A distant relation to today’s connected economy is the embattled healthcare industry, which for decades has used the interoperable technology of the time to detect and treat disease.

Pain points for patients extend beyond physical and mental aches, however, into how they will interact with medical providers and, crucially, how they will afford and pay for costly services.

PYMNTS is tracking trends around the connected patient — and their providers — to determine what’s most important during this transformative COVID-19 pandemic event.

With many thousands of consumers surveyed, data points to converging trends of care management, affordability and payments experience, and, if need be, switching doctors to get the type of care they expect and demand as the harrowing health crisis drags on.

As Karen Webster wrote on Jan. 10, “In healthcare, logistics is about integrating data and diagnostic connected devices into the online experience to make the digital visit as informative as the physical one.” These five statistics taken from recent PYMNTS studies are an at-a-glance guide to current healthcare challenges to that “informative experience” giving clues as to how medicine can cure itself in the pandemic era.

1) 21% of US consumers are paying more out-of-pocket for healthcare

With over half (54%) of those earning between $50,000 and $100,000 annually reporting that they live paycheck to paycheck (40% of those are in the six-figure income bracket), even the 54% covered by family medical insurance policies report paying more for their care in 2021.

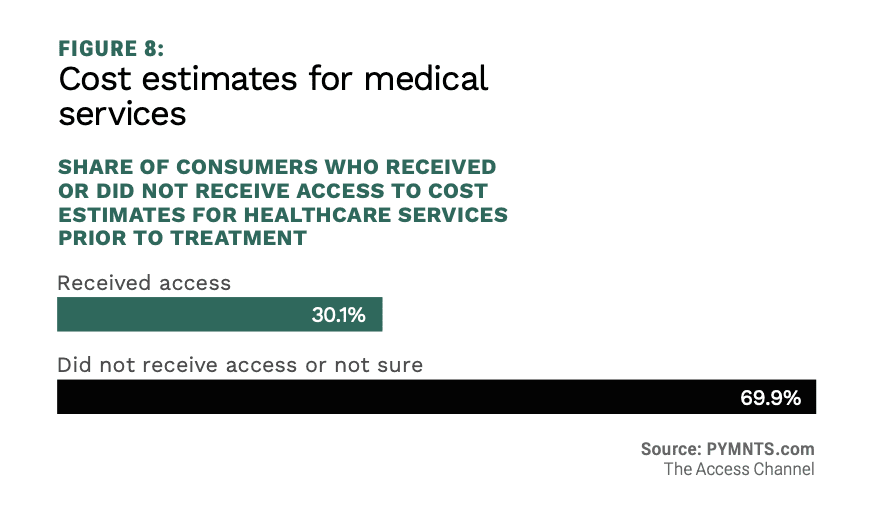

That may get worse before it gets better, as the full extent of pandemic economic damage to households and medical practices comes into clearer focus this year. More transparency in treatment costs by way of estimates so patients know what they’re facing is in demand.

Get the study: The Access Channel: How Healthcare Financing Keeps Patients Engaged

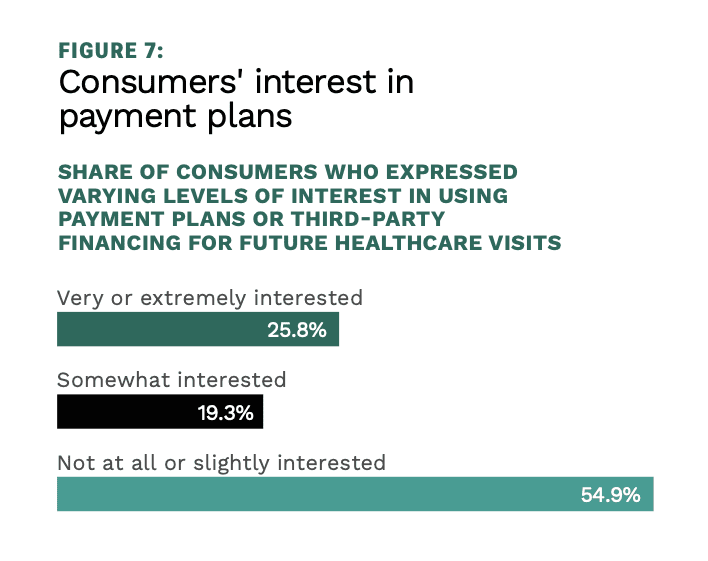

2) 45% of consumers want healthcare payment plans

As buy now, pay later (BNPL) continues its mighty roll, healthcare is one sector where consumers are intensely interested in being able to pay rising out-of-pocket costs on an installment plan.

PYMNTS reported that “a lack of payment options represents missed opportunities to engage patients. Healthcare providers — especially those treating behavioral health patients — should consider offering healthcare financing options and payment plans in tandem with online new patient onboarding. Implementing the changes necessary to improve patients’ payments experiences may require leveraging technologies that provide streamlined payment methods and financing alternatives or partnership with a technology solutions provider.”

Get the study: The Access Channel: How Healthcare Financing Keeps Patients Engaged

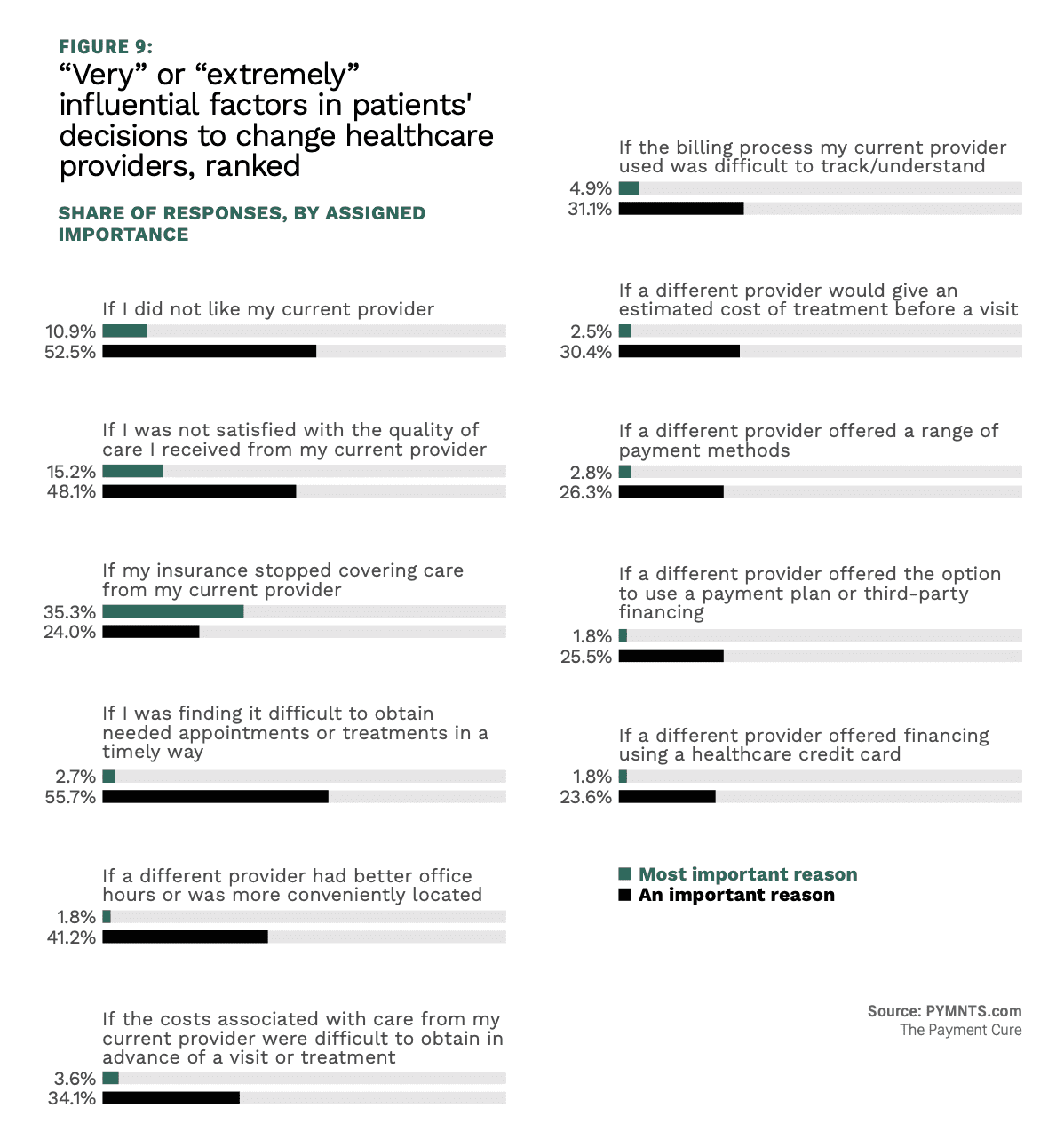

3) 63% of patients will drop healthcare providers over bad payments experience

With PYMNTS research finding that half of all patients pay for care post-appointment, less than 20% pay during or before visiting the doctor, and given the digital ease these patients are encountering as consumers in an ever more digital world, the consumerization of healthcare payments is being driven by consumer demand, and they will have it one way of the other.

The other way is using a new medical practice, and roughly two-thirds of consumer/patients surveyed by PYMNTS said they will do exactly that unless their practice offers digital payments.

Get the study: The Payment Cure: How Improving Billing Experiences Impacts Patient Loyalty

4) 76% of patients want to digital healthcare management tools

With the average wait time to see a physician now hovering around 29 days, consumer/patients are more interested than ever in having access to apps and web tools that enable them to manage various aspects of their medical relationships and information.

Per PYMNTS research, “most patients — 76% — are ‘very’ or ‘extremely’ interested in using at least one digital method to manage their healthcare services or interactions with their providers. This is especially true of bridge millennial and younger patients, whose interest in such features rises to 86%.”

Get the study: Generation HealthTech: How Digital Tools Amplify Millennial Patient Loyalty

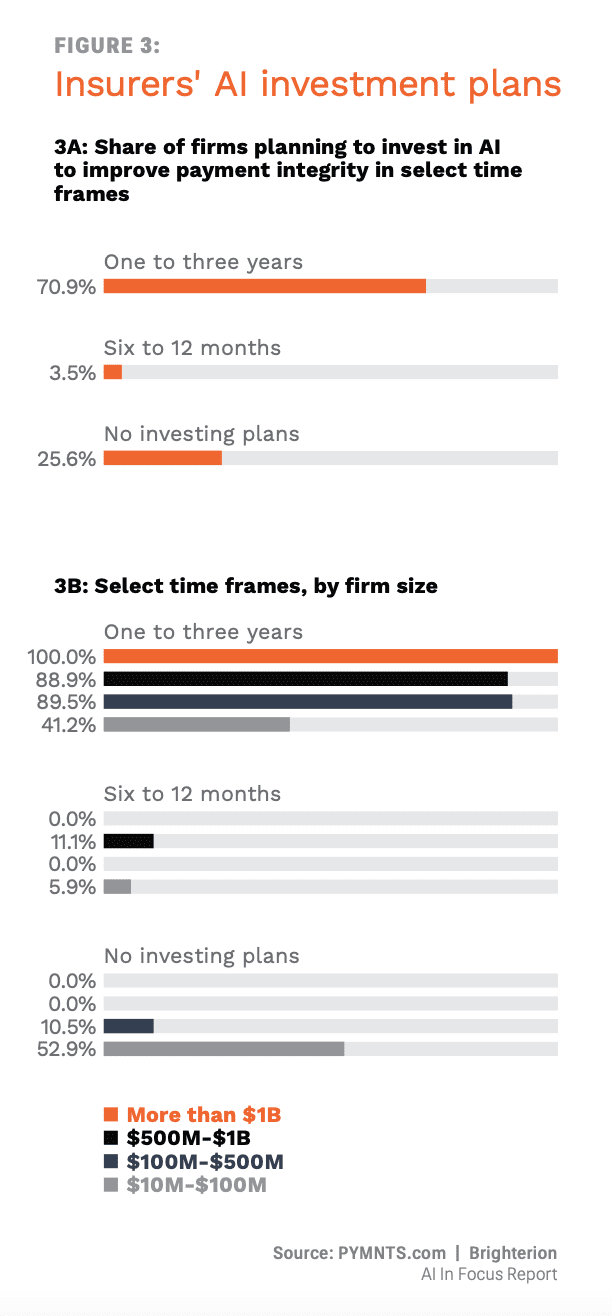

5) 71% of healthcare insurers plan on AI investments in next 3 years

Good news for digital-native consumer/patients and other cohorts is the fact that health insurers are increasingly keen to spend on placing digital at the center of operations, specifically artificial intelligence (AI) to combat fraud, waste and abuse (FWA), which keeps costs down.

PYMNTS finds that AI can improve specific aspects of the claims process and streamline healthcare insurance operations, speeding claims payments and improving patient and physician experience.

Get the study: AI In Focus: The Healthcare Technology Roadmap