While consumers already have a wide array of retail choices for transferring funds abroad, the process of actually sending money across borders still has significant challenges, including excessive, highly variable fees and long processing times, which hampers the remittance experience. As a result, many customers are turning to cryptocurrencies as a payment option to avoid some of the pain points of traditional methods.

In The Digital Currency Shift: The Cross-Border Remittances Report, a PYMNTS and Stellar Development Foundation collaboration, a survey of nearly 2,100 U.S. consumers found that the majority of those who sent remittances already owned cryptocurrency at about four times the rate of the U.S. population as a whole.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

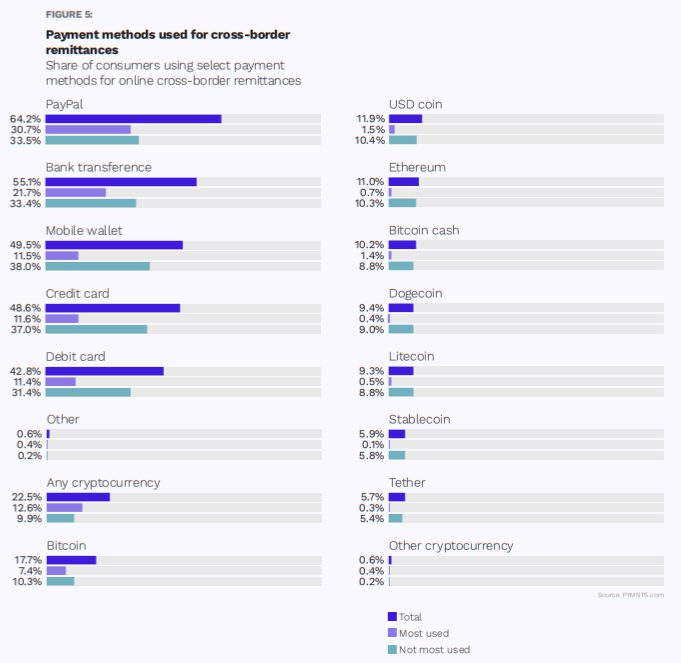

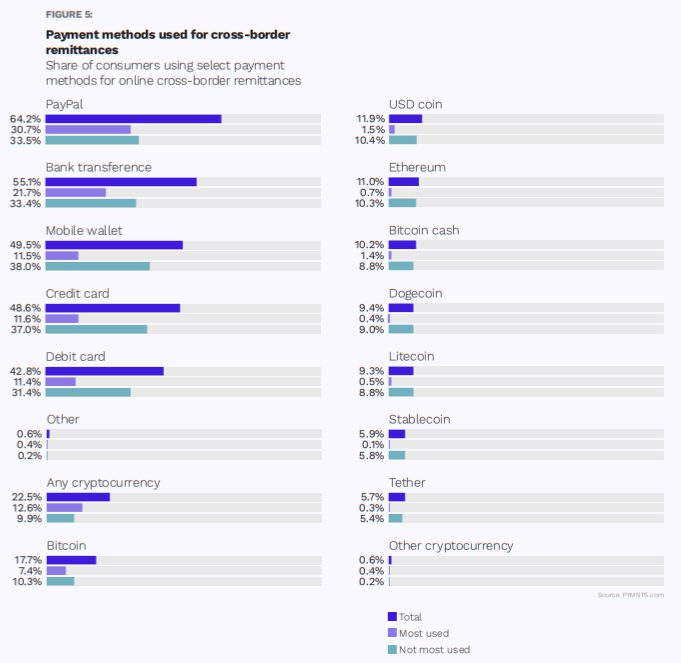

In addition, the data also revealed that despite the rise in cryptocurrency use, 64% of consumers used PayPal, making it the most common remittance method for sending remittances online. Bank transfers (55%), mobile wallets (49%) and credits cards (48%) followed as other heavily used payments methods.

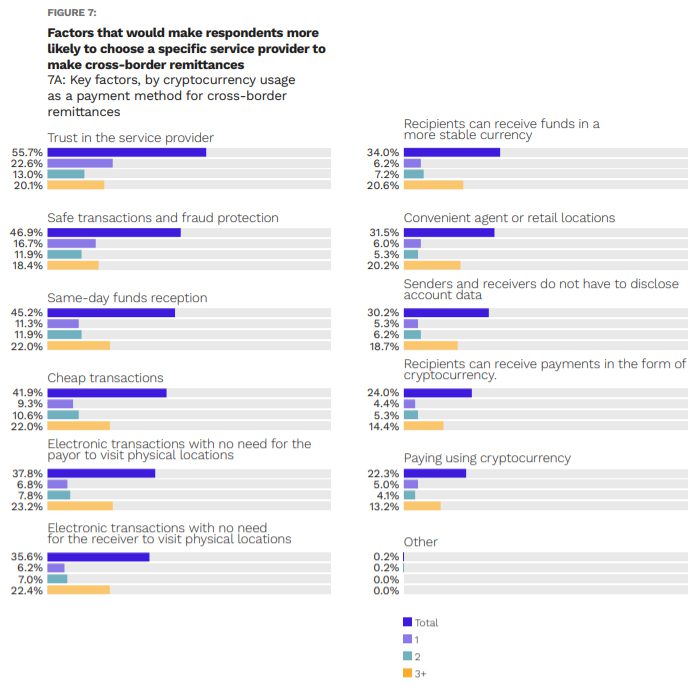

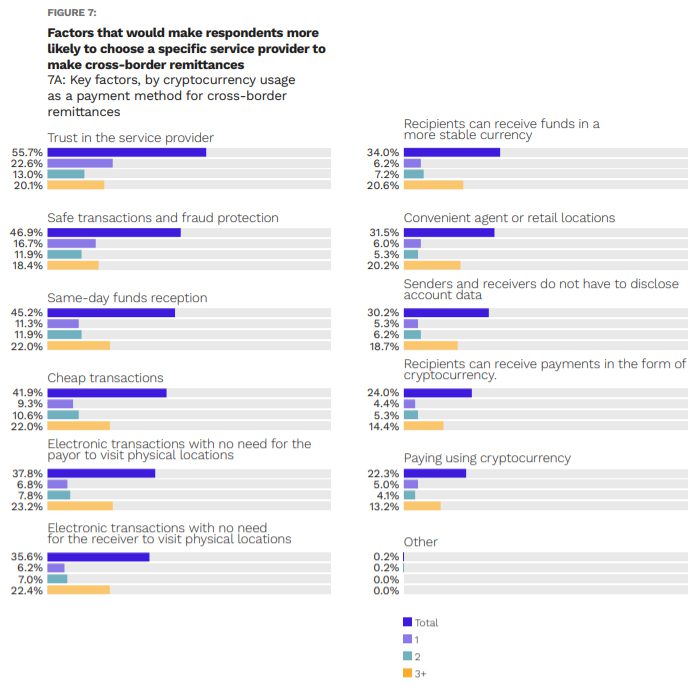

The study also found that regardless of payment method, trust was the deciding factor in consumers’ choice for choosing a particular payment service provider (PSP) 55.7% of the time. Other considerations included safety of transaction, fraud protection, speed and cost of the transaction.

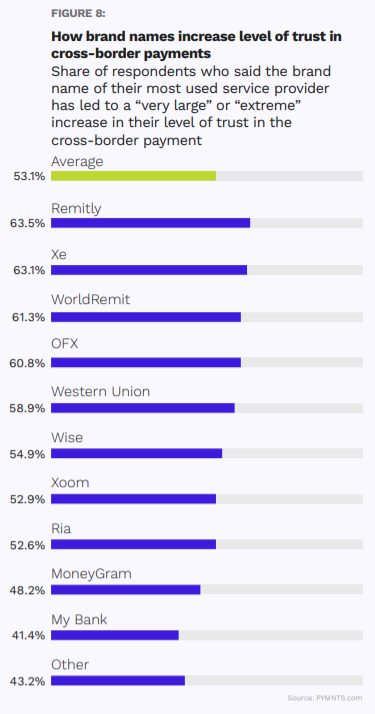

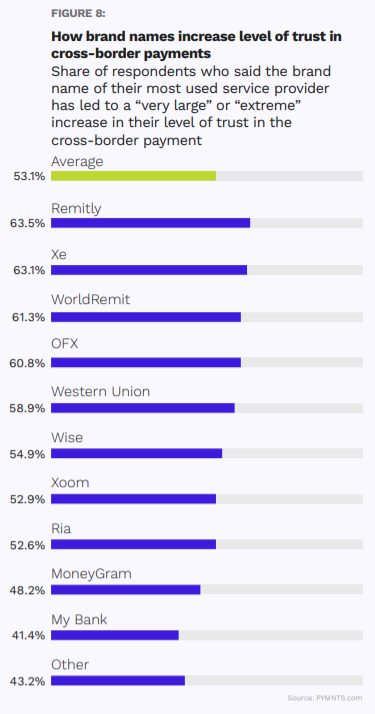

And finally, among consumers who already make remittance payments with cryptocurrency, 53% said trust in the brand name of their PSP mattered to them, with Remitly, Xe, WorldRemit, and OFX were cited as some of the most trusted names in the market.

Advertisement: Scroll to Continue

Add as Preferred Source

Add as Preferred Source