It can often make the difference between an abandoned shopping cart and a consumer purchase conversion. It is also why a backpack on Amazon that costs less than $30 may come with a warranty when a $300 pair of headphones might not.

That’s not a mistake on Amazon’s part, Extend CEO Woody Levin told Karen Webster in an interview. It’s the outcome of a lot of testing that has told them whether or not consumers will actually pony up extra cash for a warranty as just enough of a confidence booster to push them over the line to conversion.

It’s why you see the big players in retail, like Amazon, Walmart, Wayfair and Costco all offer extended refunds to consumers. They’ve seen the data that tells them that offering warranties can avoid that empty shopping cart.

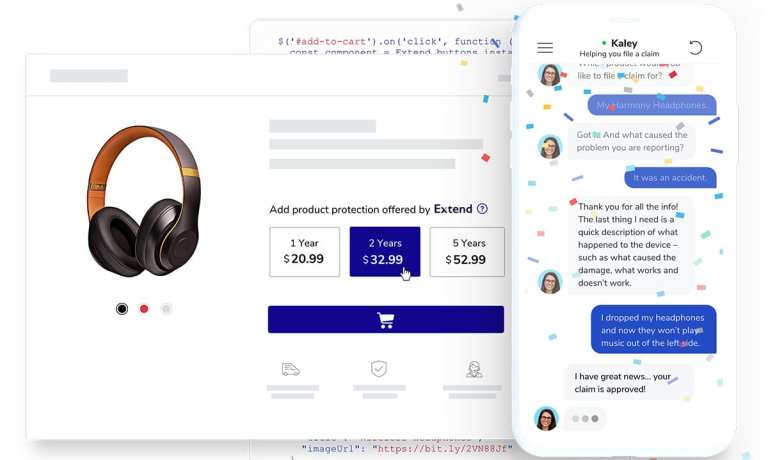

Extend exists, he said, to extend (no pun intended) the conversion-boosting factor of offering extended warranties to the scores of retailers outside the top tier that can benefit from the added confidence that an extended warranty brings. Those benefits are numerically quantifiable. Some of Extend’s merchant partners are seeing overall increases in purchase volume of 11 percent and more.

The company got its own vote of confidence this week as Extend closed a $260 million Series C funding round. Led by Softbank, the latest infusion of funds officially marks the firm’s entrance into the unicorn club with a valuation north of $1 billion.

Advertisement: Scroll to Continue

Extend is taking on what it sees as a largely green field where its main competition are legacy players that can’t move as quickly or efficiently for customers who have become accustomed to seamless online processes, Levin said. With $260 million in hand, Extend will leverage its large and growing data science team to “dive deep” and more efficiently tap its datasets to “create a better platform for merchants and consumers alike.”

Recreating The Consumer Relationship

What Extend can offer to consumers — and thus for merchants — is the ability to expand their relationship from being purely transactional to something that can become long term. It offers what all insurance is premised around selling: peace of mind.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

And the usage rates are basically similar to what one sees across the insurance industry, somewhere between 7 percent to 10 percent on an annual basis, he said. Although those figures compound annually, over three years, retailers could be looking at 20 percent to 30 percent of customers coming in with claims. What Extend offers is taking on that entire process for the merchant or manufacturer.

“We’re focused on making sure that when a customer does want to file a claim and use our service, unlike the legacy players, that they can do it quickly, they can do it efficiently and that we can take care of them and resolve their issue either with the full replacement or repair,” Levin said.

Extend can provide that warranty service so that when the manufacturer’s warranty ends, it can take over the entire warranty relationship from the moment of purchase onward via its just launched Lifecycle Management product. It’s an addition made at the request of original equipment manufacturers (OEMs) who realized their customer service departments’ expensive time is better spent outsourcing warranty issues to the team at Extend, he said.

Moreover, Extend includes post-purchase insurance on products to help guide consumers back to these brands, he said. iRobot is a prime example of this in action. Its post-purchase promotions of insurance drive the consumer back to iRobot.com and into further interaction with the brand, no matter where they made the original purchase.

Keeping Competitive In A Growing Field

Where there is success to be had, there are innovators sure to show up, Webster said. The warranty space is proving to be no different as new competitors are trying to stake a claim to the business.

But Levin said it is ready for all comers, as he believes Extend is unique in the space in terms of its offering. It owns the full technology stack that it uses, making it a technology-enabled broker and fully licensed administrator. As of January, it is also its own underwriter via its wholly owned subsidiary, Overtime Insurance Solutions. That makes Extend more able than any other player, he said, to custom fit the extended warranty offering that a merchant or brand wants.

And the demand in the market is only going to grow, he said. Consumers who’ve digitized their behaviors aren’t going to abandon them even when the pandemic is over. According to Levin, that means 99 percent of the retail industry has a chance to level the playing field.

How to do that? A lot of answers have come to the fore during the past year: BNPL, same-day shipping, mobile apps. All of these are similar to extended warranties and protection plans, Levin said. They all serve the same goal for merchants, which is making the customer more comfortable converting in the moment.