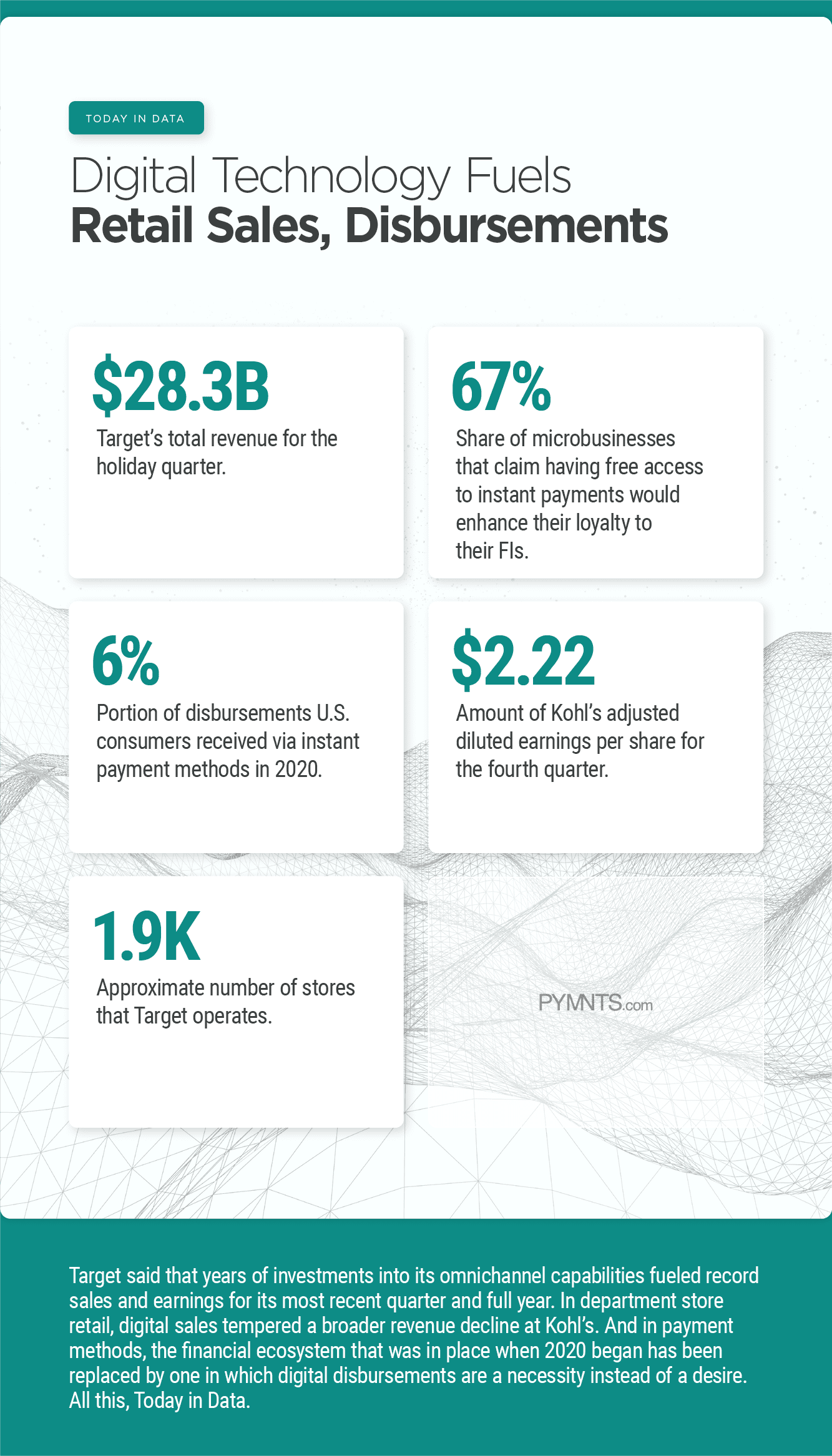

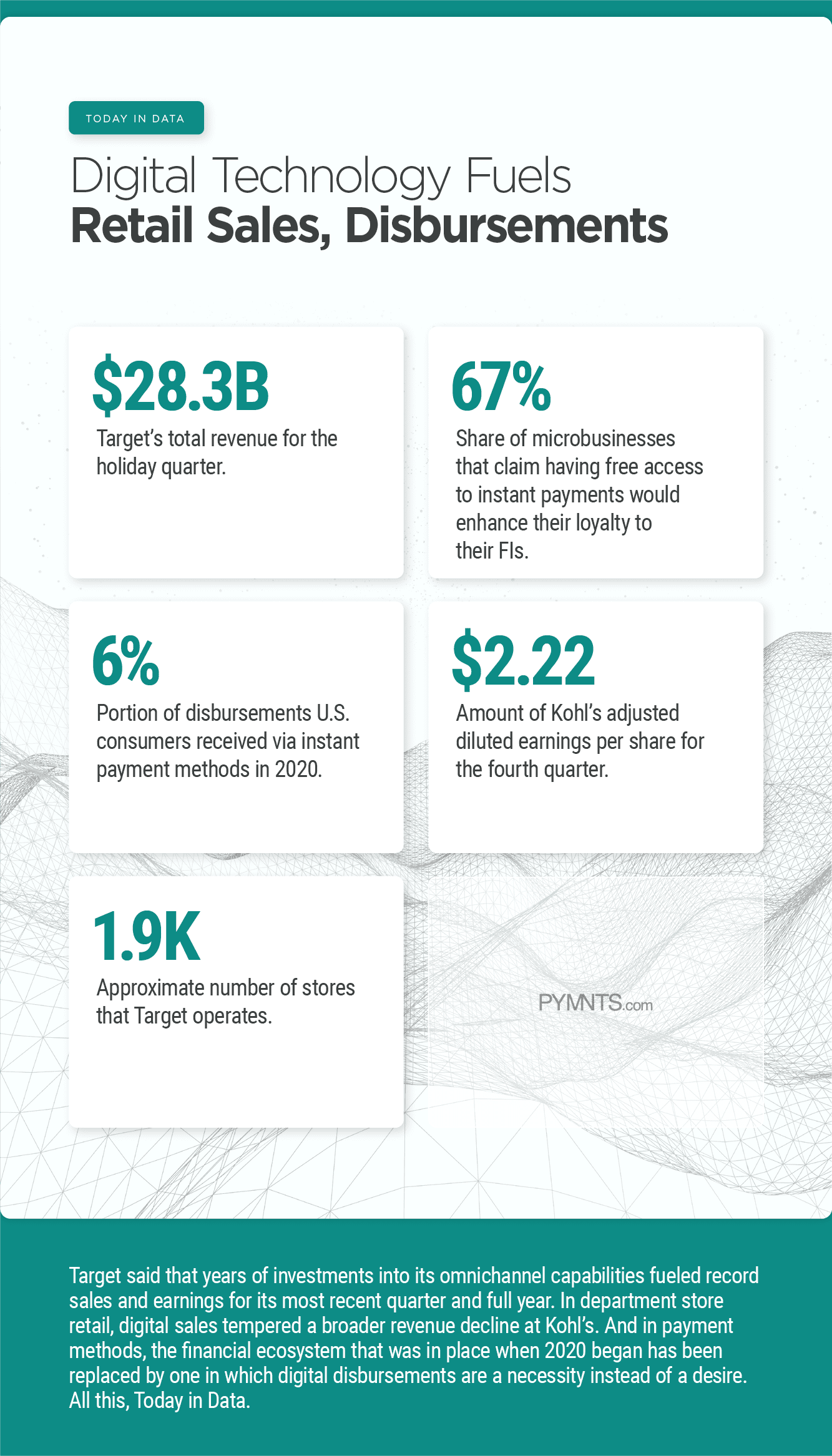

Target said that years of investments into its omnichannel capabilities fueled record sales and earnings for its most recent quarter and the full year. In department store retail, digital sales tempered a broader revenue decline at Kohl’s. And in payment methods, the financial ecosystem that was in place when 2020 began has been replaced by one in which digital disbursements are a necessity instead of a desire. All this, Today in Data.

Data:

Data:

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

$28.3B: Target’s total revenue for the holiday quarter.

67%: Share of microbusinesses that claim having free access to instant payments would enhance their loyalty to their FIs.

6%: Portion of disbursements U.S. consumers received via instant payment methods in 2020.

$2.22: Amount of Kohl’s adjusted diluted earnings per share for the fourth quarter.

Advertisement: Scroll to Continue

1.9K: Approximate number of stores that Target operates.

Data:

Data: Add as Preferred Source

Add as Preferred Source