Consumers’ shopping and payment preferences and needs have shifted drastically since March 2020, with a rising number of consumers turning to digital-first businesses or channels to make more of their routine transactions. Companies, such as retailers, have had to adjust accordingly, with many altering their business models to cater to their customers’ evolving demands.

The percentage of U.S. small- to medium-sized businesses (SMBs) planning to move to fully digital business models is rising. Nineteen percent of businesses in one recent study stated they expected to make this jump — up from 12% that stated the same in 2021. Subscription services are also capturing more of consumers’ attention, with November 2021 PYMNTS data finding that 24% of Americans use at least one, and an average of four, retail subscription services.

Businesses in the publishing and news industries and many retailers — including those in the wine or liquor space, where digital subscriptions are becoming commonplace — have taken steps to expand into the subscription space to match consumers’ newfound preferences. Another report found that 79% of commercial news or publishing entities believe subscriptions will be critical for their companies’ success in 2022.

Experimenting with new business models like these will only lead to future success if companies can make such transitions seamlessly. In practice, this means ensuring that both their internal and customer-facing payments operations run smoothly. Consumers are becoming less tolerant of frictions and more discerning about what methods and channels they wish to use to pay.

An April 2021 PYMNTS study found that most consumers weigh what payment methods are available before deciding where to spend, with 57% of consumers saying they are more likely to shop with merchants that offer digital payment options. Reducing any hiccups or pain points during the purchasing process is also critical for companies seeking to keep their customers engaged and satisfied. The same report found that 58% of consumers would shop from merchants less often — or stop shopping with them entirely — if their payments were declined.

Slow or cumbersome payments processes can also keep companies from launching the products and services they need to expand into new markets and drive sales. This makes it essential for businesses to ensure that their back-end operations can easily support the payments capabilities required in their newfound business models.

This month, PYMNTS analyzes how customer-facing and back-office process inefficiencies can slow time to market for new products and services, prevent businesses from meeting their customers’ evolving expectations and fall short of addressing their own shifting needs. PYMNTS also examines how payments orchestration can reduce these frictions and provide the streamlined interfaces businesses need to simplify their customer-facing and internal payments processes, creating a swifter pathway for launching new products or services.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

How Easing Payment Frictions Smooths Product Launches

Developing innovative products or services that meet consumers’ expectations is key to engaging consumers, but retailers must often overcome several challenges before bringing such features to market. Building out new services can be time-consuming and costly, leading many businesses to spend more than they can afford to lose after dealing with the pandemic’s lingering economic impacts. A faulty product launch or frictions within their business-to-business (B2B) or other internal processes can severely hamper businesses’ ability to innovate their business models, placing them at a competitive disadvantage.

Enlisting help from third-party providers — including payment service providers (PSPs), acquirers and gateways — can help businesses circumvent the costs and frictions of developing new payment capabilities from scratch. Not only do 57% of merchants already work with more than one payments processor to manage cross-border and domestic transactions, but 57% of merchants also work with multiple acquirers.

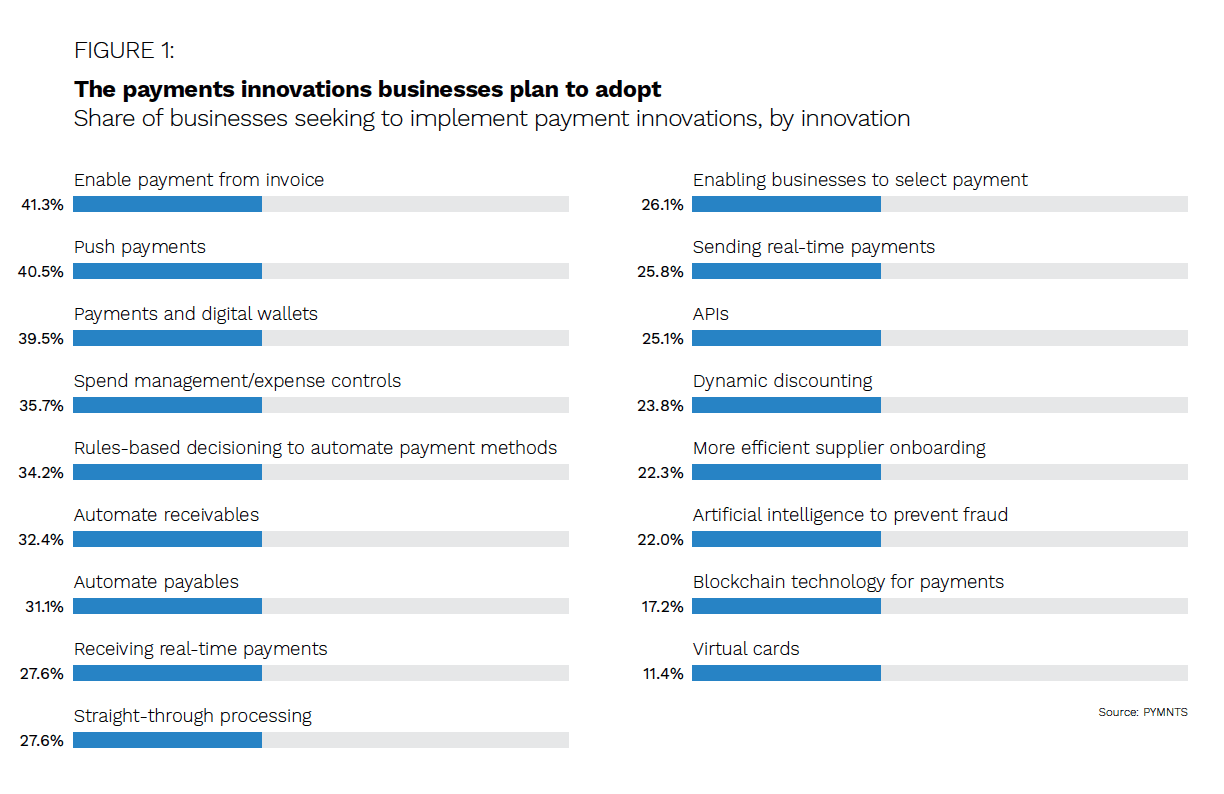

However, maintaining these relationships can be time-consuming or complicated, potentially straining businesses’ ability to quickly and effectively adapt their business models, launch new products or move to new markets. Streamlining their payments or other back-end processes to juggle these various relationships is therefore becoming a high priority for a growing number of companies. April 2021 PYMNTS data found that companies were seeking to innovate various parts of their payment operations, with 36% of businesses noting they want to implement new spend management or expense controls, for example.

Companies are also reporting higher interest in automation and other technologies that can allow them to aggregate disparate systems or tools into one place, with 34% of companies seeking to incorporate rules-based decisioning solutions to help automate payments. Another 25% of firms are interested in application programming interfaces (APIs), indicating a rising desire to streamline their back-end operations in the future.

Adding a payments orchestration layer is one way to help firms simplify other backend processes as they seek to adjust their business models or launch new products. Payments orchestration helps to easily connect any number of payment services to ensure the complete needs of a customer segment are met. This allows businesses to manage relationships with many third-party providers through one central command hub. This also provides the flexibility and time needed to develop new business models, while still enabling payment capabilities to support those business models and streamline their end-user experiences.

Optimizing transaction success rates, such as reducing i nstances of false declines — which see legitimate consumers’ purchases being erroneously flagged as fraudulent — is just one example of how payments orchestration can help improve businesses’ payments operations. This is because payments orchestration layers aggregate diverse systems and relationships into one place, making it easier to cross-reference disparate data points for more accurate risk assessments.

nstances of false declines — which see legitimate consumers’ purchases being erroneously flagged as fraudulent — is just one example of how payments orchestration can help improve businesses’ payments operations. This is because payments orchestration layers aggregate diverse systems and relationships into one place, making it easier to cross-reference disparate data points for more accurate risk assessments.

Businesses can route payments traffic through to the best gateway, fraud tool or other partner for any given transaction. For example, partnering with a payments orchestration platform enabled lifestyle brand platform Zebrands to reduce instances of false declines from 40% to 5%. Payments orchestration also allowed ticketing service SeatGeek to innovate its business model as brick-and-mortar shutdowns during the pandemic led to fewer reservations and loss of revenue in the ticketing and events space. These case studies show how payments orchestration can enable businesses to streamline one or two pieces of their payment processes and enhance their operations holistically, allowing them to expand into new markets with ease.