Accounts payable (AP) is a critical department in any business, with firms of all sizes devoting considerable time, energy, staff and resources to ensure vendors are paid on time. Nearly every facet of modern businesses rests downstream from AP: Without smooth vendor payments, a firm will lack inventory or services to sell to customers. Without customers, the business would simply cease to exist.

This important role, however, is fraught with inefficiencies, errors and delays, with companies wasting hundreds of staff hours every week on processing vendor payments and other AP tasks. Consequently, many firms have turned to automated technology and service solutions to make their AP departments more efficient and redirect time and resources to value-generating activities.

Essential Steps for AP Payments Success

Completing a single payment involves a vast chain of events that AP departments must process successfully. This can be a highly time-consuming task.

Processing vendor payments has four critical steps.

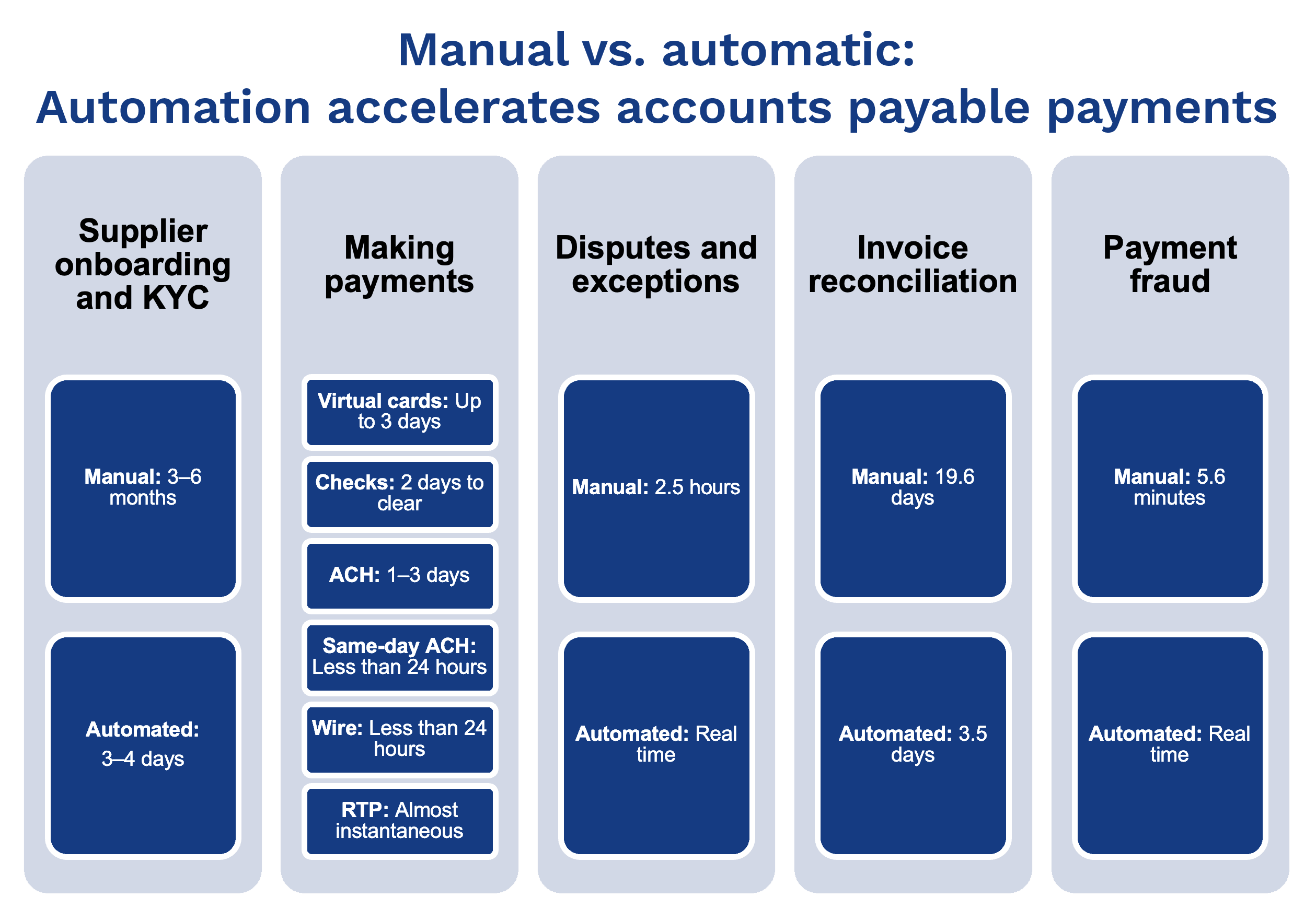

The first step to a successful payment, and the one that takes by far the longest to complete, is conducting a rigorous onboarding process to ensure a supplier is legitimate. This can take anywhere from three to six months if the process is done manually. One finance professional noted that she had to interact with 20 different contacts to ensure this process was completed successfully. Next, the company must determine the most suitable payment method for the particular supplier, which can vary in processing time. Checks typically take two days to clear, automated clearing house (ACH) payments up to three days, and wire payments take less than 24 hours. Virtual cards offer another fast payment option but can take up to three days to settle and entail extensive communication with the supplier to ensure acceptance of this transaction method.

76%

of CFOs say that manual tasks like AP take up too much of their financial team’s time.

AP teams then need to account for disputes and exceptions that could potentially complicate the payment. One study found that 43% of AP teams spend between one and five hours every month responding to vendor inquiries to settle these matters, while 25% spend between six and 10 hours. Finally, AP teams can move to the fourth step: reconciling the invoice and processing the payment, a procedure that can take anywhere from 11 to 19 days, depending on their level of automation.

Making payments can be a massive time drain for AP departments using manual methods.

This 11- to 19-day figure does not tell the full payment-processing story, however. Companies leveraging AP automation technology can complete the process in an average of just 3.4 days, while most companies with less efficient AP operations take nearly 18 days.

Indeed, this long processing time is a constant headache for financial departments, as it ties up accounting staff that could potentially work on value-adding projects. According to one recent survey, 76% of CFOs reported that manual tasks like AP consume too much of their financial team’s time.

Several Factors Add Up to Sluggish Accounts Payable

Manual AP processes add up to massive amounts of time spent making vendor payments, but no one process is at fault. Every step in the AP system can be a significant time drain, even if everything proceeds smoothly.

29%

of mid-sized companies experience AP complications that result in time delays.

Know your business verifications can lead to major time delays.

A recent study found that know your business (KYB) checks are one of the biggest culprits of delayed vendor onboarding. While most verifications can be done in less than two hours on average, a full 20% of these checks take more than 24 hours to process. This largely is the result of AP teams utilizing software ill-suited for the task, with 40% of businesses saying they relied on Microsoft Word or Excel for these compliance checks. Some companies reported onboarding success rates as low as 50%, and other companies said they were spending up to 25% of their revenue on compliance costs.

Mid-sized firms are the most likely to experience payment errors and discrepancies that can lead to time loss.

A recent PYMNTS Intelligence study found that 29% of mid-sized companies (with revenues ranging from $750 million to $1.5 billion) experienced AP complications — a greater share than both large firms (24%) and small firms (22%). Among mid-sized firms, 18% cited payments and payment exceptions as their most frequently encountered issue, compared to 15% of large firms and 9.4% of small firms.

This inconsistency in AP experiences could be a result of mid-sized firms confronting the worst of both worlds when it comes to payables. These companies tend to process a higher volume of payments than smaller firms, but they are less likely than larger firms to have found ways to mitigate disruptions through automation.

Unlocking Operational Improvements With AP Payment Automation

Automating AP payment processes can be an enormous time-saver for companies, allowing accounting teams to streamline their operations and focus their efforts on value-adding endeavors. Firms that have implemented automation have high praise for their new operational capability.

Sources

Automation can reduce AP processing times by up to 16 days.

On average, each step in the payment approval process takes between two and seven days. Automation technology can reduce the time spent on each step to just one day or even half a day, trimming the entire timeline to under four days. Invoice approval shows the single greatest acceleration, as automated systems can instantly match the invoice and purchase order, alleviating the need for staff to comb through files manually to locate the corresponding documents.

Companies that have automated AP report huge gains in efficiency.

According to PYMNTS Intelligence data, CFOs of companies that have automated their AP departments reported substantial improvements in invoice tracking. Specifically, 93% reported reduced days of delay as a leading improvement, with 54% noting that automation software made a substantial impact in reducing those delays.

Automation software also reduces the potential for errors, further expediting AP processes that can be inherently slow. Forty-six percent of CFOs surveyed said that their companies achieved significant improvements around payment and exceptions, while 39% said that automation software led to major reductions in delays caused by invoicing errors and discrepancies.

Getting Results: Automation Delivers Substantial Value

AP automation unlocks meaningful time savings compared to traditional paper-based processes and other legacy systems. According to PYMNTS Intelligence data, 54% of CFOs said that AP automation brought significant reductions in delays, and 77% said that automation reduced errors in the AP process.

Automation not only benefits the AP departments themselves but also delivers substantial gains downstream:

- Vendor payments are less likely to be delayed, resulting in improved vendor relations.

- Payroll has fewer errors, leading to reduced employee stress and attrition.

- Cash flow is streamlined, meaning that unexpected expenses can be paid faster and with less disruption to everyday processes.

PYMNTS Intelligence found that just 28% of firms have added AP automation to their workflows in the past 12 months. This attitude is changing fast, however, with both 70% of less-automated firms and 44% of more-automated indicating that they “definitely need” additional automation. As the benefits of AP automation gain greater awareness among organizations, it is inevitable that more businesses will adopt this technology, extending the benefits to an even broader range of companies.

Accounts Payable Automation and Assurance. AP Matching. https://www.apmatching.com/. Accessed September 2023.

Ardent Partners’ Accounts Payable Metrics that Matter in 2023. Basware. https://www.basware.com/en-en/resources/ardent-partners-accounts-payable-metrics-that-matter-in-2023/. Accessed September 2023.

Are you spending too much time on manual review? Ravelin. https://www.ravelin.com/blog/are-you-spending-too-much-time-on-manual-review. Accessed September 2023.

Burnette, M. How Long It Takes a Check to Clear. NerdWallet. 2022. https://www.nerdwallet.com/article/banking/how-long-does-a-check-take-to-clear. Accessed September 2023.

Dixon, A. How Long Does a Wire Transfer Take? SmartAsset. 2023. https://smartasset.com/checking-account/how-long-does-a-wire-transfer-take. Accessed September 2023.

Girsch-Bock, M. Invoice Cycle Time: What Is It and How To Improve It. Planergy. https://planergy.com/blog/invoice-cycle-time/. Accessed September 2023.

How Accounts Payable Automation Helps Make Exceptions the “Exception to the Rule.” Corcentric. https://www.corcentric.com/blog/how-accounts-payable-automation-helps-make-exceptions-the-exception-to-the-rule/. Accessed September 2023.

7 Steps to Automate Supplier Onboarding: From Manual to Magnificent. Kodiak Hub. https://www.kodiakhub.com/e-books/7-steps-to-automate-supplier-onboarding-from-manual-to-magnificent. Accessed September 2023.

Sullivan, T. What is an ACH Transfer? All about ACH bank transfers. Plaid. 2022. https://plaid.com/resources/ach/how-does-an-ach-transfer-work/. Accessed September 2023.

Supplier onboarding: Top 12 ways to speed up the process. Spend Matters. 2020. https://spendmatters.com/2020/02/06/top-12-ways-to-speed-up-supplier-onboarding/. Accessed September 2023.

Why Some Businesses Don’t Like Virtual Cards. PYMNTS. 2014. https://www.pymnts.com/in-depth/2014/why-some-businesses-dont-like-virtual-cards/. Accessed September 2023.↩