Giving a sense of the scope of digital transformation happening in developing markets, contemplate this: “The share of Brazilian consumers who consider digital channels their preferred means of shopping has grown by more than 30 percent to make up 46 percent of consumers.” It marks a definitive sea change, occurring in a very compressed timeframe.

Such is the view from PYMNTS March 2021 Global Digital Shopping Index: Brazil Edition, a Cybersource collaboration, based on survey responses from over 2,000 consumers and 500 merchants in this largest of Latin American (LATAM) nations.

The new Brazil Index maps progress of transformation in this smartphone-savvy region with a clear case of digital lifestyle fever, yet also with a high numbers of unbanked consumers.

Per the Index, “Our data shows consumers in Brazil are highly mobile-oriented, suggesting that the wide penetration of smartphones is serving as an on-ramp to digital commerce for large shares of the population. Digital adoption is also led by younger and relatively affluent consumers — a circumstance that has significant implications for merchants and retailers, considering that the majority of the country’s population is younger than 34 years old.”

A mélange of payment methods are making inroad with Brazilian users, where choice is as decisive a factor as anywhere. And with this country’s unique mix of in-store and online shopping habits meeting new payments paradigms, the future is unfolding in real time.

Meet Brazil’s Preeminent Shopper Personas

Advertisement: Scroll to Continue

Providing needed context around who is shifting and why, the PYMNTS March 2021 Global Digital Shopping Index: Brazil Edition identified five distinct consumer personas emerging in the Brazil market, mimicking similar patters around the world as digital-first becomes the norm.

Among the five personas, we find the “online native” who prefers end-to-end digital from desktop to doorway; there’s the “mobile native” who lives (and buys) predominantly via smartphone; the “brick-and-mortar” native who loves that in-store energy; the “online cross-channel” enthusiast who starts out online and ends up at curbside; and the “mobile cross-channel” consumer who would order and pay for everything via mobile if they could.

Love of in-store shopping is a standout trait of Brazilians, or was, until lockdowns and infection fears quickly eroded that bond. As the Global Digital Shopping Index: Brazil Edition states, “preference for in-store shopping has plunged 17 percent since the pandemic’s onset in Brazil, representing the largest drop-off in any of our studied markets. The preference for buying goods digitally among Brazilian consumers has increased 33 percent since the start of the pandemic, however.”

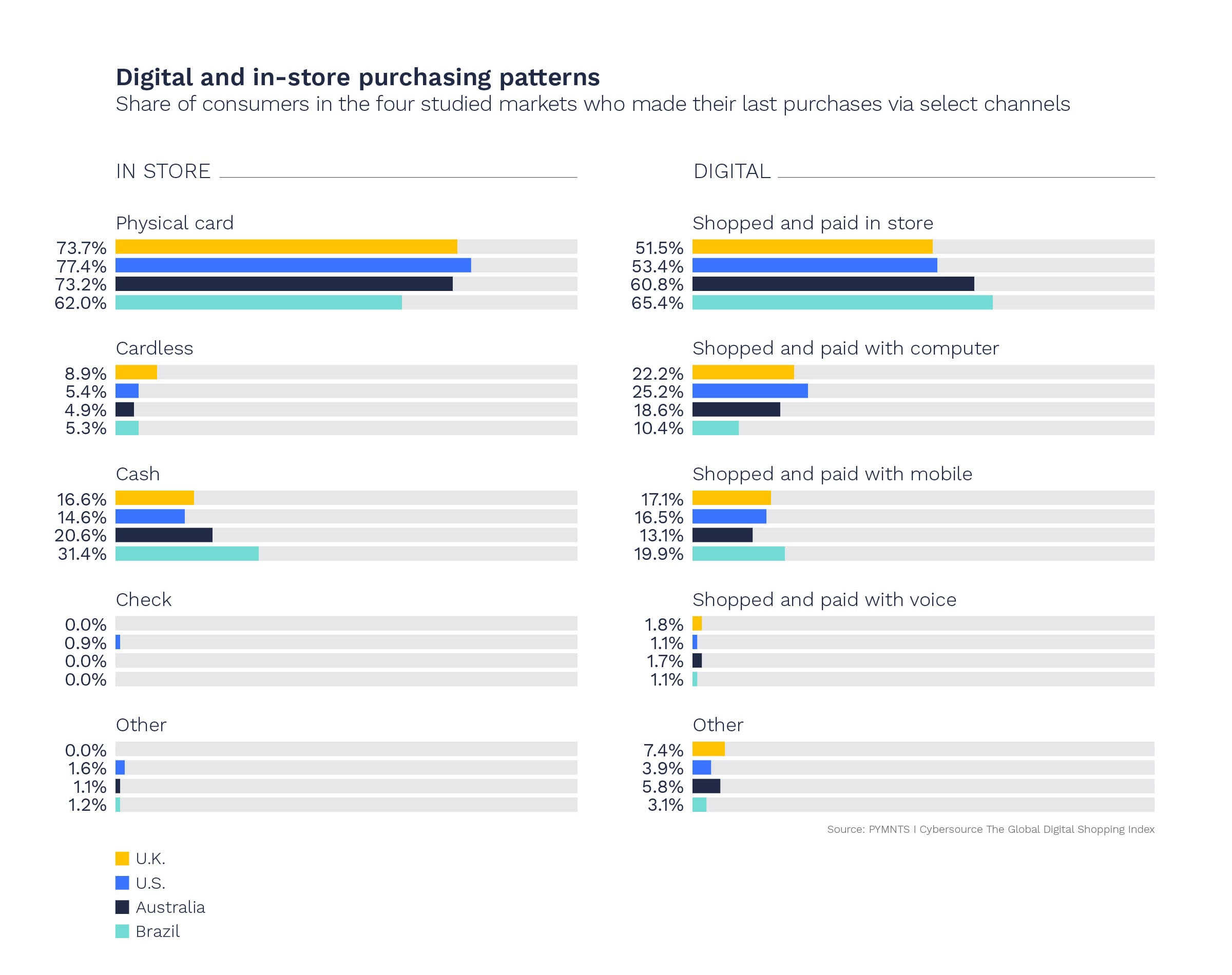

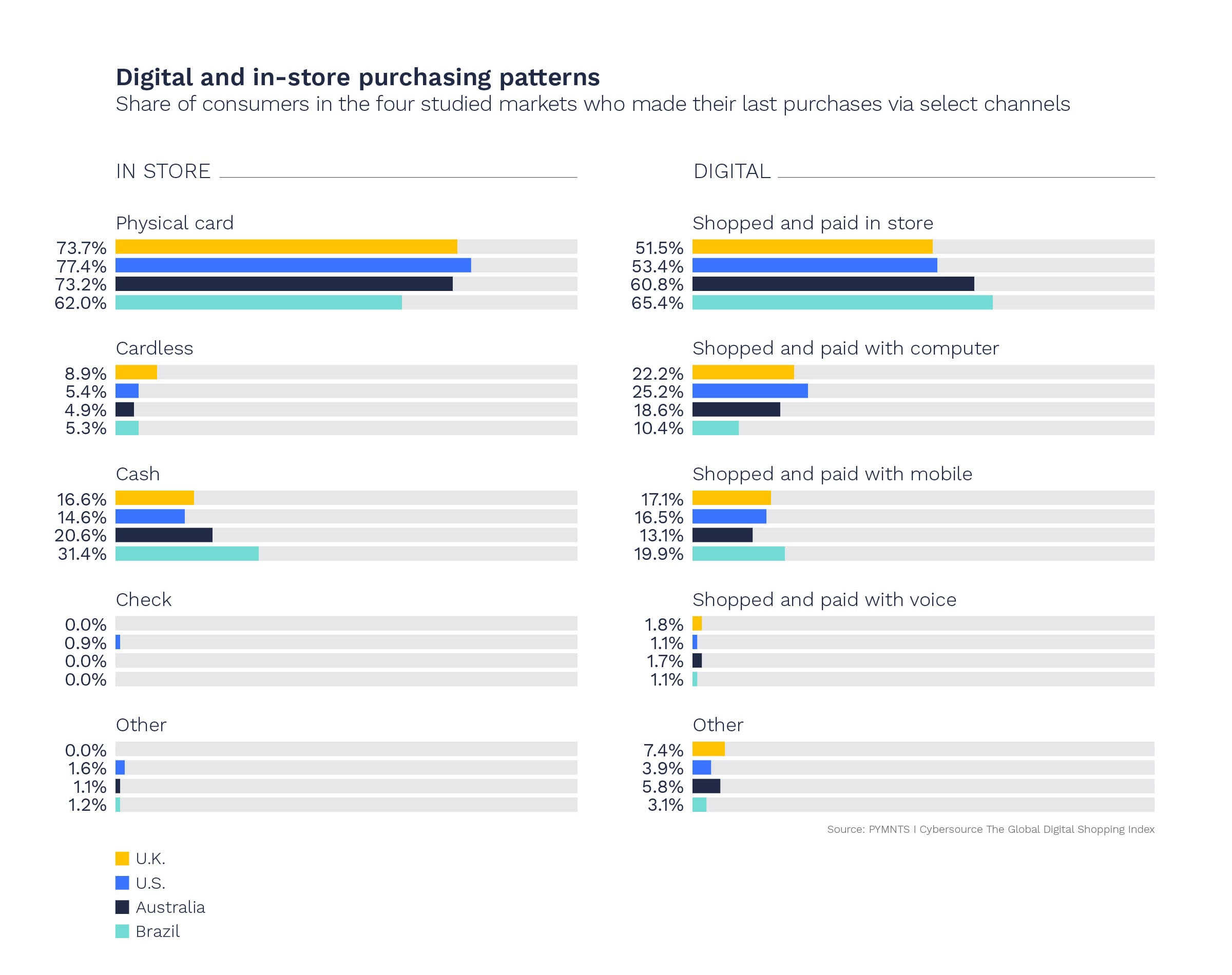

Brazil’s digital commerce channels are less mature than other studied markets, helping explain the gap researchers found between consumers’ stated preference for in-store shopping (54 percent), versus the 65 percent who actually shopped in-store for their latest purchases.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Part of what makes Brazil such an engrossing case study is the mobile-first footing of its large population, even in a payments ecosystem that lags other markets in many ways.

According to the Index, “Brazilian consumers are twice as likely to make purchases via mobile devices than computers: 20 percent reported using mobile channels to make their most recent purchases while only 10 percent reported using computers for their most recent purchases. The reverse is found in the other markets, where computer use outstrips mobile use.”

Feature Fascination Completes The Picture

A mobile-first mindset sets Brazilian consumers apart, as does it demographic makeup.

Per the Global Digital Shopping Index: Brazil Edition, “… younger consumers in Brazil — as well as more affluent ones — are helping to drive digital adoption,” and “young high-earners” — under age 37 and out-earning two-thirds of the nation — “…are nearly twice as likely as other Brazilians to report making their most recent purchases via mobile or online channels.” Nearly 50 make these digital purchases (1.7 times the share of other consumers).

When talking in smartphone terms, things eventually turn to features. Brazil’s mobile-first millions expect their shopping apps to both understand them and protect them from crime.

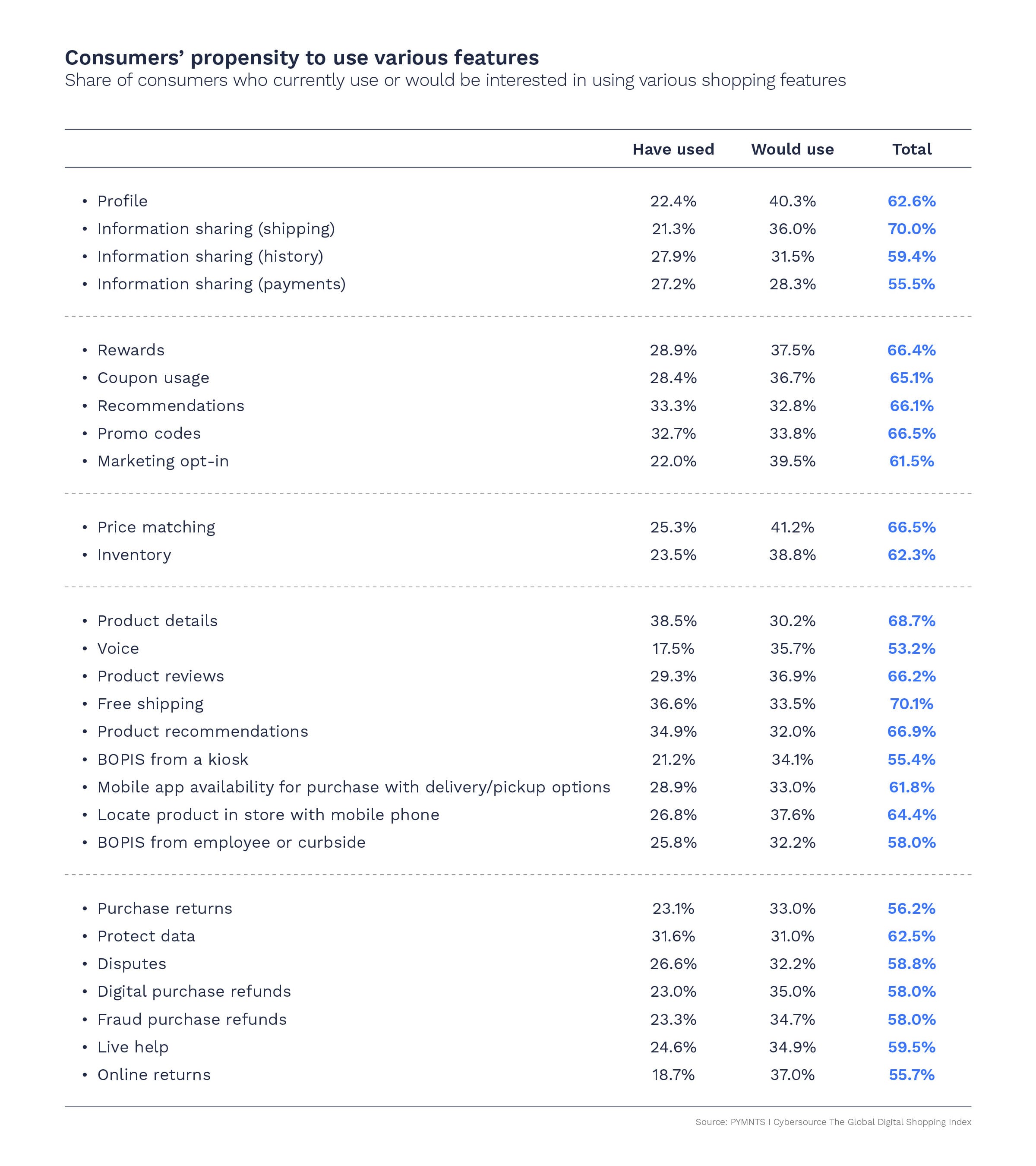

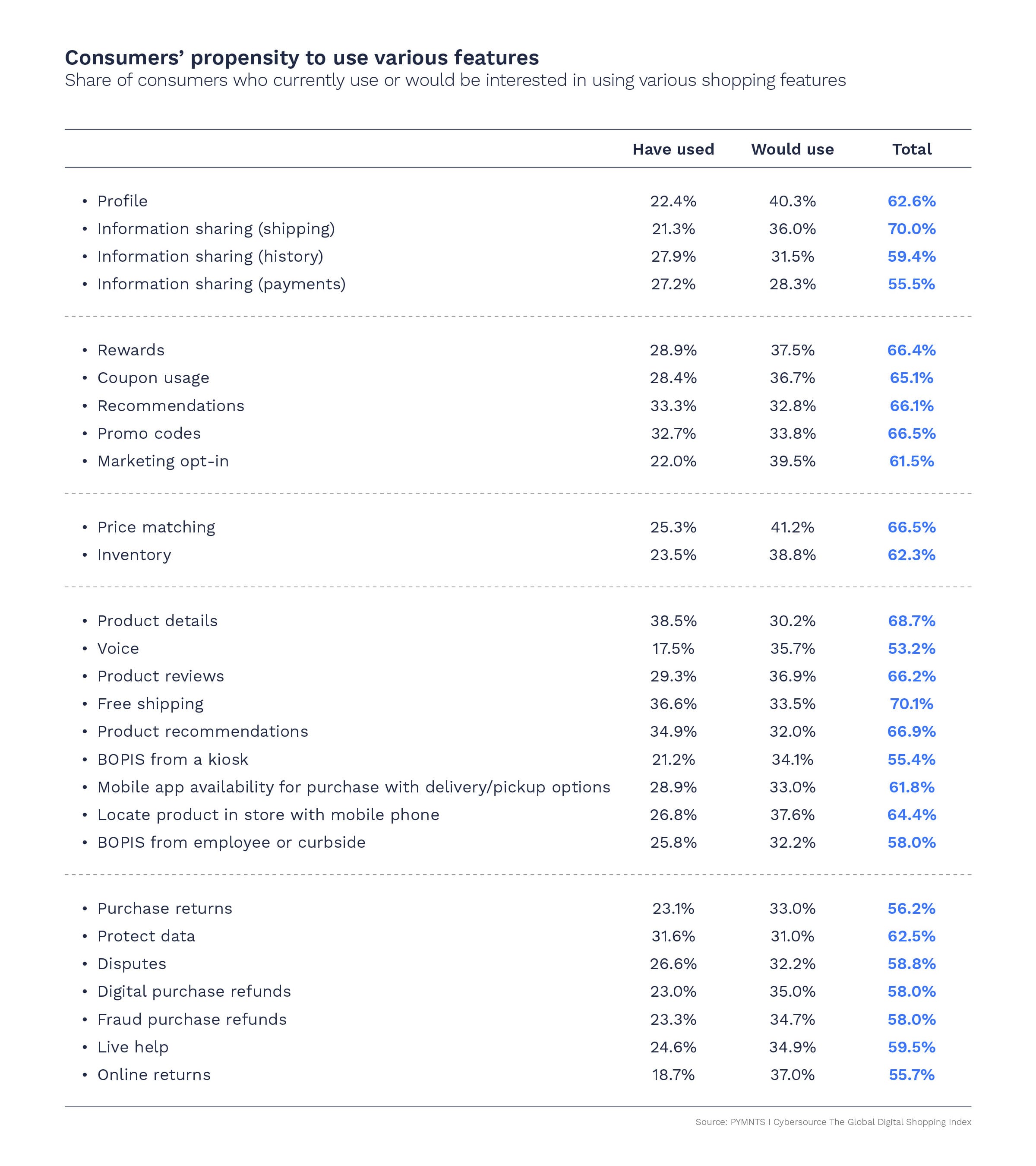

“Several … features stand out as the most popular and compelling for Brazilian consumers,” according to the March 2021 Index. “At the top of the list is free shipping, which a combined 70 percent have either used (37 percent) or would be interested in using (34 percent).”

After information-based features that help consumers make better choices, 69 percent “use or would use product details, for example, and 67 percent use or would use product recommendations.” Rewards program integrations also rate highly among Brazil’s shoppers.

Add as Preferred Source

Add as Preferred Source