Many beauty services — such as haircuts, nail or skincare treatments — require close,  in-person contact that was strongly discouraged during much of the health crisis, forcing a significant number of these retailers to shutter their doors. Federal Reserve data found that 100,000 businesses in the salon and spa industries shut down over the course of the pandemic, making this one of the retail categories hit the hardest by the events of the past 17 months.

in-person contact that was strongly discouraged during much of the health crisis, forcing a significant number of these retailers to shutter their doors. Federal Reserve data found that 100,000 businesses in the salon and spa industries shut down over the course of the pandemic, making this one of the retail categories hit the hardest by the events of the past 17 months.

Beauty retailers have seen new life as guidelines surrounding in-person contact relax across the country, but the industry landscape has changed after last year’s leaner times. Competition for consumers returning to their salons or barbershops has become fiercer, especially as many of these customers are expecting the same conveniences they experience when shopping online.

In the August Digitizing Beauty Business Report, PYMNTS examines how the beauty industry has changed over the course of the past 18 months and how beauty and wellness retailers can meet consumers’ digital-first expectations. It also analyzes what tools and solutions are proving key to doing so at speed and at scale.

Around The Health And Beauty Industry

Beauty and healthcare are reviving as the rules regarding in-person retail relax, with reservations for such services rising 156 percent year over year in May. Payment volume is also increasing as consumers loosen their grip on their wallets, expanding 121 percent during that same time frame. This represents a 25 percent jump from payment volumes glimpsed prior to the pandemic, indicating that consumers are more than ready to splurge on beauty and related products. Seventy-four percent of individuals even indicated that they expect to increase the money they spend on makeup particularly, for example. Beauty retailers should therefore move to give themselves any advantage they can over their competitors.

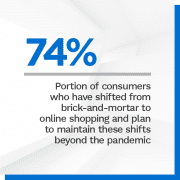

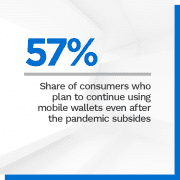

One way beauty retailers may be able to gain that advantage is by paying attention to consumers’ changing payment expectations. Many customers are now using digital-first payment methods at the point of sale (POS) and spending more frequently online, and beauty companies are taking notice. Payment provider Square noted that its customer base in the beauty and wellness space expanded 296 percent between January and May, for example. Thirty-nine percent of hair salons specifically began implementing touchless checkout tools within the past year to keep pace with shifting customer needs, in fact. Touchless payment and checkout thus appear to be playing a greater role within this space.

beauty companies are taking notice. Payment provider Square noted that its customer base in the beauty and wellness space expanded 296 percent between January and May, for example. Thirty-nine percent of hair salons specifically began implementing touchless checkout tools within the past year to keep pace with shifting customer needs, in fact. Touchless payment and checkout thus appear to be playing a greater role within this space.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Virtual and augmented reality can also aid retailers in the beauty industry. Foot traffic at these merchants has ballooned in recent months as brick-and-mortar retail regains lost ground, expanding 226 percent year over year in April 2020. Customers returning to in-person locations are expecting a different experience than they may have witnessed just one year prior. Ulta Beauty is among those using virtual tools to keep shoppers’ interest, offering a QR code in its stores that shoppers can scan via their mobile phones to examine products virtually. Offering such experiences could become more commonplace within the beauty space and as customers increasingly expect to see digital conveniences reflected in their brick-and-mortar shopping experiences.

For more on these and other stories, visit the Report’s News & Trends.

How The Salon Industry Leveraged Contactless Payments Amid The Pandemic

For many merchants in 2020, keeping the lights on meant going digital. This was not an option for hair salons and other businesses that offer services that must be conducted in person, however, and these businesses are working quickly to find and engage new customers after a lean year. To do so, they must embrace the digital-first preferences consumers have developed after  their time indoors.

their time indoors.

This is why many salons have adopted tools such as contactless payments and online booking options, explained Jason Foodman, president of Rosy Salon Software.

To learn more about why touchless payments are becoming key for salons to stay successful as consumers’ payment wants shift, visit the Report’s Feature Story.

Deep Dive: Technology Helps Beauty Retailers Regain Lost Ground

Many retailers have had to adjust their customer engagement in recent months, but doing so has been especially tricky for merchants that typically thrive within brick-and-mortar environments. Beauty retailers such as hair salons were hit hard by the health crisis, with salon revenues plummeting by about 33 percent last year. While consumers are tentatively returning to in-person retailers, it is unlikely that many will fully return to their pre-pandemic shopping behaviors — making it imperative for hair salons or other beauty merchants to look to digital-first technologies that can help them engage customers as well as potentially regain some of their lost revenue and customer trust.

To learn more about how technologies such as artificial intelligence (AI) and augmented reality (AR) solutions may prove crucial to beauty retailers’ success, visit the Report’s Deep Dive.

About The Report

The Digitizing Beauty Businesses Report, a PYMNTS and American Express collaboration, explores how consumers’ interest in digital-first technologies is affecting their expectations when returning to brick-and-mortar salons, spas and other beauty retailers.

The United States beauty industry raked in more than $62 billion in sales in 2019, but the largely brick-and-mortar retail space was badly affected by the global pandemic.

The United States beauty industry raked in more than $62 billion in sales in 2019, but the largely brick-and-mortar retail space was badly affected by the global pandemic.

The United States beauty industry raked in more than $62 billion in sales in 2019, but the largely brick-and-mortar retail space was badly affected by the global pandemic.

The United States beauty industry raked in more than $62 billion in sales in 2019, but the largely brick-and-mortar retail space was badly affected by the global pandemic.