Geolocation data and adjacent technologies are helping to customize and personalize shopping, banking and more, as consumers acclimatize to a commercial world that increasingly concerns itself with where you are in the moment, powering next-gen connected commerce experiences.

The November 2020 PYMNTS report Location, Location, Location: How Location Data Can Help Banks Prevent Online Fraud, a GeoGuard collaboration, surveyed more than 2,000 U.S. consumers who have connected devices and use credit or debit cards at least once a month, curious as to their disposition toward sharing location data with card-issuing financial institutions (FIs), and where it leads.

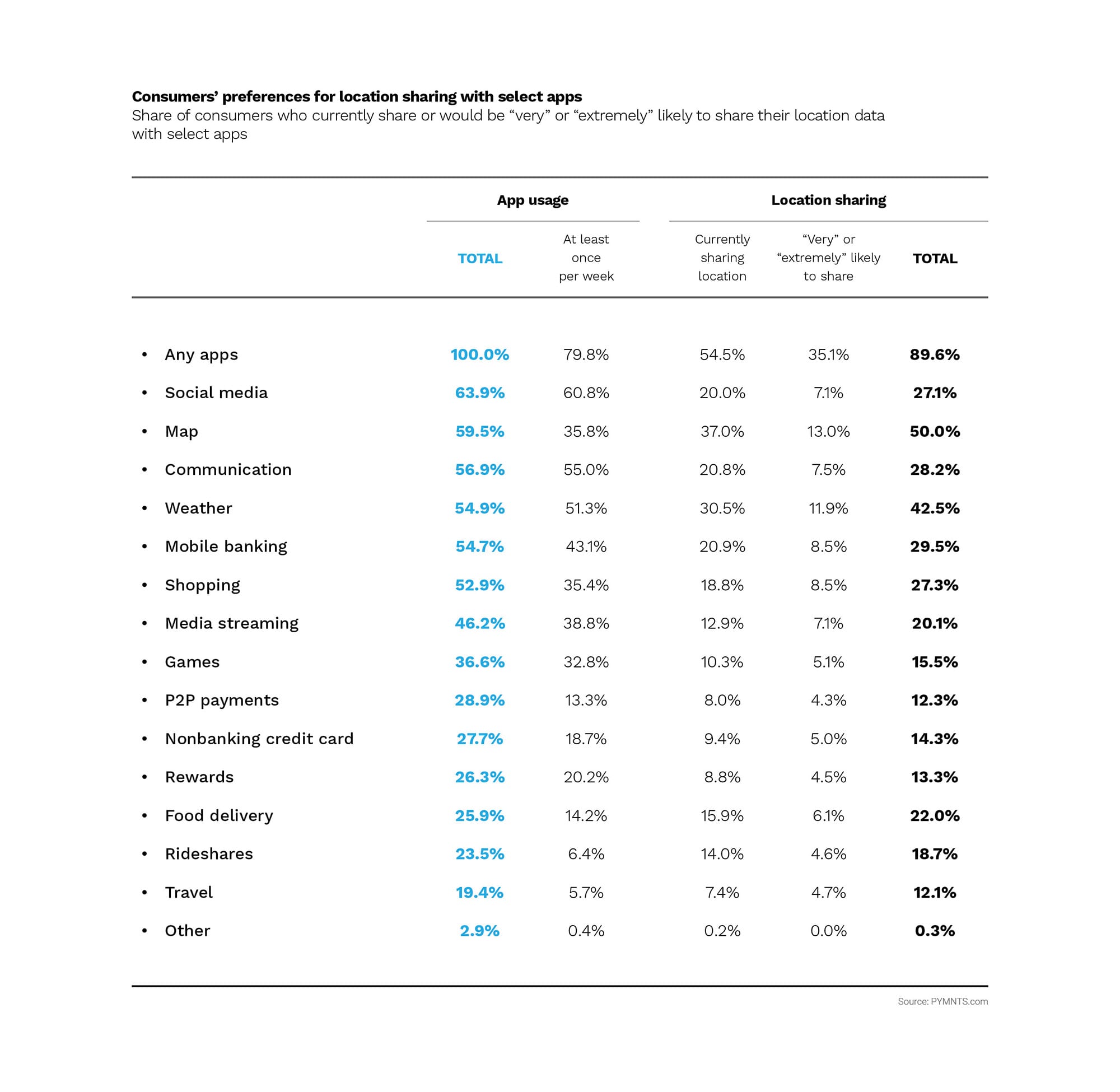

Per the new report, “Some consumers are as comfortable sharing location details with FIs as other consumers are sharing it with navigation or food delivery apps. Others are on the fence about providing this information to their banks.” PYMNTS found that 28 percent of consumers now share location data with debit or credit card-issuing banks “because they believe access to such information could help their FIs fight fraud. Another 32 percent, however, are not willing to allow their banks to access location data, and 36 percent of them do not understand why FIs would need this information.”

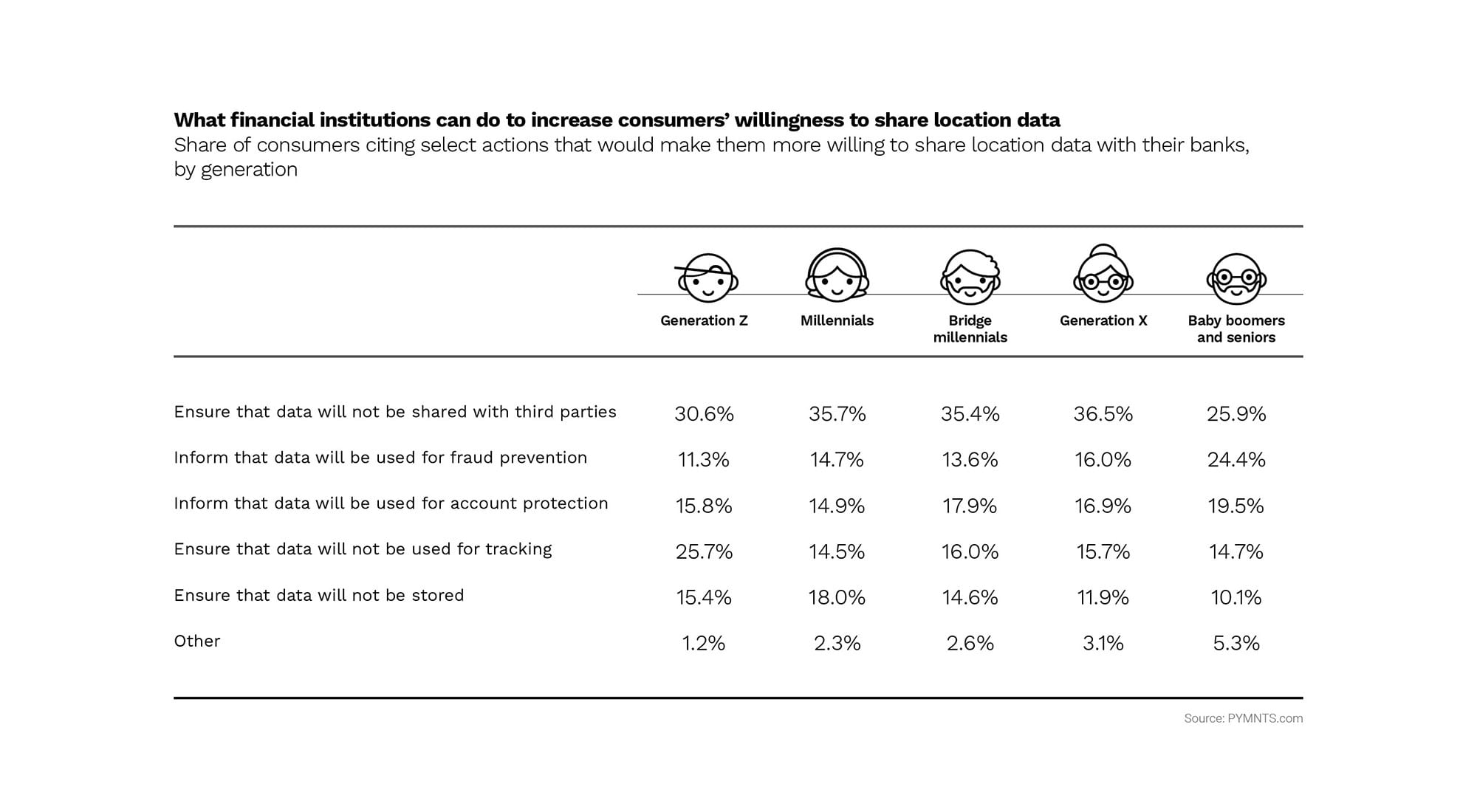

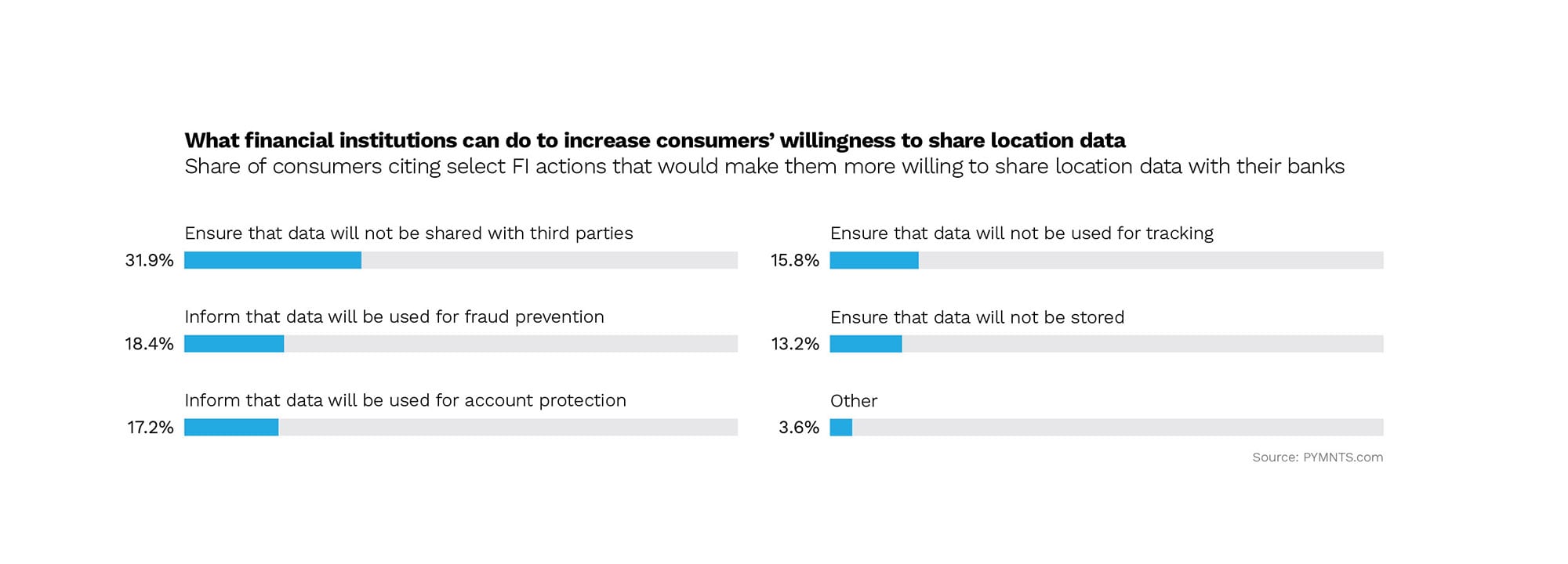

Ensuring that location data will not be shared with third parties and that it will be used to better protect accounts can go a long way toward easing their anxieties, however. Our research shows that approximately 49 percent of consumers would feel more comfortable if they had these assurances. Assurances are especially important to Generation X and millennial consumers, at 37 percent and 36 percent, respectively. We also found that 32 percent of consumers overall would be willing to share their location data if the FI would explain it was seeking location data for fraud reduction and better account protection.

Explain Yourself

A little information goes a long way, a fact that helps explain some of the more confounding findings from the How Location Data Can Help Banks Prevent Online Fraud report.

While the report notes that “50 percent of credit or debit card users who currently share location data or are ‘very’ or ‘extremely’ likely to do so believe that sharing this data helps the bank better protect them from fraud,” adding that “thirty-three percent of consumers say they would be ‘very’ or ‘extremely’ likely to share location data if doing so could help reduce fraud and better protect their accounts. This is particularly true among bridge millennials and millennials, as 38 percent and 37 percent share the sentiment, respectively.”

Conversely, 82 million people — nearly a third of all U.S. consumers — “are not willing to share location data with their card-issuing banks,” researchers found. “This is especially true for credit card users: 38 percent of them choose not to share their location data, as do 30 percent of debit card users.” Over a third don’t understand why banks would need geo-data, and 36 percent have related security worries. “A smaller share of consumers (20 percent) say their bank does not explain why the information is needed when they are asked for it.”

PYMNTS new research shows that close to 90 percent of credit or debit users either currently share location or will if that data help banks and FIs harden defenses and communicate it.

Careful With That Customer

Of the numerous revelations in Location, Location, Location: How Location Data Can Help Banks Prevent Online Fraud, a few stand out as having significant near-term impacts on FIs.

“Certain consumers would switch to a financial institution that offers [geolocation] capabilities: 42 percent of consumers say they would be at least ‘somewhat’ likely to switch to an FI that uses location-tracking capabilities for protecting their customers from fraud. This sentiment is especially strong among consumers from younger generations, as more than 55 percent of Generation Z consumers and millennials and 52 percent of bridge millennials say so.”

Clearly, if geolocation data is part of your strategy, a plan to communicate that strategy to card account holders must be baked in, too. Consumers who share data with Google are less likely to trust their own banking app to know their location. The finding speaks volumes about trust.

FIs have their work cut out for them, and luckily, people want to trust banks with their data.

“Nearly 30 percent of consumers say that the first step their banks can take to make them feel more comfortable with sharing location data is to ensure their details will not be shared with third parties,” How Location Data Can Help Banks Prevent Online Fraud states. “This assurance would also make 27 percent of those credit card users who were not willing to share and 29 percent of those who have not been asked feel more comfortable about sharing location information.”