If you’re driving in Bentonville, Arkansas, don’t be surprised if that Walmart truck alongside you on the road doesn’t have a driver inside, after the box store giant revealed this week that it had begun successfully moving customer orders daily between a dark store and a Neighborhood Market location.

Reportedly the first such middle-mile delivery route anywhere in the world, the feat, in partnership with autonomous trucking company Gatik, is Walmart’s latest step forward in updating its logistics network amid a constant battle with Amazon and an industry-wide labor shortage.

Related news: Walmart Rolls out First-Ever Driverless Truck Route

Gautam Narang, CEO and co-founder of Gatik, said the news is a “revolutionary breakthrough” for the autonomous trucking industry.

“Our deployment in Bentonville is not a one-time demonstration,” he said. “These are frequent, revenue-generating, daily runs that our trucks are completing safely in a range of conditions on public roads, demonstrating the commercial and technical advantages of fully driverless operations on the middle mile.”

Winning the battle for market share requires winning the battle for delivery, which is why both Amazon and Walmart have spent substantial resources trying to innovate in the space. Both have tested drone deliveries: Walmart strengthened its partnership with DroneUp earlier this year; Amazon has invested in several autonomous driving tech companies, and the eCommerce giant purchased several Boeing 767-300 jets in January to bolster its Amazon Air fleet.

Advertisement: Scroll to Continue

Amazon has also committed to expanding its one-day delivery service, though progress on that promise was hindered by the pandemic. Chief Financial Officer Brian Olsavsky told analysts last month that the company was making progress in ramping up the offering in 2019 and early 2020, but even now, “we’re still not back to the levels that we saw pre-pandemic.”

“We’re getting closer,” he added. “We feel that labor constraints have not helped us close the gap there. But we don’t want to be just as good as we were before the pandemic. We expect that to increase in 2022.”

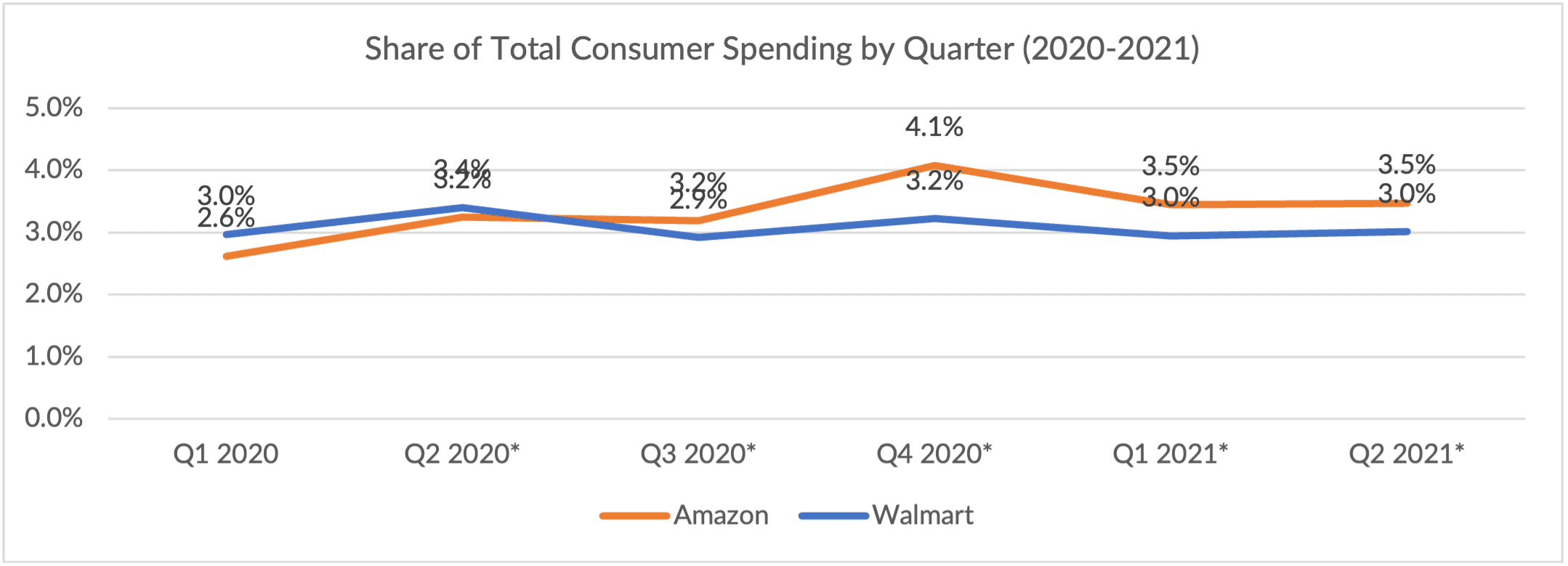

According to PYMNTS’ proprietary data, Amazon captured 3.5% of all consumer spending in the third quarter, compared to Walmart’s 3% share. The Seattle-based behemoth overtook Walmart’s lead in the middle of 2020 as the pandemic forced most purchases to be made online. Amazon has a 50% share of the eCommerce market.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Expanding Fulfillment Capacity

Walmart also this week said it has chosen the Dallas-Forth Worth metro area for two new high-tech supply chain facilities, including an automated fulfillment center set to open in 2023 and an automated grocery distribution center that will open in 2024. The two facilities will be among the company’s largest automated fulfillment and distribution centers when they are completed, part of Walmart’s efforts to increase the use of automation in its supply chain.

Related news: Retailers Outline Supply Chain Strategies in Bid to Win Customers

Amazon executives said last month when reporting third-quarter earnings that the company has also nearly doubled its operations capacity in the past two years to keep up with customer demand. Early in the pandemic, the eCommerce giant was forced to constrain capacity for some third-party sellers as digital sales exploded, but Olsavsky said Amazon now has enough space.

The biggest challenge now, he said, is finding enough workers. As a result of the industry-wide labor shortage, Amazon was forced to reroute inventory to warehouses that had enough workers to receive the products, which Olsavsky said resulted in “less optimal placement, which leads to longer and more expensive transportation routes.”

See more: Amazon Warns of Billions in Additional Costs to Meet Holiday Demand

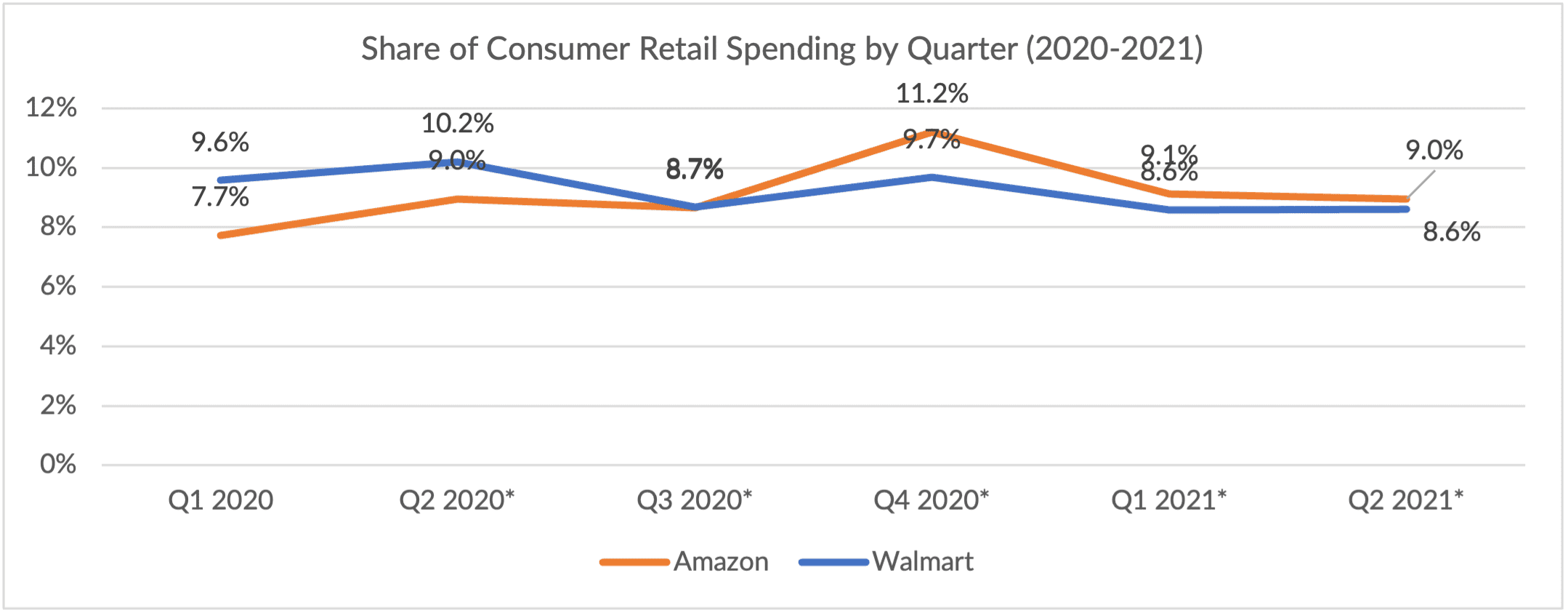

Still, Amazon says it will not pass costs onto consumers or third-party merchants, likely in order to keep a tight hold on consumers’ retail spend as it edges ever closer to overtaking Walmart as the largest retailer in the U.S. In 2020, Walmart saw 9.5% of all retail purchases compared to Amazon’s 9.2% share, though for three quarters in a row, Amazon has captured a larger percentage, according to PYMNTS data.

Add as Preferred Source

Add as Preferred Source