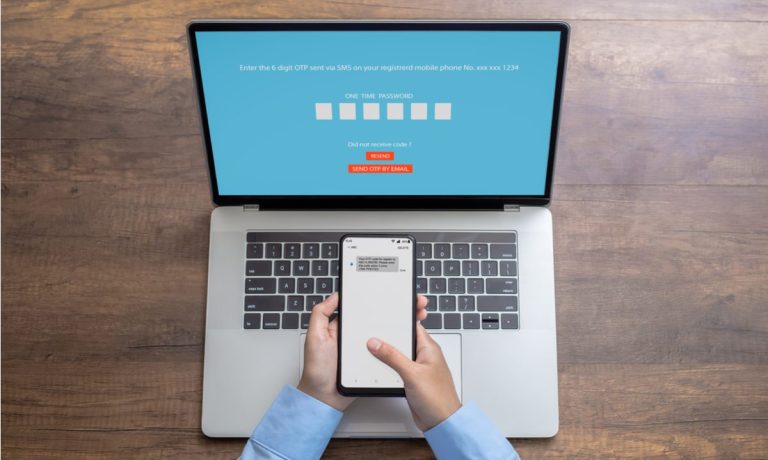

Almost half (43%) of businesses plan to invest in digital authentication solutions this year, and two-thirds (66%) of organizations say upgrading their digital identification processes will help them to get more customers.

Two-thirds of those surveyed also say improving their digital security through financial investment will increase the trust their customers have in them. More than half (52%) of consumers in large urban areas say they are “very” or “extremely” interested in multifactor authentication.

It’s unclear if that’s a function of those consumers already being on the wrong end of a digital identity breach or just making it sure it never happens to them.

We’ll set aside the fact that 57% of businesses aren’t planning to enhance their digital authentication offerings, and that one-third of businesses don’t yet realize that implementing such a solution would be a boon to their bottom lines and congratulate those who have gotten this far in their journeys.

Maybe we’ll see 100% adoption when all the remaining holdouts find themselves on the wrong end of a data breach and they lose a large swath of customers — or their entire business — as a result of their cavalier approach to this increasingly important resource: data.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Meanwhile, 128 of 194 countries have regulations that dictate which organizations can collect, use and share consumers’ data, meaning data privacy is top of mind across the global financial space. More than 40 countries among the 194 that responded have legislation that spells out the need to get users’ consent when initially obtaining this information.

Advertisement: Scroll to Continue

Among the most comprehensive data protection acts are California’s Consumer Privacy Act, Brazil’s General Data Protection Law, Australia’s Privacy Principles/Privacy Act, Singapore’s Personal Data Protection Act and the European Union’s General Data Protection Regulation (GDPR).

The GDPR could get even more robust in 2022, with experts predicting more regulatory oversight of consent management, meaning that organizations would have to clarify the fine print within opt-in boxes so that consumers have a clear basis for giving or denying their consent.

While opt-in consent boxes have been the financial industry standard for collecting and maintaining consumer data, those consumers are often confused about exactly what they’re allowing by giving their consent to share their information.

It’s a high-stakes version of clicking “I Agree” after skimming the Apple terms and conditions that could lead to a consumer’s information ending up in the hands of a company which it never intended.

In the November-December edition of the Authenticated Payments Report, PYMNTS examines how regulations surrounding consent management are shifting globally and why getting consent management right will determine open banking’s growth in markets worldwide.

The Authenticated Payments Report, a PYMNTS and LoginID collaboration, is the go-to monthly resource for updates on trends and changes in payments authentication.

Add as Preferred Source

Add as Preferred Source