The world of streaming is becoming an increasingly crowded and competitive space — such as the longtime segment leader and trend-setter Netflix is beginning to really feel the pressure, beset as it is on all sides by competition.

The scrappy upstart, now with 208 million subscribers worldwide, is no longer looking quite so scrappy and is instead defending its kingdom against an army of rising competitors.

Disney has proven to be the most active and aggressive of those competitors — but the old media competition has rolled in over the last year with HBO and Viacom also stepping into the arena to take on Netflix. All three services grew more quickly in the first three months of this year than Netflix, sending a scare through the investor community that the OG streaming player is starting to run out of steam up against its up-and-coming (and yet incredibly well established) opponents.

“Netflix isn’t just in the game, it had a hand inventing it. But prospering is different to plodding, so the rest of this year is crucial,” warned Sophie Lund-Yates, equity analyst at Hargreaves Lansdown according to Financial Times reports. “Performance in the pandemic was impressive, but anyone can make hay while the sun shines.”

And as Netflix added less than 4 million new subscribers worldwide in Q1 2020, it seems to analysts that the sun stopped shining, and Netflix needs an umbrella.

“There’s no real change that we can detect in the competitive environment,” said CEO Reed Hastings, who largely brushed off the threat from rivals after reporting those figures last month.

Advertisement: Scroll to Continue

But while Disney, HBO and Viacom have certainly made a mass of headlines, they are far from Netflix’s only problem in the streaming areas as there are now more than 100 streaming services to choose from, the Financial Times reports, with what appears to be a streaming niche for everyone — horror movies, house and home decoration, classic movies, B-movies, talk show, musical theatre, horse racing. And Netflix, with its growth viably slowed, isn’t the only entertainment streaming service in the game reportedly feeling the pain.

After a year of explosive growth during the pandemic, Disney announced it now has 103.6 million Disney+ subscribers — well short of analyst estimates of 109 million. Disney’s explanation for the hiccup is similar to that of Netflix — the pandemic bounce is winding down, and membership sign-ons are returning to more “normal” levels. Like Netflix, Disney also says subscriber growth will pick back up through the year, particularly as more high-profile content debuts.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Disney CEO Bob Chapek also noted that “every single market has exceeded expectations” in terms of global subscriber additions and that Disney+ is still expanding to new countries, with Malaysia and Thailand coming in June.

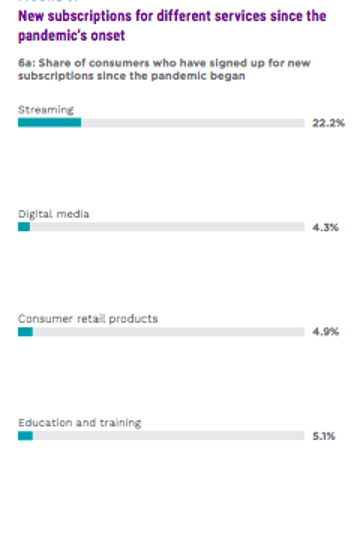

The CEOs of Netflix and Disney aren’t wrong in pointing to a streaming surge in 2020 — according to PYMNTS data, 22 percent of consumers signed up for new streaming services since the start of the pandemic, and 62.7 percent of those who subscribed to these services for their day-to-day entertainment needs were using them more than they did prior to the health crisis. Streaming services experienced the largest increase as a result of the pandemic in absolute terms in its early days — 30 million additional subscribers — although the increase is relatively low when compared to February’s total.

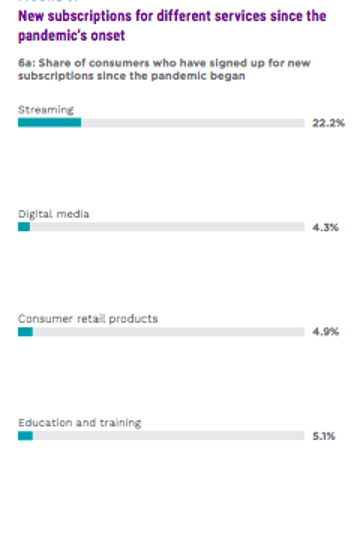

Roughly five times the share of consumers have signed up for streaming services than for other subscription types, and almost 60 percent of streaming service subscribers claim they are now using their streaming subscriptions more often than they were pre-pandemic. A fact that makes sense, since being shut in and on lockdown does present an opportunity to watch a whole lot more TV. Streaming is especially popular among Gen Z consumers and bridge millennials, with 34.7 percent signing up for a new streaming subscription since the health crisis began — roughly 12 percentage points above the average.

But streaming programs face a bigger problem, according to PYMNTS data, than merely recruiting new users — they soon face the difficulty of holding on to the ones that they’ve captured as consumers are increasingly able to venture out and do things outside of their homes.

Digital media services, PYMNTS data demonstrates are facing the highest cancellation risk of any of the new subscription services signed on for, with 17 .5 percent of subscribers — 4.3 million users — likely to cancel their plans once the pandemic ends. The risk is lower among streaming and education and training services, with 12 .6 percent of users in each sector saying they would be “somewhat” or “very likely” to cancel their services.

It was a golden year for streaming services in 2020, as homebound consumers were suddenly willing to sign on to keep themselves entertained while homebound. But as the front doors are opening, it will be interesting to watch which services manage to stick it out and translate that pandemic bump into real post-recovery staying power.

Read More On Subscriptions:

Add as Preferred Source

Add as Preferred Source