Perks And Rewards Push Debit Card Usage, Loyalty Higher

Debit cards have proven to be the most popular payment method among United States consumers, especially within the last year as they sought to improve visibility into their finances. As financial institutions (FIs) seek to maintain those debit cardholders and gain an edge in attracting more, many are offering debit rewards including cash back, discounts and other perks.

Debit cards have proven to be the most popular payment method among United States consumers, especially within the last year as they sought to improve visibility into their finances. As financial institutions (FIs) seek to maintain those debit cardholders and gain an edge in attracting more, many are offering debit rewards including cash back, discounts and other perks.

The August Next-Gen Debit Tracker® examines debit cards’ surging popularity over the past several years and analyzes how some FIs are turning to rewards programs to offer debit products that stand out.

Around The Next-Gen Debit Space

New research suggests a debit card is one way to promote greater financial inclusion among the unbanked. The report examined five years’ worth of data from the social program Prospera, finding that more than 1 million debit cards were distributed to participants during that time. It revealed that recipients were able to get a better handle on their spending and saving decisions when benefits were delivered via debit card rather than via direct deposit.

Debit cards’ popularity continues to rise even among consumers who have credit cards. A recent survey of 1,011 U.S. consumers found that 48 percent of credit cardholders prefer debit over credit. Researchers determined that many consumers reserve credit cards for big-ticket purchases or emergencies, and respondents indicated that they wanted to avoid the temptat ion to overspend when using credit.

ion to overspend when using credit.

If there’s one way to give debit cards an edge, it could be to offer potential customers rewards programs. San Francisco-based technology services provider Oxygen Inc. recently introduced a tiered loyalty program, called Elements, encouraging debit use. Benefits include cash back, discounts on subscriptions to Netflix and Peloton, increasing annual percentage yields and other benefits.

For more on these and other subscription commerce news items, download this month’s Tracker.

Truist On Driving Loyalty With Debit Rewards

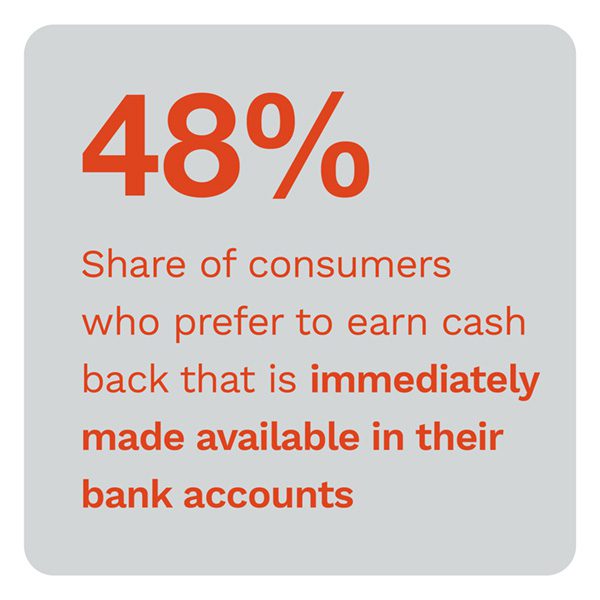

The financial crunch fueled by the pandemic has driven consumers to desire improved transparency into their spending and rewards to help give them a boost. Banks have extended debit reward incentives and cash back in response, to maintain existing customers and meet these new demands. In this month’s Feature Story, Carl Thibodeau, senior vice president of consumer credit and debit card solutions for Truist, explains the changes in debit user behavior spurred by the pandemic and what is driving them to seek out debit rewards and cash back.

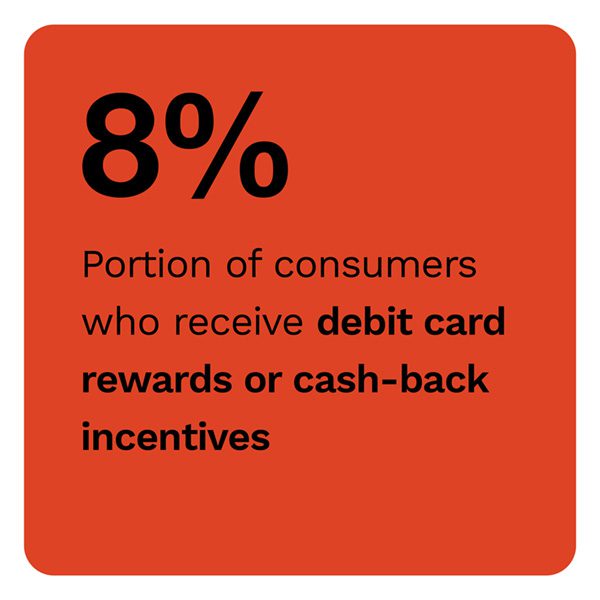

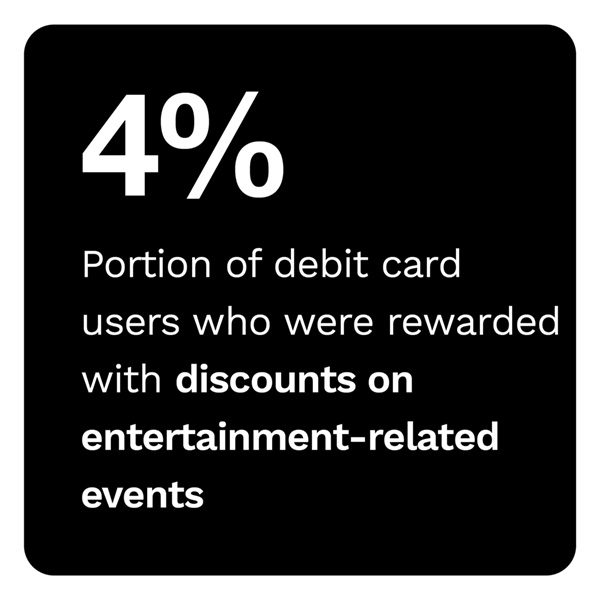

Deep Dive: How Debit Rewards Can Benefit Consumers, Merchants And FIs

Rewards and loyalty programs have long been a fixture in the credit card space, but just 50 percent of consumers say they receive rewards such as cash back and other perks for using their debit cards. This gap in availability represents a lost opportunity for FIs, especially as they seek to attract millennials and Generation Z consumers who are hungry for both debit cards and rewards. The August Deep Dive explores how issuers and FIs are coming up short in offering rewards programs for consumers and details how such incentives can help them grow their customer bases and foster loyalty.

About The Tracker

The Next-Gen Debit Tracker®, a collaboration between PYMNTS and PULSE, a Discover company, examines consumers’ changing payment behaviors as well as the innovations that are reshaping how they use debit.