Consumers and businesses alike are taking steps to optimize their cash flows as the U.S. economy recovers from the pandemic, with consumer spending having leveled out in recent months.

Businesses are taking steps to ensure their products and services stand out to individuals who may still be more closely examining where their money goes. Capturing their attention remains critical for the vast number of companies still trying to shake off the pandemic’s lingering economic impacts.

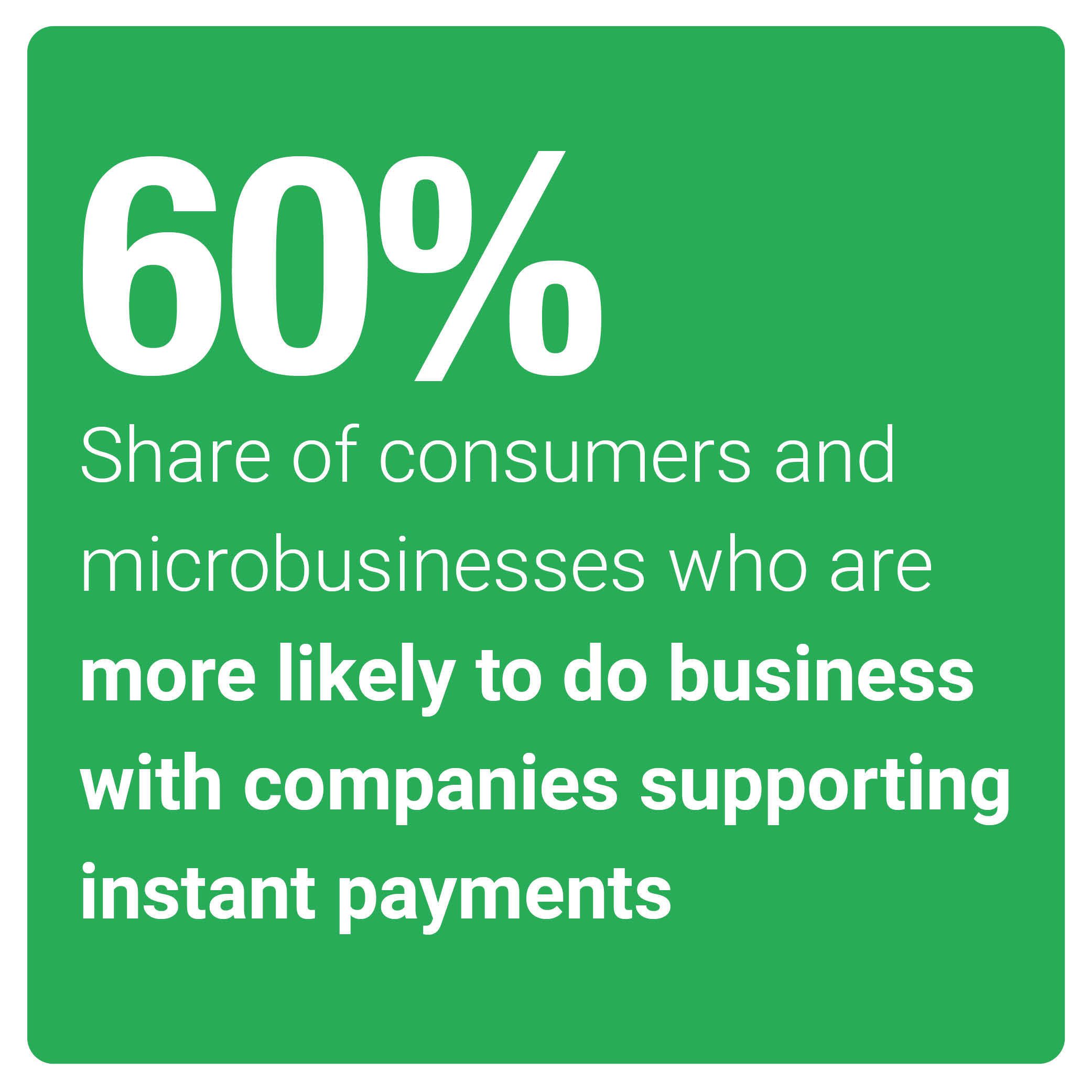

One feature more businesses are examining to expand customer loyalty is rewards or rebates programs that can offer consumers incentives to shop with them. Such programs must consider how the pandemic’s impacts may have changed individuals’ payment wants. Consumers are expressing a rising level of preference for instant payment and disbursement methods, with one PYMNTS study finding nearly 60% of individuals and microbusinesses are more likely to foster new relationships with businesses that allow instant payments.

In the latest Disbursements Tracker®, PYMNTS examines how consumers’ payment and disbursement demands are shifting and what this means for their expectations of rewards or rebate experiences. It also analyzes what merchants can do to ensure they are meeting such expectations.

Around the Disbursements World

Pharmacy chain Walgreens is among those hoping the introduction of a robust rewards program will help it better engage and retain customer loyalty. The company announced the launch of two new credit cards, which will offer holders up to 10% back on product purchases. It will also offer 3% cash back on grocery, health or wellness transactions, even outside of Walgreens’ pharmacy locations, a category that includes visits to healthcare providers. The company will also be incorporating its cash back and rewards program into its mobile app in the hopes of growing loyalty among new cardholders.

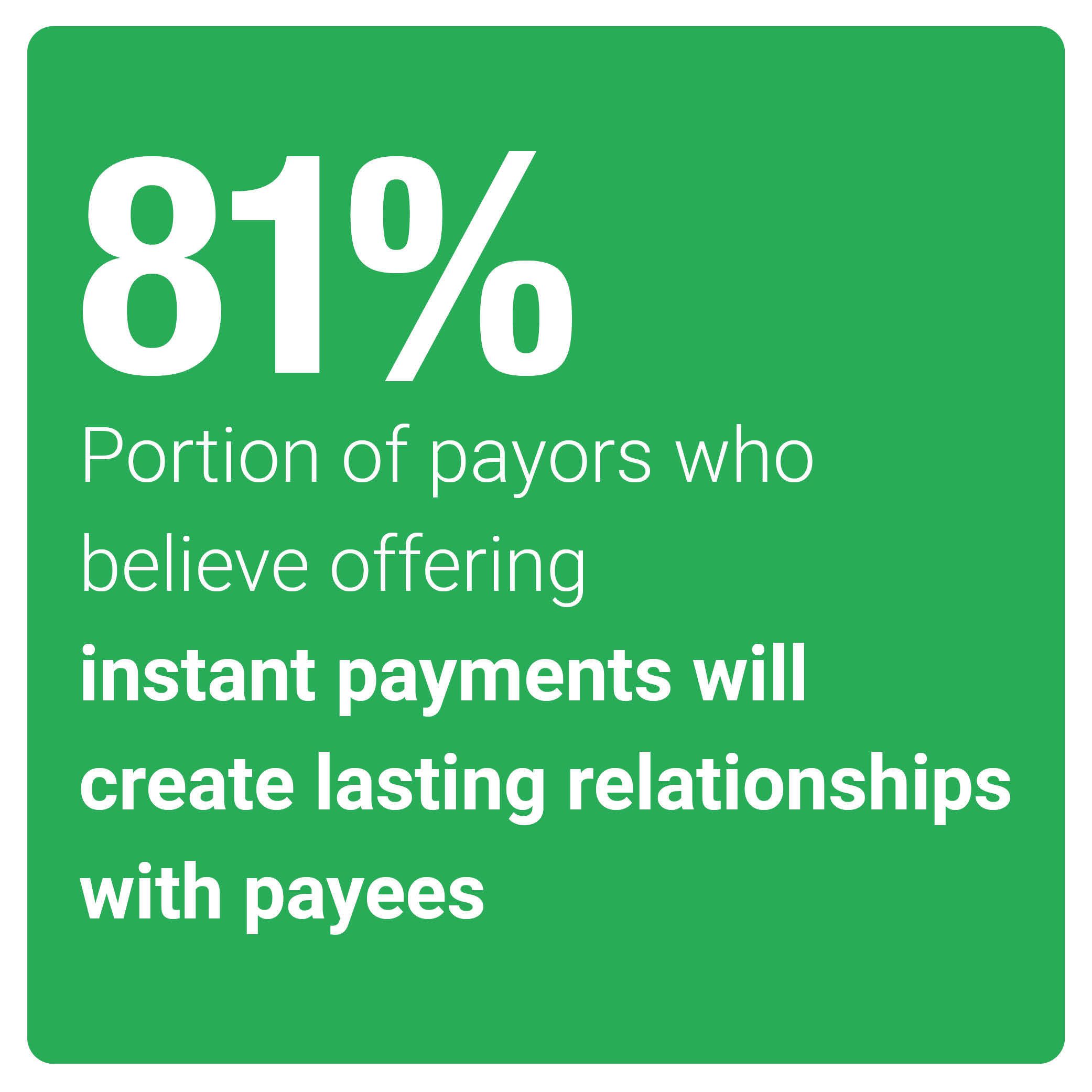

Rewards incentives will fail to keep consumers’ attention if the funds from such programs are not instantly available, however. Individuals today are anticipating swifter disbursement and payment experiences wherever they are, no matter the business in question. This includes disbursements for more complex transactions outside of the retail category, such as claims payments for insurance policies with multiple policyholders, explained Drew Edwards, CEO of Ingo Money. It is therefore critical for businesses across all industries to be able to send and receive funds, as well as attached personal information, as swiftly as possible. This makes use of technologies that can link together different platforms more easily, such as application programming interfaces (APIs), essential, Edwards said.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

One industry where consumers appear especially keen to redeem their loyalty or rewards points is travel, one of the spaces hardest hit by the pandemic. One report found 63% of American Express cardholders were hoarding their card points specifically to spend them on upcoming trips, for example. This could represent both a key opportunity and an emerging challenge for companies in the travel space, including hotels, airlines and booking sites. Use of these points can help reignite consumers’ interest in travel and their loyalty to specific companies. Catering to a large number of customers all using their rewards points simultaneously could lead to cash flow issues for businesses. Several airlines are now reconsidering the structure of their current rewards programs, indicating the pandemic could have a lasting effect on how such programs run within the travel industry.

where consumers appear especially keen to redeem their loyalty or rewards points is travel, one of the spaces hardest hit by the pandemic. One report found 63% of American Express cardholders were hoarding their card points specifically to spend them on upcoming trips, for example. This could represent both a key opportunity and an emerging challenge for companies in the travel space, including hotels, airlines and booking sites. Use of these points can help reignite consumers’ interest in travel and their loyalty to specific companies. Catering to a large number of customers all using their rewards points simultaneously could lead to cash flow issues for businesses. Several airlines are now reconsidering the structure of their current rewards programs, indicating the pandemic could have a lasting effect on how such programs run within the travel industry.

For more on these and other stories, visit the Tracker’s News & Trends.

How Supporting Instant Disbursements for Rewards and Incentives Can Help Merchants Retain Digital-First Customers’ Loyalty

Instant shopping and payment experiences are fast becoming the norm for consumers, especially when heading to online channels. eCommerce merchants are therefore seeking ways to stand out from the digital crowd, with many turning to features such as loyalty or rewards programs to gain customers’ attention.

Retailers must understand that digital-first customers also expect to access their rewards funds as instantly as they can pay, however, explained David Leeds, CEO of eGift card and rewards provider Tango Card. To learn more about consumers’ instant rewards expectations and how retailers can match them, visit the Tracker’s Feature Story.

Deep Dive: Why Offering Instant Rewards Disbursements Could Be Vital to Creating Lasting Customer Loyalty

Consumers today are only growing more exacting in their preferences when they shop, and i f their chosen retailers do not match up, individuals will move on to the next merchant. One of the most notable changes — brought about in part by the impacts of the global health crisis — has been a rise in the adoption of swifter, digital payment methods, even at brick-and-mortar stores. The popularity of contactless cards and touchless mobile wallets has increased over the past year, and consumers’ rising comfort level with such payment methods also impacts how they expect to receive disbursements such as rebates or rewards from favored merchants.

f their chosen retailers do not match up, individuals will move on to the next merchant. One of the most notable changes — brought about in part by the impacts of the global health crisis — has been a rise in the adoption of swifter, digital payment methods, even at brick-and-mortar stores. The popularity of contactless cards and touchless mobile wallets has increased over the past year, and consumers’ rising comfort level with such payment methods also impacts how they expect to receive disbursements such as rebates or rewards from favored merchants.

To learn more about how merchants can offer instant access to cash back or rewards and how this can help create lasting customer loyalty, visit the Tracker’s Deep Dive.

About the Tracker

The Disbursements Tracker®, a PYMNTS and Ingo Money collaboration, is the go-to monthly resource for the latest trends and changes in the digital disbursements space, covering developments occurring in the government, insurance and retail sectors as well as instant payments adoption’s global progress.