an added perspective on whether their ex ante assessment was appropriate for the identified markets.11 Such studies are not only a great way to utilize an agency’s resources since the markets, its participants, and potential competition issues are already identified. Such studies also provide a way for competition agencies to be accountable for their assessment. Further, it also becomes important to conduct follow up studies in the same markets to identify the impact of earlier studies and follow-on steps taken to address any concerns. These follow up studies will also help the CCI understand any new set of issues and identify new approaches that may be needed keeping in view the results from previous studies and its own subsequent actions.

This approach helps competition agencies look at and revisit markets with a clear vision of the past and the future. In doing so, competition agencies transition from being market regulators to also being market facilitators. Like these regulators, the CCI, having now completed more than a decade of enforcement, must adopt a more structured approach towards achieving the objectives that are set out in these studies and make further efforts to act as a facilitator by incentivizing engagement with industry participants through its market studies.

Click here for a PDF version of the article

1 Abhay Joshi is a Partner and Tanaya Sethi is a Principal Associate with the Competition Law & Policy practice group at Economic Laws Practice, New Delhi, India.

2 Business Standard, CCI to launch study into film distribution, examine OTT impact on releases (August 2, 2021) https://www.business-standard.com/article/economy-policy/cci-to-launch-study-into-film-distribution-examine-ott-impact-on-releases-121080200014_1.html.

3 ICN Market Studies work, https://www.internationalcompetitionnetwork.org/working-groups/advocacy/market-studies/.

4 Using Market Studies to Tackle Emerging Competition Issues – Contribution from India, OECD (November 12, 2020) https://one.oecd.org/document/DAF/COMP/GF/WD(2020)24/en/pdf.

5 Using Market Studies to Tackle Emerging Competition Issues – Contribution from India, OECD (November 12, 2020) https://one.oecd.org/document/DAF/COMP/GF/WD(2020)24/en/pdf.

6 The Role of Market Studies as a Tool to Promote Competition – Background Note by the Secretariat, OECD (November 25, 2016) https://one.oecd.org/document/DAF/COMP/GF(2016)4/en/pdf.

7 OECD, Market Studies Guide for Competition Authorities (2018)

www.oecd.org/daf/competition/market-studies-guide-for-competition-authorities.htm.

8 CCI, Market Study on E-commerce in India – Key Findings and Observations (January 8, 2020) https://www.cci.gov.in/sites/default/files/whats_newdocument/Market-study-on-e-Commerce-in-India.pdf.

9 CCI, Discussion paper on blockchain technology and competition (April 2021) http://www.cci.gov.in/sites/default/files/whats_newdocument/Blockchain.pdf.

10 CCI, Market Study on the Telecom Sector in India – Key Findings and Observations (January 22, 2021) https://www.cci.gov.in/sites/default/files/whats_newdocument/Market-Study-on-the-Telecom-Sector-In-India.pdf.

11 OECD Background note by the Secretariat, Merger Control in Dynamic Markets (December 6, 2019) https://one.oecd.org/document/DAF/COMP/GF(2019)8/en/pdf.

Featured News

Judge Appoints Law Firms to Lead Consumer Antitrust Litigation Against Apple

Dec 22, 2024 by

CPI

Epic Health Systems Seeks Dismissal of Antitrust Suit Filed by Particle Health

Dec 22, 2024 by

CPI

Qualcomm Secures Partial Victory in Licensing Dispute with Arm, Jury Splits on Key Issues

Dec 22, 2024 by

CPI

Google Proposes Revised Revenue-Sharing Limits Amid Antitrust Battle

Dec 22, 2024 by

CPI

Japan’s Antitrust Authority Expected to Sanction Google Over Monopoly Practices

Dec 22, 2024 by

CPI

Antitrust Mix by CPI

Antitrust Chronicle® – CRESSE Insights

Dec 19, 2024 by

CPI

Effective Interoperability in Mobile Ecosystems: EU Competition Law Versus Regulation

Dec 19, 2024 by

Giuseppe Colangelo

The Use of Empirical Evidence in Antitrust: Trends, Challenges, and a Path Forward

Dec 19, 2024 by

Eliana Garces

Some Empirical Evidence on the Role of Presumptions and Evidentiary Standards on Antitrust (Under)Enforcement: Is the EC’s New Communication on Art.102 in the Right Direction?

Dec 19, 2024 by

Yannis Katsoulacos

The EC’s Draft Guidelines on the Application of Article 102 TFEU: An Economic Perspective

Dec 19, 2024 by

Benoit Durand