A perfect storm of pandemic economic pressures is driving more working Americans to have to make ends meet between paychecks — a situation that isn’t improving much, if at all.

New Reality Check: The Paycheck-To-Paycheck Report, a PYMNTS and LendingClub collaboration, The Generational Divide Edition, surveyed nearly 3,100 U.S. consumers in December 2021, finding a combination of factors driving paycheck-to-paycheck living.

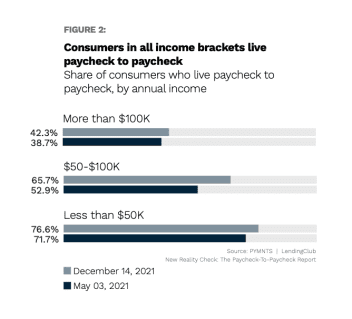

Getting straight to the point, the new study states that “61% of consumers were living paycheck to paycheck in December 2021. Although this is four percentage points less than a year earlier, this share has been on the rise since May 2021 and now is approaching pre-pandemic levels.”

With the closing months of 2021 seeing a marked rise in consumers needing to stretch paychecks, that’s likely a holiday spending impact mixed with current runaway inflation, compounded in many cases by job loss and related pandemic disruptions.

As would be expected, those who earn and save more are less affected than others.

“Paycheck-to-paycheck consumers fall into two categories: those who are and those who are not able to pay their bills easily. Our research finds that 39% of paycheck-to-paycheck consumers are able to pay their bills, while 22% struggle to do so every month,” per the study.

Findings are a mixed bag, with the report noting that “The share of consumers who do not live paycheck to paycheck declined from 46% to 39% from May 2021 to December 2021, while the share of consumers living paycheck to paycheck increased across the board” simultaneously.

Get the study: New Reality Check: The Paycheck-to-Paycheck Report

A Tale of Demographic Differences

Generational differences in earning, spending and saving behavior comes into sharp contrast in New Reality Check: The Paycheck-To-Paycheck Report, Generational Divide Edition.

Per the study, “demographics of consumers currently living paycheck to paycheck indicates that millennials are the most likely to fall into the category, but the greatest increase in consumers living paycheck to paycheck is among baby boomers and seniors.”

Data shows that 54% of baby boomers and seniors were living paycheck to paycheck In December 2021, showing a dramatic uptick compared to the 40% who were in May 2021.

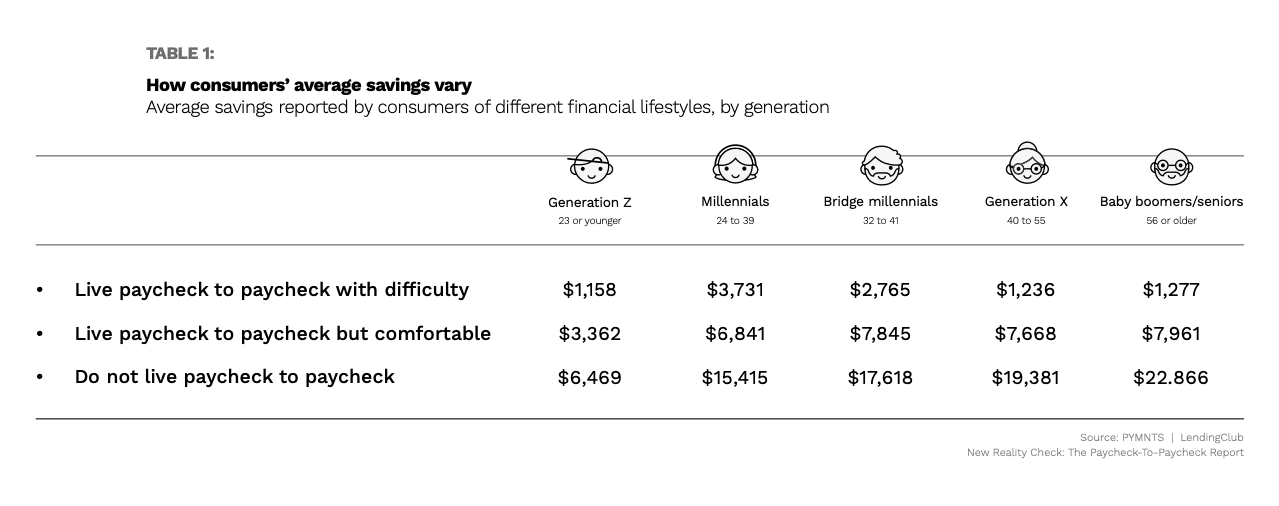

Not surprisingly, the level of savings among different demographic cohorts helps explain who’s is struggling and who isn’t, relatively speaking, among these consumer age groups.

The study found, “Generation X consumers and baby boomers and seniors who live paycheck to paycheck and struggle to pay their bills report having $2,765, $1,236 and $1,277 in savings, respectively.”

Conversely, “Savings balances for consumers who do not live paycheck to paycheck increase by generation. Baby boomers and seniors are the consumers with the highest average savings among those living paycheck to paycheck without issues paying bills ($7,961) and among those who do not live paycheck to paycheck ($22,866).”

Get the study: New Reality Check: The Paycheck-to-Paycheck Report

Savings Only Helping Some

As successive studies expose the very real problem of consumers living paycheck to paycheck — and often struggling to do so — consumers are anxious about covering emergency expenses.

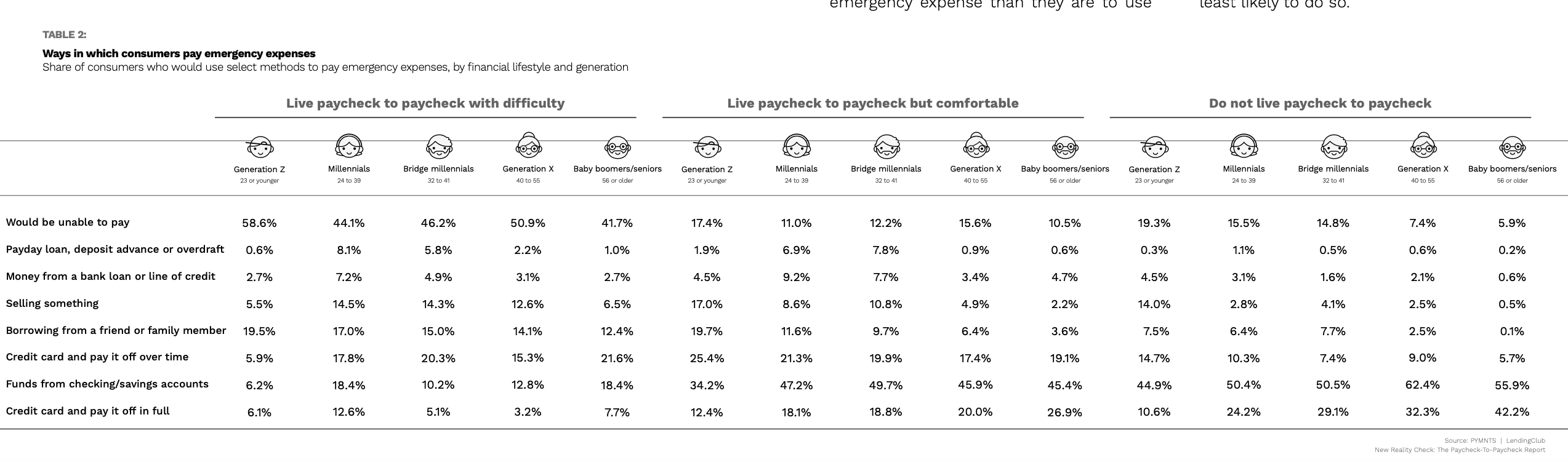

Per the latest findings, “paying an emergency expense can be a significant challenge for all consumers living paycheck to paycheck, especially for those who struggle to pay their bills each month. When asked how they would handle an emergency expense of $400 based on their current financial situations, approximately half of consumers living paycheck to paycheck with issues paying their bills reported that they would be unable to pay such an expense.”

Here again, consumer savings (or lack thereof) are playing a pivotal role for those with savings.

PYMNTS found that “among consumers who live paycheck to paycheck without issues paying bills, close to half of almost all generations would cover emergency expenses with money from their checking or savings accounts.”

As New Reality Check: The Paycheck-To-Paycheck Report concluded, “With inflation likely becoming part of the economic picture for months to come, consumers who live paycheck to paycheck will need to review their financial plans and find ways to manage their spending.”

Get the study: New Reality Check: The Paycheck-to-Paycheck Report