Subscriptions — which can cover everything from retail products to video, audio and gaming services — have a significant footprint in the global economy.

Consumers’ budgets are finite, however, and so is their interest in adding new subscription services, especially as inflation ratchets up the costs of everyday essentials. Subscription merchants now are encountering a progressively crowded marketplace in which it has become more difficult — and therefore more critical — to stand out.

The pandemic boosted subscription services as a whole, and subscription types such as video streaming became a part of consumers’ normal monthly budgets. The retail subscription market is estimated to have grown 41% since the start of the pandemic, and many replaced their regular shopping habits with online subscriptions. Circumstances and consumer attitudes are evolving, though, and reopening brings more opportunities for consumers to spend their money with local merchants or seek entertainment outside their homes. Subscription services will have to position themselves for a post-pandemic world without a captive audience.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

The following Deep Dive examines how competition in the subscription commerce space is heating up as consumers’ capacity for more services reaches its saturation point. It also explores how offering cost-saving features such as pauses, guarantees, refunds and other promotions can help merchants thrive in an increasingly competitive subscription landscape.

Subscriptions Could Plateau Following Pandemic Surge

U.S. consumers see a growing gap between the perceived value and cost of video services, and 44% plan to cancel a cable or streaming subscription within the next six months. Three-quarters said they had purchased or upgraded a device during the past year to improve their TV-viewing experience, and 57% said they spent more on those technology upgrades recently than in previous years. Many consumers also are reaching a tipping point in terms of adding new streaming subscriptions, as 59% currently are subscribed to more services than they were before the pandemic. On the other hand, just 8% subscribe to fewer services.

Rising costs of living have consumers facing smaller monthly budgets, and many are looking for ways to cut back on expenses. A lack of content and rising costs are among the top concerns for those looking to cut back on their subscriptions, with 80% of these subscribers agreeing with each of these assertions. Forty-eight percent said they had cut back on other expenditures, such as shopping and traveling, to cover the cost of video subscriptions.

Making the Cost Worth It

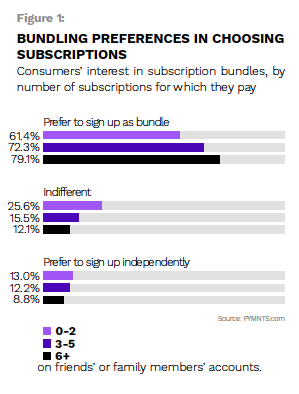

Subscription services providers are not entirely out of luck as they work to turn this tide, however. Boosting the perceived value of the services they provide — either by cutting costs, increasing the scope of their services or using a combination of both strategies — is one way in which they can discourage customers from unsubscribing. Bundling is one particularly popular cost-cutting option that can give consumers more services for a single price, and 51% of consumers are motivated to seek out subscription bundles to cash in on cost savings. These bundles can promote more than just added content, as services can bundle dissimilar products to increase the total perceived value of a subscription package. Subscription providers also can offer features that allow users to pause their subscriptions or skip a delivery, encouraging those who otherwise might have outright canceled to stay aboard.

Bundles and pause features offer opportunities for services providers to prevent churn, particularly in cases in w hich subscribers stay with a streaming service until they finish a show or season, then cancel only to sign up once more if additional content becomes available. The churn rate for streaming services in the U.S. hovered around 37% between October 2020 and February 2021, illustrating just how much money providers could be leaving on the table if they fail to offer options such as bundling and pause features. It even can be worth it for companies to offer lower rates to stop churn, making measures that do not hit their profits quite as hard — such as bundles and subscription pausing — tempting in comparison. Many of the consumers who cancel and eventually resubscribe already are on the lookout for other cost-saving measures such as bundling, promotions and even piggybacking.

hich subscribers stay with a streaming service until they finish a show or season, then cancel only to sign up once more if additional content becomes available. The churn rate for streaming services in the U.S. hovered around 37% between October 2020 and February 2021, illustrating just how much money providers could be leaving on the table if they fail to offer options such as bundling and pause features. It even can be worth it for companies to offer lower rates to stop churn, making measures that do not hit their profits quite as hard — such as bundles and subscription pausing — tempting in comparison. Many of the consumers who cancel and eventually resubscribe already are on the lookout for other cost-saving measures such as bundling, promotions and even piggybacking.

Software subscription services have taken a slightly different route to reduce churn, offering the opportunity for subscribers to pay only for what they use. Use-based pricing has grown 32% over the past year, with 45% of Software-as-a-Service (SaaS) companies offering it as an option. More than 40% of enterprise customers already pay on a use basis, and this figure includes use-based subscription tiers. Research shows that this share could grow to 60% within the coming year.

Playing to Subscriptions’ Strengths

Subscription services also have existing strengths they can emphasize to attract and retain subscribers. Understanding customers — individually, generationally and even geographically — is important to capitalizing on those strengths.

Providing the right customization and personalization that appeals to subscribers depends on who the subscribers are, and there is no one-size-fits-all solution. Subscription providers have an advantage, though, when it comes to understanding their customers. The built-in relationship of subscription services and the ability to gather data on subscribers’ habits positions subscription providers to understand and accommodate their customers in a manner few other companies can match.