Today in B2B payments: Hokodo puts BNPL to work for digital B2B marketplaces, and TIS optimizes payments visibility for global corporates. Plus, ActZero discusses small business cybersecurity, SumUp partners with Google Pay and Tipalti streamlines cross-border accounts payable.

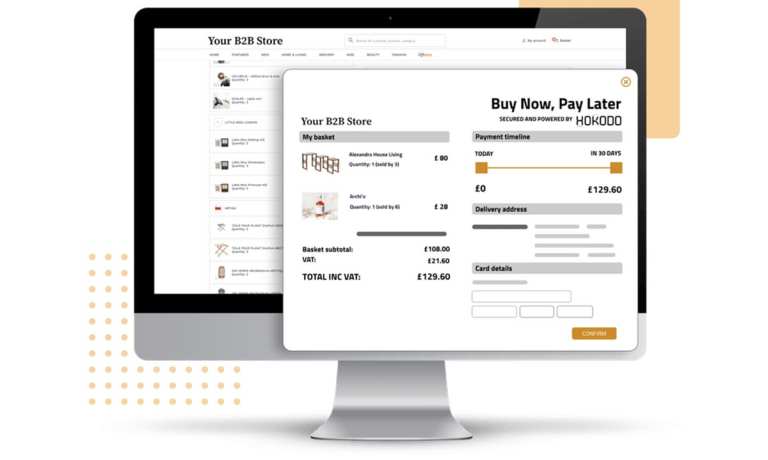

Hokodo Puts BNPL To Work For UK B2B Marketplaces

A Proactive Strategy For The Existential Crisis of an SMB Cyberattack

From ransomware to business email compromise scams, the cybersecurity threat on small businesses today is overwhelming. It’s important not to blame the victim, says ActZero Chief Operating Officer Chris Finan, but it’s vital that SMBs take proactive measures to avoid a cyber event that could kill their businesses outright.

TIS Optimizes Payment Visibility For Global Corporates

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

SumUp Taps Google Pay For Merchants To Spend POS Proceeds

Advertisement: Scroll to Continue

To let retailers conduct more expedient and secure transactions with its prepaid debit card, SumUp is teaming with Google Pay, reported IBSintelligence on Wednesday (June 9). SumUp lets small businesses accept payments by the way of card readers, according to the company’s website. The SumUp Card serves as a prepaid debit card that lets cardholders make payments with the funds they obtain via transactions accepted through SumUp.

Tipalti Streamlines Global AP For Multisubsidiary Corporates

Global payment automation program Tipalti has rolled out new ways for corporates to manage accounts payable (AP) data, a press release said on Wednesday (June 9). This feature will also aid in simplifying foreign exchange (FX) as well as currency management requirements for corporates. The new feature, called Tipalti Multi-Entity, will aid in letting companies access visibility control and access for an optimized workflow, ensuring better audit preparedness and subsidiary-specific communications.

Read More On B2B Payments:

See More In: ActZero, B2B, B2B Payments, Commerce, Hokodo, News, payments, SumUP, Tipalti, TIS, Today In B2B Payments

Add as Preferred Source

Add as Preferred Source