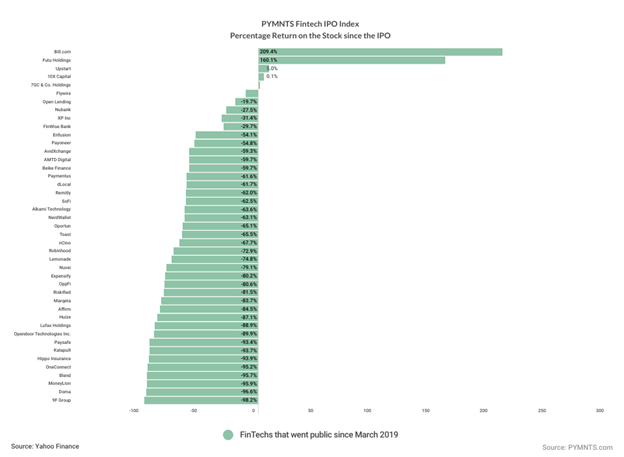

Even some skyrocketing performers — up double digits — were not enough to boost the FinTech IPO Index.

The pantheon lost 2.7%, despite rumors of deal-making, despite economic data that showed a surprising resilience in consumer spending. Rallies proved short-lived, as Fed chairman Jerome Powell splashed cold water this week on the sentiment that the Fed would end its rate hike campaign. The specter of higher rates means that some of the platforms and the digital disruptors that populate the FinTech 100 will see pressures of their own in the form of higher costs of capital and a dropoff in demand from end consumers (particularly for lenders).

Katapult shares leaped 36.5% through the past five sessions. And though there was no company-specific news underpinning the push, the headline numbers from the Commerce Department released last week showed that retail sales were up 0.3% month on month, representing a slight deceleration from the revised April estimate of 0.4% growth. But that was better than the consensus that spending would dip in May.

Shares in nCino surged 23% on the week.

As reported this past week, nCino’s stock rallied as news outlets reported that nCino was considering its options after private equity firms expressed interest in taking over the company. As Reuters noted, nCino’s board of directors was considering forming a special committee to review the private equity firms’ interest and look at the next steps.

Expensify shares were up more than 16%. Yahoo Finance reported earlier in the month the company will join the broad-market Russell 3000 Index and is set to become part of that Index effective June 26.

These gains were not enough to overcome the impact of names that trended to the downside. 9F Group, a volatile stock, to say the least, sank 25%. Upstart shares lost 13.6%, giving up at least some momentum that has seen its stock rally triple digits through the past month. SoFi shares were 12.8% lower through a week that saw at least some Wall Street bulls urge caution in the wake of a huge rally.

In one note spotlighted by CBS Marketwatch, Piper Sandler analyst Kevin Barker observed that “We believe some outperformance is warranted, particularly if we were to see a significant decline in interest rates driving better margins and more attractive lending opportunities (i.e. student loans),” adding that “However, we have seen rates actually move higher in the past two months, which will be an incremental headwind in the near term, and we are increasingly concerned rates could remain higher for longer due to persistent inflation.” He downgraded his rating from overweight to neutral.

Shares of Affirm were more than 12% lower, two weeks after the announcement that Amazon Pay had enabled merchants to add the company’s Adaptive as a payment option at checkout.

Robinhood stock slipped 5%.

As disclosed this past week, Robinhood agreed to acquire X1 to pursue a push beyond trading. The $95 million acquisition, according to The Wall Street Journal, will let the company create a new credit card line of business.

#image_title