On This Topic

As news is unfolding, information will be constantly updated. Please check back with us for the court decisions on the scandal and our expert’s point of view!

The LIBOR Scandal

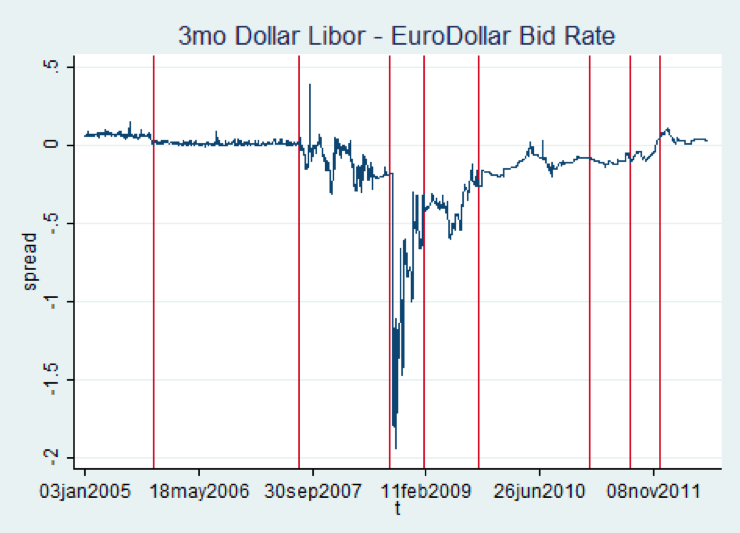

On May 29, 2008, the Wall Street Journal (the Journal) printed an article which claimed that several global banks were reporting unjustifiably low borrowing costs for the calculation of the daily LIBOR benchmark rates. Specifically, the writers claimed that the banks were reporting rates that were significantly lower than rates justified by bank-specific costs and trend movements in the default insurance market. Although the Journal acknowledged that its “analysis doesn’t prove that banks are lying or manipulating LIBOR,” it conjectured that these banks may “have been low-balling their borrowing rates to avoid looking desperate for cash.”

Rosa Abrantes-Metz (NYU Stern School of Business), Michael Kraten (Providence College), Albert D. Metz (Moody’s Investors Service), and Gim Seow (University of Connecticut – School of Business) extend the Journal’s study and perform the following analyses: (a) a comparison of LIBOR with other rates of short-term borrowing costs, (b) an evaluation of the individual bank quotes that were submitted to the British Banker’s Association (BBA), and (c) a comparison of these individual quotes to individual CDS spreads and market cap data. They selected different periods because three major news items were announced in the public press: (a) there was a “coordinated intervention” by the European Central Bank, the Federal Reserve Bank, and the Bank of Japan; (b) AIG warned that defaults were spreading beyond the subprime sector, and (c) BNP Paribas suspended three funds that held mortgage backed securities.Furthermore, the Wall Street Journal first published the news that the BBA intended to investigate the composition of these rates. They concluded that there are some questionable patterns with respect to the banks’ LIBOR quotes.

Over the past few years, large-scale investigations have been launched around the world on the manipulation allegations and possible collusion among several leading financial institutions. Although, the main regulators are calling into question “the world’s most important rate”, the market has to find a way to link more than $300 trillion USD in contracts worldwide, which use the LIBOR benchmark. However, its reliability has been questioned since Barclays’ settlement with UK and US regulators laid bare the scandal of wrongdoing. Mr. Wheatley, the incoming chief executive of the Financial Conduct Authority said that “LIBOR needs to get back to doing what it is supposed to do, rather than hat unscrupulous traders and individuals in banks wanted it to do.” LIBOR is viable and necessary for the financial system and its contracts. It will continue to depend on daily estimates from panels of banks of interbank borrowing rates, but sponsorship will move from the British Bankers’ Association to a fully independent and regulated administrator.

These statements are somewhat in line with different proposals by various academics and institutions. For example, Rosa Abrantes-Metz and David S. Evans (University of Chicago) suggested a way on how to fix the “broken” LIBOR interbank lending rate, with the following main transformations:

- Banks that participate in the rate setting process would have to submit bid and ask quotes for interbank lending and commit that they would conduct transactions within that range. If they traded outside of those ranges they would have to justify and face a penalty. This leads to the CLIBOR—for “committed” LIBOR.

- All large banks would have to submit interbank transactions including rates to a data-clearing house. The data-clearing house would use the actual transactions to verify the commitment of the banks to the submitted rates. It would also report aggregate transaction data, keeping the actual identities of the trading parties anonymous, with a necessary time delay.

- A governing body would be established from the CLIBOR participating banks, representatives of CLIBOR users, and other independent parties such as academics. That governing body would enter into a long-term contract, based on competitive solicitation, with a private sector entity to supervise the CLIBOR, operate the data-clearing house, and disseminate information.

If Rosa Abrantes-Metz‘s and David S. Evans‘ proposal will be implemented completely is yet to be seen, however, getting LIBOR back on track with focusing on the essential currencies that investors and borrowers use the most is a crucial point to consider. Faced with evidence that banks were letting traders influence their rate submissions has called for an additional oversight regime and appropriate processes. To regulate the rate-setting process, and making LIBOR manipulation a serious offense will act as a strong legal and psychological mechanism. Banks will have to demonstrate to the regulator how they arrive at their estimates and the FSA will approve the individual responsible for the submission at each bank. The reforms also call for more banks to submit LIBOR estimates to minimize the influence of individual institutions.

Finally, according to the Final Report, Banks will be forced to actively participate in the interest rate derivatives and interbank lending markets. Banks that do take party will be allowed more privacy – their individual submissions which are closely watched as a sign of financial health, would be kept confidential for three months. This recommendations will force banks to provide quotes according to particular guidelines set out by regulators and which, at the end of the day, may well reduce the incentive to provide the most accurate quotes, and replace those with “the least risky quotes.”

Please enjoy our collection on LIBOR and also participate in our LinkedIn group discussions!

Featured News

Federal Judges Press Administration Over Attempted CFPB Workforce Cuts

Feb 25, 2026 by

CPI

Interoperability Becomes Finance’s Next Regulatory Flashpoint

Feb 25, 2026 by

CPI

US Steps Up Diplomatic Pressure on Countries That Limit Cross-Border Data Flows

Feb 25, 2026 by

CPI

Musk Moves to Exclude Law Firm’s OpenAI Probe From Jury in April Trial

Feb 25, 2026 by

CPI

Federal Judge Unlikely to Halt Landmark Antitrust Trial Over Concert Ticketing

Feb 25, 2026 by

CPI

Antitrust Mix by CPI

Antitrust Chronicle® – Behavioral Economics

Feb 22, 2026 by

CPI

Behavioral Antitrust in 2026

Feb 22, 2026 by

Maurice Stucke

Behavioral Economics in Competition Policy: Going Beyond Inertia and Framing Effects

Feb 22, 2026 by

Annemieke Tuinstra & Richard May

Agreeing to Disagree in Antitrust

Feb 22, 2026 by

Jorge Padilla

Recognizing What’s Around the Corner: Merger Control, Capabilities, and the New Nature of Potential Competition

Feb 22, 2026 by

Magdalena Kuyterink & David J. Teece