The pandemic transformed how holiday shoppers secured items in 2020, and researchers expect these trends to continue during this year’s holiday season. PYMNTS’ findings show that 87% of United States consumers plan to do at least some of their holiday shopping online, 13% more than the share that did in 2020. Another survey on holiday shopping forecasts that more than 36% of U.S consumers will do their shopping exclusively online. It also projects that most U.S. consumers will increase their holiday spending or keep it at the same level this year.

The pandemic transformed how holiday shoppers secured items in 2020, and researchers expect these trends to continue during this year’s holiday season. PYMNTS’ findings show that 87% of United States consumers plan to do at least some of their holiday shopping online, 13% more than the share that did in 2020. Another survey on holiday shopping forecasts that more than 36% of U.S consumers will do their shopping exclusively online. It also projects that most U.S. consumers will increase their holiday spending or keep it at the same level this year.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

These are but a few of the key findings in Modern Banking Ecosystem: Security-Driven Digital Transformation, a PYMNTS and Featurespace collaboration. The Playbook analyzes how the holiday-influenced eCommerce spending boom, combined with supply chain issues and product shortages, presents new security and fraud challenges for card-issuing financial institutions (FIs). It also explores the growing imperative of catching fraudsters before they cause lasting financial damage and details the emerging technologies FIs can use to better protect customers from identity theft and online fraud.

More key findings outlined in the Playbook include:

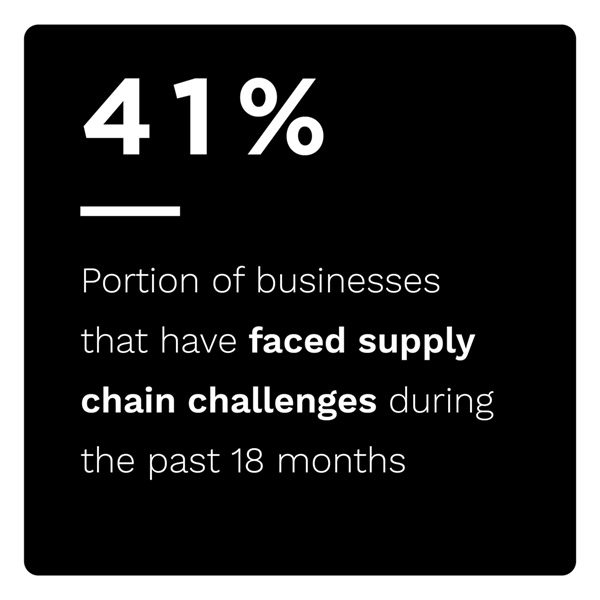

Supply chain issues had an impact on holiday shopping, increasing fraud potential. Research found that 41% of businesses have faced supply chain challenges in the past 18 months, and 27% reported delayed or canceled shipments of inventory or raw materials. These supply chain challenges do not bode well for holiday shopping, as consumers may rush to online and in-store retailers only to confront out-of-stock notices or empty shelves. The survey also uncovered that 64% of retailers worry about receiving inventory on time, and 75% of shoppers exhibit concern about products being out of stock.

Supply chain issues had an impact on holiday shopping, increasing fraud potential. Research found that 41% of businesses have faced supply chain challenges in the past 18 months, and 27% reported delayed or canceled shipments of inventory or raw materials. These supply chain challenges do not bode well for holiday shopping, as consumers may rush to online and in-store retailers only to confront out-of-stock notices or empty shelves. The survey also uncovered that 64% of retailers worry about receiving inventory on time, and 75% of shoppers exhibit concern about products being out of stock.

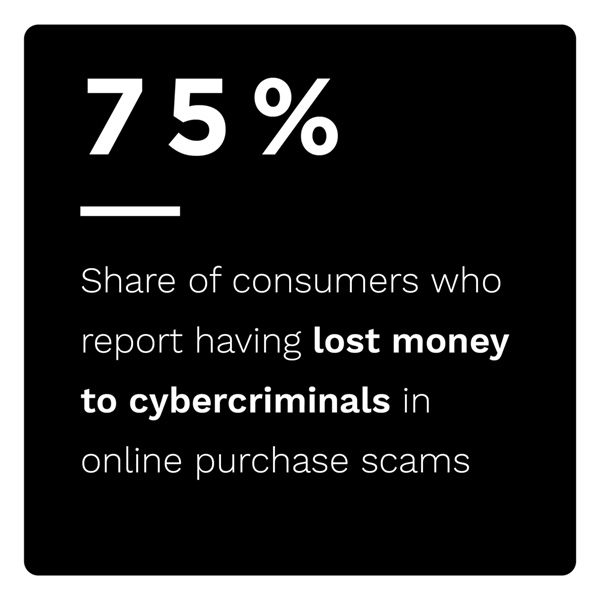

The increase in card-not-present (CNP) transactions during this year’s holiday shopping boom raises the potential for fraud. CNP fraud involving online and mobile transactions is difficult to detect and prevent. These transactions require better fraud protection for card-issuing FIs and merchants, as such entities represent the front line in safeguarding consumers’ financial data from identity theft and payment fraud. More robust CNP fraud prevention measures include multifactor authentication, adding biometric identification or sending a code to a verified phone number or email when completing a transaction.

The overwhelming rise in sophisticated fraudulent activity requires newer tools that can differentiate between actual customers and fraudsters. Behavioral analytics monitors transactions for fraudulent activity, relying on data recognition of individual consumer behaviors to recognize changes rather than aggregated consumer data across an entire population. Powered by artificial intelligence (AI) and machine learning (ML), the latest adaptive behavioral analytics technologies provide real-time deep learning into customer trends and fraud detection.

The overwhelming rise in sophisticated fraudulent activity requires newer tools that can differentiate between actual customers and fraudsters. Behavioral analytics monitors transactions for fraudulent activity, relying on data recognition of individual consumer behaviors to recognize changes rather than aggregated consumer data across an entire population. Powered by artificial intelligence (AI) and machine learning (ML), the latest adaptive behavioral analytics technologies provide real-time deep learning into customer trends and fraud detection.

To learn more about what FIs can do to keep their customers secure as the holiday shopping season continues, read the report.