Both businesses and consumers alike are now expecting to be able to conduct a widening range of their financial tasks through digital tools first, including paying routine bills such as utility, rent or other monthly expenses.

Financial institutions (FIs) must move to offer features that match these expectations accordingly or risk losing out on customer engagement and lasting loyalty, putting pressure on banks to innovate their online bill payments for swifter and more seamless transactions.

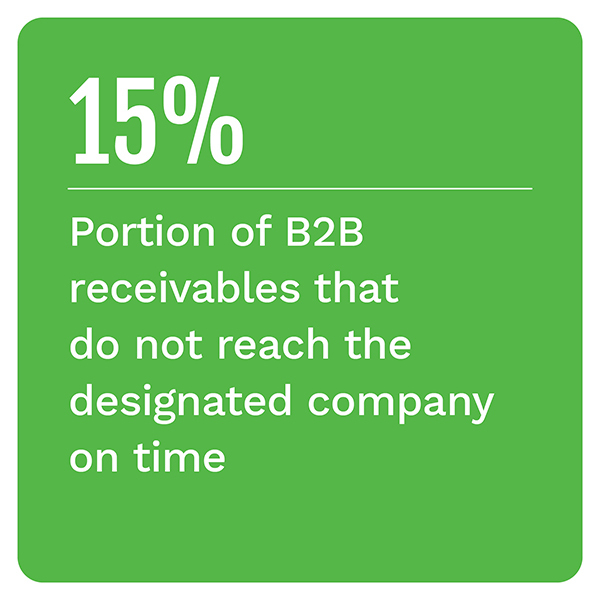

Consolidating both their consumer-to-business (C2B) and business-to-business (B2B) payments onto one platform through the use of technologies such as application programming interfaces (APIs) or other tools can help FIs keep pace with shifting expectations — a rising necessity as late payments create more frictions for their clients. Many businesses are still looking to smooth out their accounts payable (AP) and accounts receivable (AR) processes to match the needs of their own clients, making any delay brought about by their banks costly. One study found 15 percent of receivables in the United States are not delivered on time, for example.

In the latest Treasurer’s Guide To AR Payment Optimization: Solving The Online Bill Pay Problem Edition, PYMNTS takes a close look at how the bill payment needs of both businesses and consumers are shifting, as well as why such shifts make it crucial for FIs to keep online bill payments digital throughout the process. It also examines how these shifts may impact the way payments and banking are conducted in the future.

Around The B2B Payment Optimization World

Businesses are growing more aware of the need to digitize their payment proc esses, but this is easier said than done for organizations that still use paper documents. Paper invoices are still more widely used by United States businesses than their virtual counterparts, with 75 percent of the approximately 25 billion invoices sent annually still requiring manual processing. Such a reliance is creating increasing costs for businesses, as they need to wait for employees to receive, check and finalize approve paper invoices — a time-consuming process that can also strain their relationships with clients waiting for payments. Innovating their invoicing as well as their payment processes should therefore be a top priority for businesses.

esses, but this is easier said than done for organizations that still use paper documents. Paper invoices are still more widely used by United States businesses than their virtual counterparts, with 75 percent of the approximately 25 billion invoices sent annually still requiring manual processing. Such a reliance is creating increasing costs for businesses, as they need to wait for employees to receive, check and finalize approve paper invoices — a time-consuming process that can also strain their relationships with clients waiting for payments. Innovating their invoicing as well as their payment processes should therefore be a top priority for businesses.

Late payments can also lead to cash flow issues for businesses as well as strained customer relationships if payments sent via online bill pay features revert to checks, for example. This can set back companies’ ability to finalize their receivables by a matter of weeks. Businesses are also still reporting struggles getting funds to their own suppliers in a timely manner as they look to remove frictions in the bill payment process, with one study finding it took 58 days on average for firms to pay suppliers in the first quarter 2021. This compares to the 55 days on average it took during that same quarter in 2020, indicating that although many organizations are aware of the need for B2B payment digitization, problems still persist. Finding bill pay solutions that remain fully digital throughout the process may be one way to overcome such friction points.

Businesses are not the only gro up looking for more speed, transparency and overall control over their payment experiences. Consumers are asking to become more involved in their banking as well, with 17 percent of individuals noting they want to be able to complete financial tasks on their own without the aid of bank employees. Individuals are also turning to online or mobile banking channels first and foremost when completing financial tasks, with 65 percent of consumers noting mobile apps were their preferred way to interact with their own FIs. This growing use of digital channels is also translating into more of a want for banking features that are digital-first as well, for that matter, with 43 percent of consumers noting they want easier ways to pay their bills. Matching consumers’ rising expectations for speed and seamlessness should be a key focus for banks looking to keep them engaged.

up looking for more speed, transparency and overall control over their payment experiences. Consumers are asking to become more involved in their banking as well, with 17 percent of individuals noting they want to be able to complete financial tasks on their own without the aid of bank employees. Individuals are also turning to online or mobile banking channels first and foremost when completing financial tasks, with 65 percent of consumers noting mobile apps were their preferred way to interact with their own FIs. This growing use of digital channels is also translating into more of a want for banking features that are digital-first as well, for that matter, with 43 percent of consumers noting they want easier ways to pay their bills. Matching consumers’ rising expectations for speed and seamlessness should be a key focus for banks looking to keep them engaged.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

To learn more about these and other stories, visit the Guide’s News & Trends.

Why Seamless Digital Bill Payment Features Are Key To Keeping Customers Loyal

Both businesses and consumers need to pay bills on a monthly basis — and both groups want to be able to do so easily and, most importantly, quickly.

This is especially the case after both spent over 17 months interacting with their billers over online channels, making matching their expectations for convenient and speedy payment experiences essential for FIs as they look to retain the loyalty of both their business and consumer clients, explained Aju Asar, vice president of Enterprise Data Services and Analytics for Patelco Credit Union.

To learn more about why offering frictionless bill payment features is essential to ensure lasting customer engagement and loyalty, visit the Guide’s Feature Story.

Deep Dive: Keeping Online Bill Payments Fully Electronic Is Key For FIs To Stay Competitive

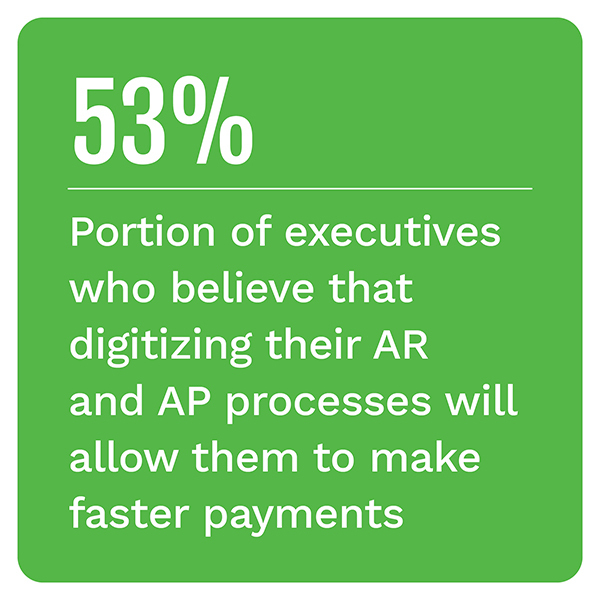

Many employees who went remote during the course of the pandemic do not appear to have plans to return to offices, meaning companies must race to innovate historically manual AR and AP processes to work via virtual channels. The continued reliance many companies still have on paper checks is beginning to hurt their bottom lines, additionally, with 38 percent of companies noting they were experiencing cash flow issues due to stalled payments in one August 2020 survey. This makes it essential for companies to support friction-free payment experiences — and further, this means it is essential for their FIs to ensure payments made via online channels reach their recipients that way as well.

have plans to return to offices, meaning companies must race to innovate historically manual AR and AP processes to work via virtual channels. The continued reliance many companies still have on paper checks is beginning to hurt their bottom lines, additionally, with 38 percent of companies noting they were experiencing cash flow issues due to stalled payments in one August 2020 survey. This makes it essential for companies to support friction-free payment experiences — and further, this means it is essential for their FIs to ensure payments made via online channels reach their recipients that way as well.

To learn more about how businesses’ AR and AP payment needs are shifting and why it is therefore critical for FIs to keep online bill payments digital throughout the process, visit the Guide’s Deep Dive.

About The Guide

The Treasurer’s Guide To AR Payment Optimization, a PYMNTS and CheckAlt collaboration, examines the latest B2B and consumer payment trends and how businesses can keep pace with them. It also examines which solutions and technologies are becoming key to companies’ payment optimization efforts.