With each passing day, passwords are looking more and more like a relic of the digital past. Consumers are growing less confident in this method of access to online devices and accounts, which is driving companies to get serious about trading hackable passwords for biometrics.

According to PYMNTS’ study The Passwordless Future: Decoding Consumers’ Device-Based Authentication Preferences, done in collaboration with Entersekt, “research finds that most consumers — 90 percent — want new, robust authentication measures in place,” adding that “despite decades of using passwords to shop and bank, PYMNTS’ research found that nearly half of United States consumers are now comfortable with the idea of using passwordless technology to access their financial accounts.”

This is a practical matter — new data breaches are reported daily with millions of passwords for sale on the Dark Web — as much as it is a matter of trust between consumers and financial institutions (FIs), app providers and other digital tech entrusted with one’s online credentials.

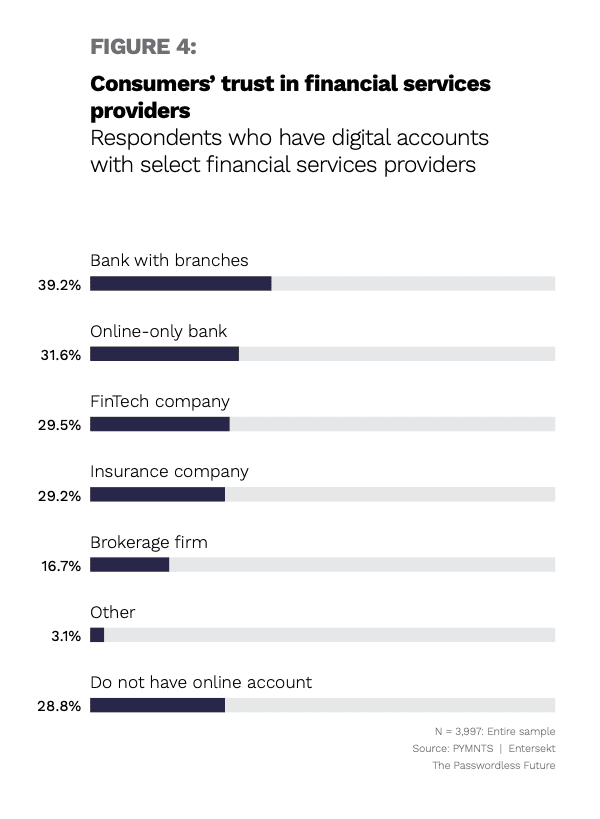

“Trust is often born of context — the in-the-moment specifics of each transaction that either affirm or dispel the idea that an FI or financial service merits their business,” per the study. “FIs must earn the privilege of consumer trust continually, not just one time.”

Get the study: The Passwordless Future: Decoding Consumers’ Device-Based Authentication Preferences

Data Security Isn’t Secure Enough

Advertisement: Scroll to Continue

Digging into how trust is at core of passwordless wishes, the study found consumers drawing the line at data security, especially across the variety of devices and accounts accessed.

PYMNTS found that data security had an “extremely or very big impact” 65% of consumers with regard to institutional trust.

Another 60% expressed similar opinions about transaction security specifically, while 56% “rated having a detailed data protection and privacy statement as a factor that would have an ‘extremely or very big impact’ on their trust.”

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

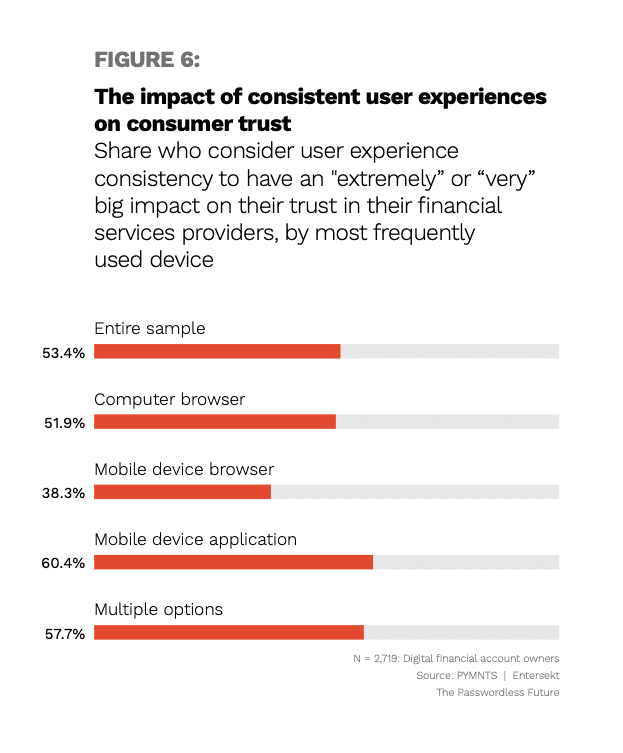

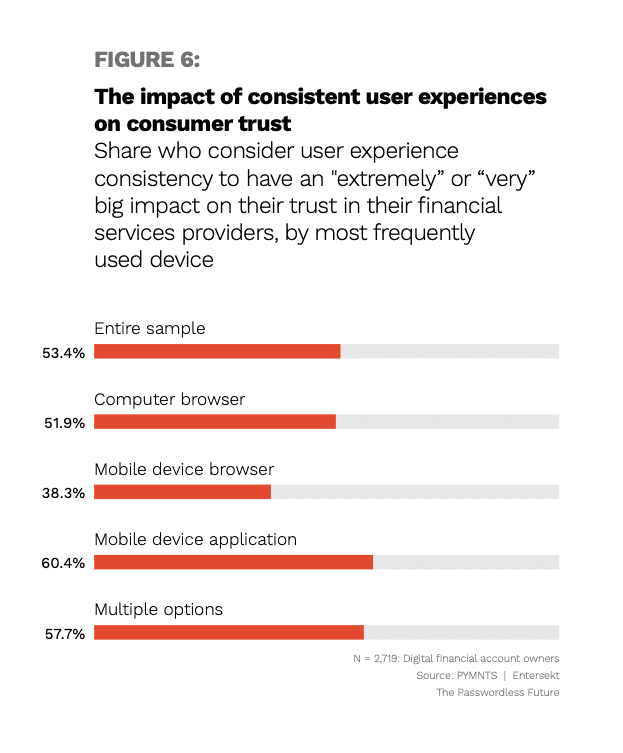

Consumers rated consistent experiences across all platforms to be nearly as important as a sense of data security when influencing their trust in their financial services providers.

Get the study: The Passwordless Future: Decoding Consumers’ Device-Based Authentication Preferences

Biometrics Pressing Past Passwords

New technology is providing solutions to legacy security problems like passwords by leaning heavily into biometrics as both more secure and more seamless as an experience.

Per the study, “Our research revealed that account holders would be more open to authenticating their identities with fingerprint scans than any other type of biometric scan. In a private setting, 49 percent of account holders would be open to authenticating their identities with fingerprint scans, and 44 percent would be open to authenticating with facial scans.”

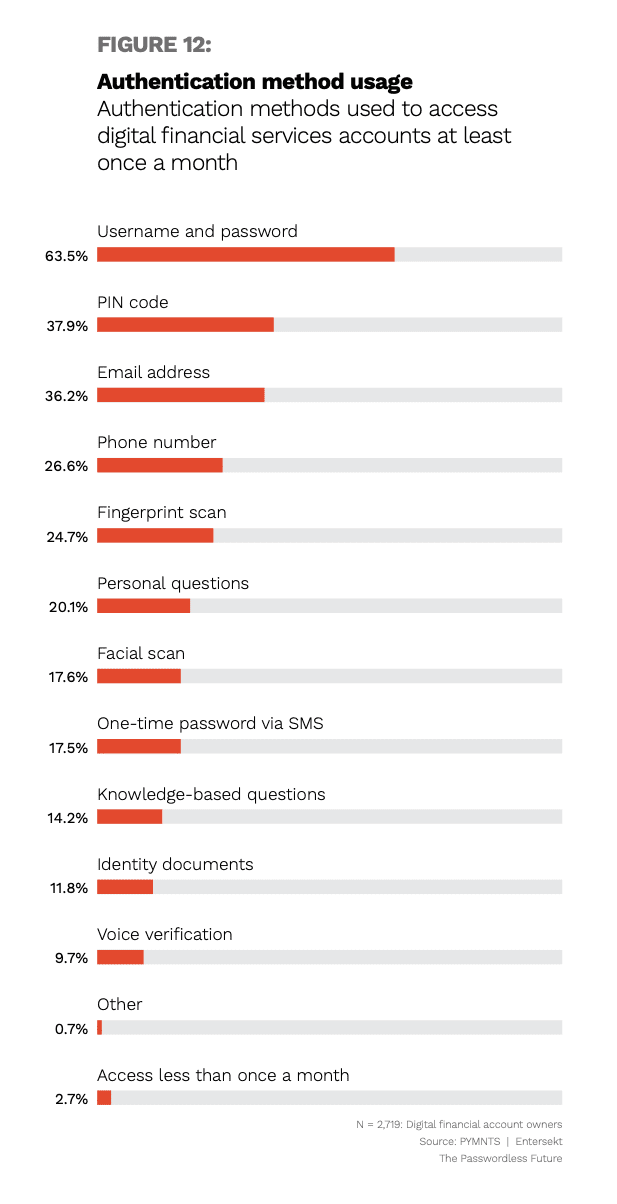

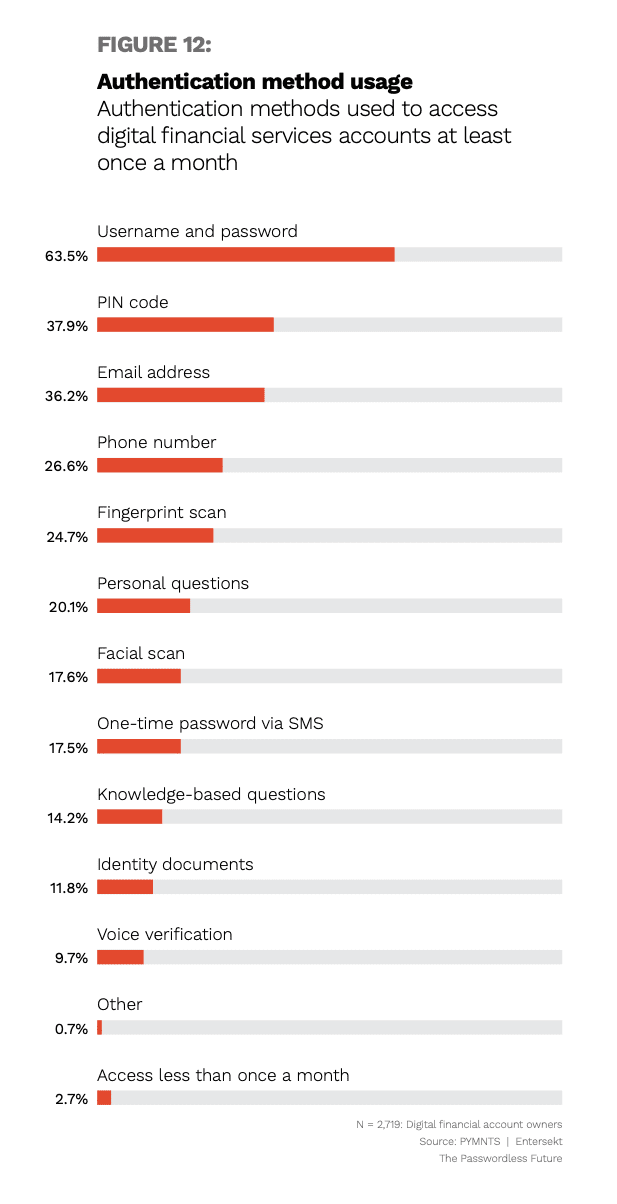

Additionally, 36% of cross-device consumers already use fingerprint scans, 28% use facial scans, and 18% use voice scans on a monthly basis.

As the study concluded, “Consumer willingness to try new authentication methods and the belief that passwords will soon be phased out indicates an opportunity for financial services providers to leverage their earned trust to introduce security measures that improve the user experience while boosting customer loyalty.”

Get the study: The Passwordless Future: Decoding Consumers’ Device-Based Authentication Preferences

Add as Preferred Source

Add as Preferred Source