As the Connected Economy touches more aspects of how we pay, shop and live, there’s an “out with the old” mindset taking hold when it comes to onboarding, authentication and new definitions of what digital credentials should be in a digital-first, fraud-fraught world.

For Generation Superconnected: The Coming User Authentication Shift Report, a collaboration between PYMNTS and Nok Nok Labs, researchers surveyed more than 2,120 adult consumers about their sharing preferences for personal information with merchants and digital platforms, to gain a clearer understanding of consumer views on matters of data security and identity.

Defining superconnected consumers as “those who have six or more connected devices, are convenience-focused” and increasingly habituated to digital platforms and tools, the report notes that this group is averse to usernames and passwords, and for good reason.

“There are numerous risks associated with a password-based security system, according to global law enforcement. Malware downloaded with a single click on a compromised email can install a keystroke logger that may capture and transmit password data in seconds to cybercriminals,” the Report states, adding that “a stolen password will do far more harm faster than a stolen wallet. Criminals can steal valuable personal data, create synthetic identities with personal information found on online accounts and then resell the lot on the dark web to other criminals in seconds, well before a breach is even noticed.”

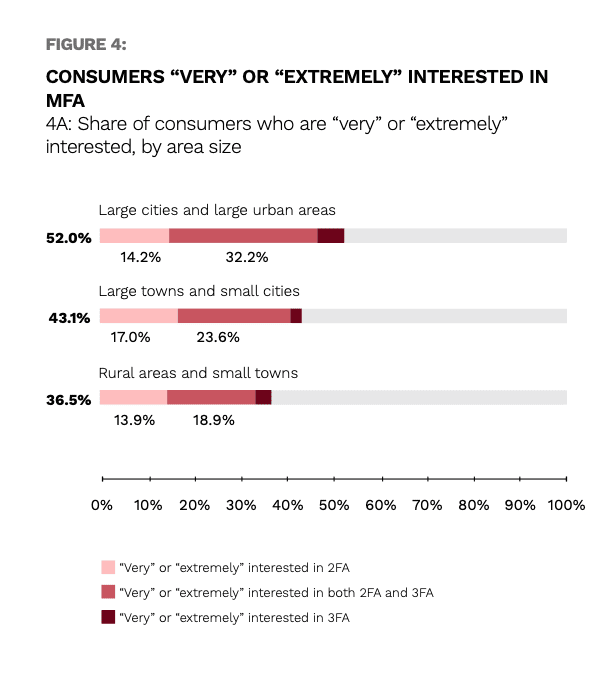

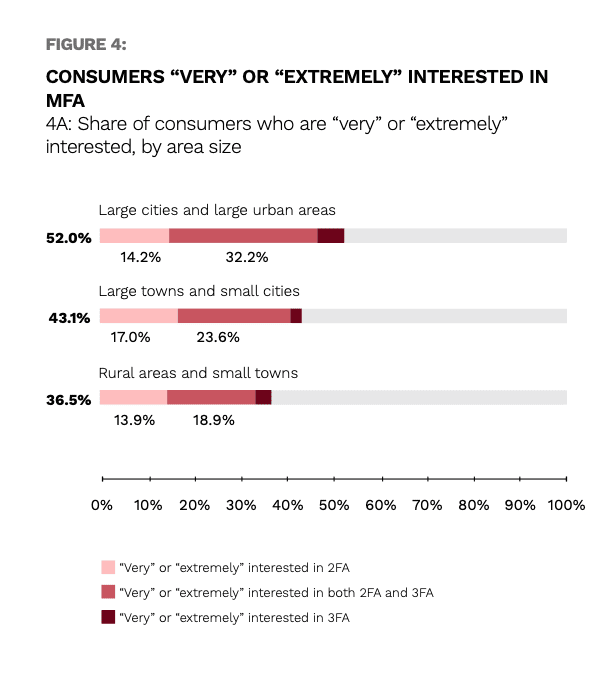

Personal data theft cost consumers $43 billion in 2020 alone, the report states. For that reason, among others, interest in multi-factor authentication is growing rapidly among the superconnected, and companies are getting the message about demand for two-factor (2FA) and three-factor (3FA) that make the fraudster’s work nearly impossible. And that’s the point.

The Rising Tide Of Data Security

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Interest in secure onboarding and multifactor authentication is also easy to understand when viewed against the backdrop of digital wallet and mobile banking adoption since 2020.

According to Generation Superconnected, “half of consumers increased their use of online or mobile banking over the last 12 months, with young adults and the affluent showing the greatest gains. Digital money management is now part of consumers’ toolkits for navigating online and in-store experiences.”

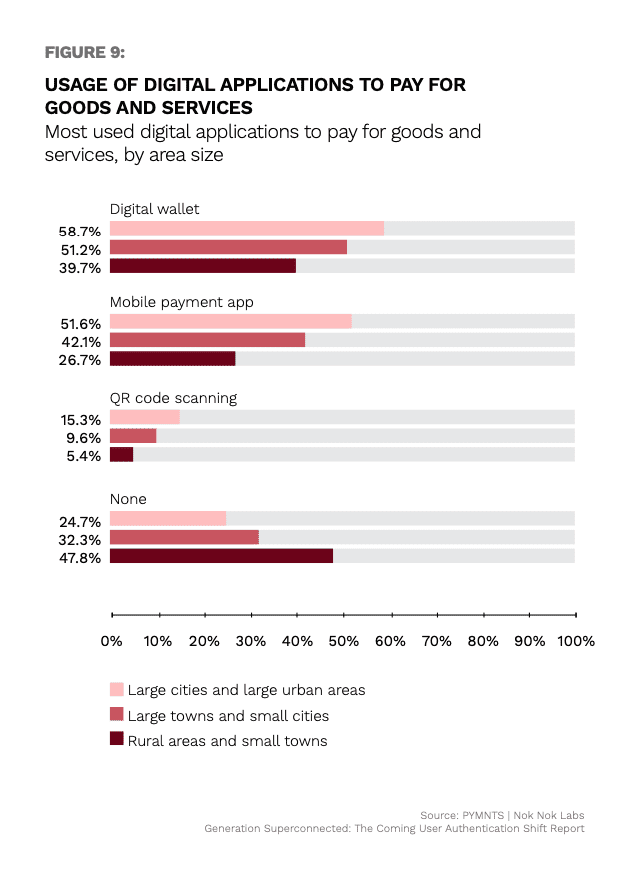

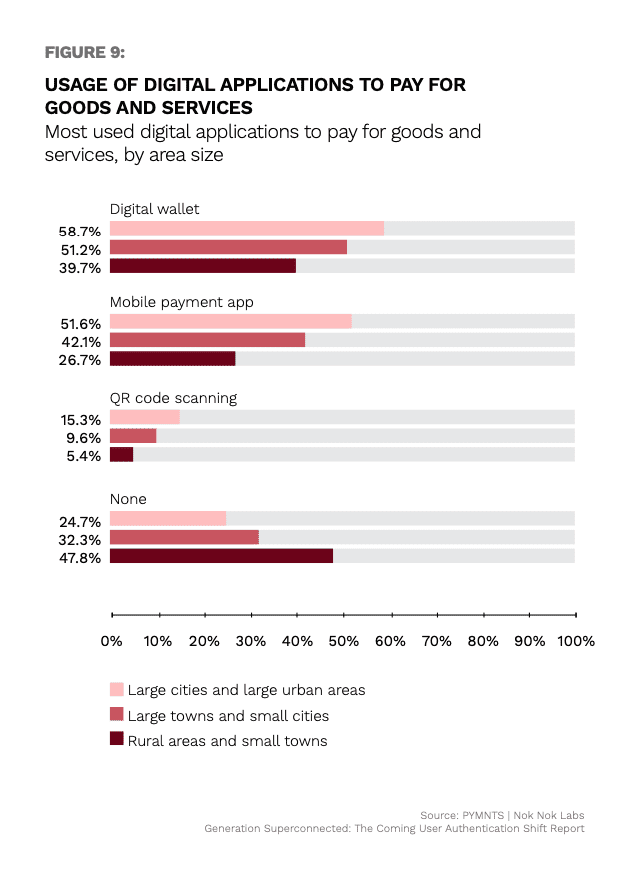

Additionally, researchers found that “49 percent of consumers currently use digital wallets to pay for goods and services, and 37 percent use digital wallets to pay more than any other method. Overall, digital wallets are the most used applications to pay for goods and services. These numbers represent 97.7 million and 74.9 million United States consumers, respectively.”

Biometrics And The Future Of Authentication

Generation Superconnected: The Coming User Authentication Shift Report throws several trends into sharp relief, perhaps most notably the digerati’s call for better online credentials.

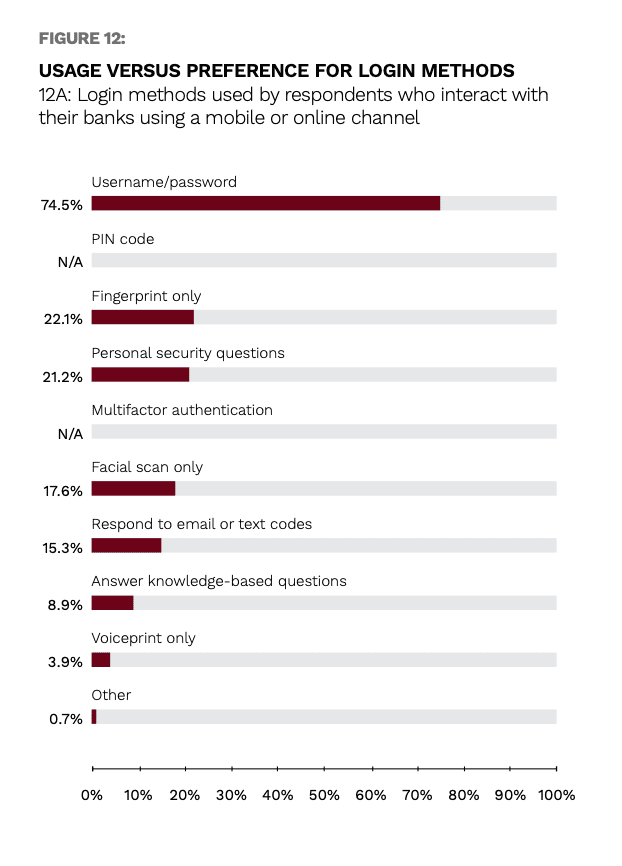

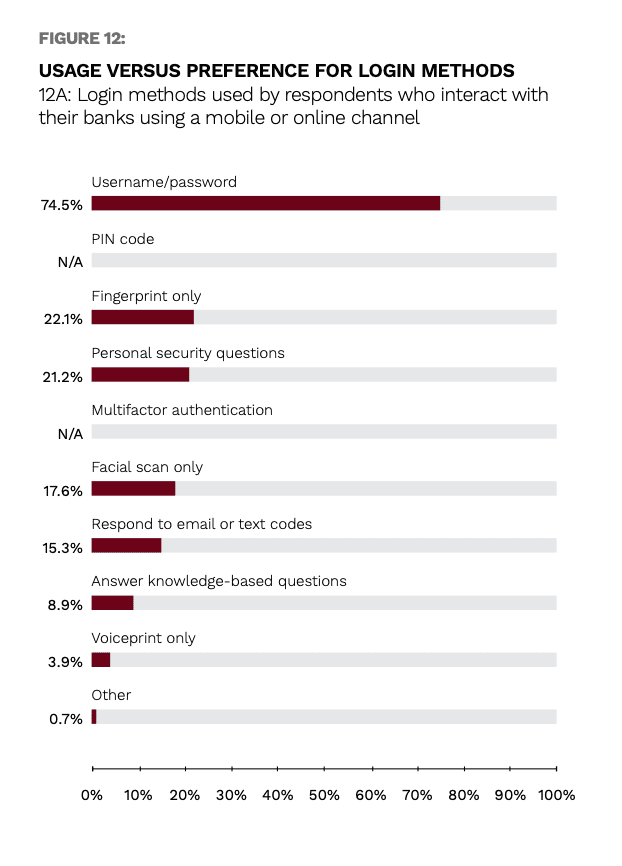

While PYMNTS researchers found that three-quarters of consumers are using usernames and passwords to access bank accounts “but only 42 percent prefer to do so” the findings suggest that the transition is already here and being driven by consumer demand for data security.

The report notes that while “adoption rates for secure passwordless authentication are relatively low” at present with under 25 percent of consumers using biometric tools, “superconnected consumers showed the lowest preference levels for username and password logins and the highest levels of interest in passwordless user authentication.”

In other words, online players from marketplaces to social media platforms and beyond should heed the biometric signals being thrown off by the superconnected and go passwordless.

Add as Preferred Source

Add as Preferred Source