Working from home became the new normal for millions of employees in 2020, and many are likely to stay sequestered in their virtual offices even as companies reopen their physical offices.

One April 2020 study found that 74% of chief financial officers planned to move at least 5% of their employees to permanent remote positions, indicating many companies are expecting to see virtual workforces continue to develop.

Operating remotely entails more than just a change of scenery. Companies also have to reorganize processes that have long taken place within brick-and-mortar offices to fit virtual screens. This includes adjusting their accounts payable (AP) and accounts receivable (AR) processes to match the needs of increasingly digital teams and the online preferences of their clients and suppliers — making innovative spend management tools a top priority. One March PYMNTS report found that nearly 36% of businesses in the United Kingdom and the United States are planning to innovate their spend management and expense controls, for example.

Operating remotely entails more than just a change of scenery. Companies also have to reorganize processes that have long taken place within brick-and-mortar offices to fit virtual screens. This includes adjusting their accounts payable (AP) and accounts receivable (AR) processes to match the needs of increasingly digital teams and the online preferences of their clients and suppliers — making innovative spend management tools a top priority. One March PYMNTS report found that nearly 36% of businesses in the United Kingdom and the United States are planning to innovate their spend management and expense controls, for example.

In the latest “Corporate Spend Playbook,” PYMNTS analyzes how the shift to remote work and the rising digital-first preferences of customers and other businesses are affecting companies’ spending and budgetary needs, and how companies can adjust their spend management tools accordingly.

Across The Spend Management Ecosystem

Migrating to remote work models took its toll on companies’ spend management processes, creating delays and frustration as employees suddenly working from home attempted to file expenses with virtual AP teams. One report revealed that expense report violations spiked 292% year over year in 2020 as employees struggled to decipher confusing terms or whether they were eligible for reimbursement. Companies can reduce these instances by implementing spend tools that aggregate expense data in one place, making it easier for their workers to file the necessary paperwork and have their questions answered without adding money and cost to businesses’ bottom lines.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Many companies may face barriers to conducting their spend management processes at the speed that remote teams and suppliers now require, however. One of the top challenges to successful expense management is a lack of access to the data necessary to make real-time spending decisions, with 49% of chief financial officers stating that this was their main obstruction in 2020. Twenty-eight percent of this group also claimed this lack of data access led to delayed product launches. Addressing this point of friction is therefore top of mind for business leaders.

Still, businesses remain optimistic about how 2021 will shape up even as they look to solve spend management challenges. Seventy-six percent of U.S. companies reported being positive about their businesses’ prospects for the next 12 months, and they said they are also expecting B2B spending to increase as well. Companies anticipate B2B spending will rise 3.4% year over year in the second quarter of 2021, a jump that would represent about $140 billion in new spending. This makes overcoming budgeting challenges essential for companies, as getting their piece of this new spending necessitates that their spend management services can handle this increased volume with ease and convenience.

Still, businesses remain optimistic about how 2021 will shape up even as they look to solve spend management challenges. Seventy-six percent of U.S. companies reported being positive about their businesses’ prospects for the next 12 months, and they said they are also expecting B2B spending to increase as well. Companies anticipate B2B spending will rise 3.4% year over year in the second quarter of 2021, a jump that would represent about $140 billion in new spending. This makes overcoming budgeting challenges essential for companies, as getting their piece of this new spending necessitates that their spend management services can handle this increased volume with ease and convenience.

For more on these and other stories, visit the Playbook’s News & Trends.

How Holistic Spend Management Tools Can Keep SMBs Competitive

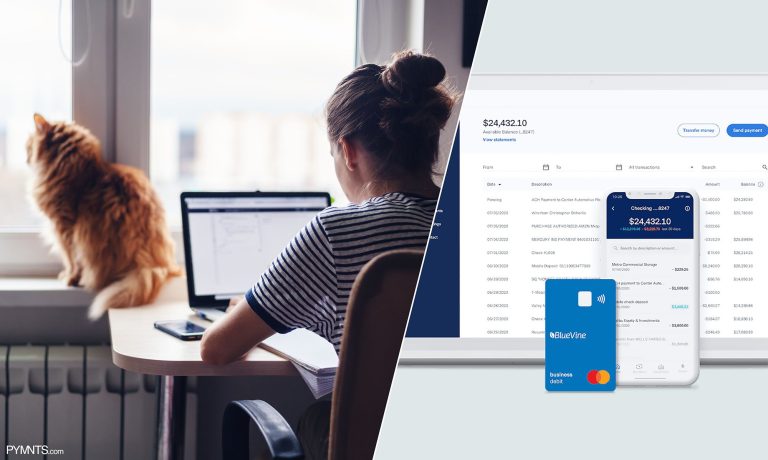

Many businesses have run their spend management processes the same way for years if not decades, but the past 18 months have rendered traditional budgeting and expense approaches obsolete. Finding ways to consolidate their payments and better track expenses in this new environment is therefore key, especially for small- to medium-sized businesses (SMBs) without the financial resources of larger firms to handle any potential hiccups.

Moving to a spend management platform that can handle all payments and spending data is a necessity, explained Herman Man, chief product officer for small business banking solution BlueVine.

To learn more about how moving to all-in-one spend management solutions can provide SMBs with key advantages to keep them competitive, visit the Playbook’s Feature Story.

Deep Dive: Why Firms Need To Innovate Their Budgeting, Spend Controls To Keep Pace With Remote Working Environments

Companies migrated to remote work models during the pandemic, a switch that is likely to become permanent for a significant number of firms moving forward. This means companies need to be able to conduct routine budgeting and spending processes via virtual channels, and businesses working from outdated tools may find it much harder to keep their spending where it should be. Finding digital spend controls can help companies keep more detailed track of their cash flow as they make the switch to virtual workforces.

Companies migrated to remote work models during the pandemic, a switch that is likely to become permanent for a significant number of firms moving forward. This means companies need to be able to conduct routine budgeting and spending processes via virtual channels, and businesses working from outdated tools may find it much harder to keep their spending where it should be. Finding digital spend controls can help companies keep more detailed track of their cash flow as they make the switch to virtual workforces.

To learn more about how companies’ spend management needs have shifted as remote work becomes more popular, and how they can keep pace by implementing automated budgeting and spend solutions, visit the Playbook’s Deep Dive.

About The Playbook

“The Corporate Spend Playbook”, a PYMNTS and Airbase collaboration, examines how spend management automation can boost payments transparency and facilitate smoother payments operations.