The share of consumers taking it month by month financially is on the rise, and this increase in economic anxieties could have an impact on how they get their food needs met.

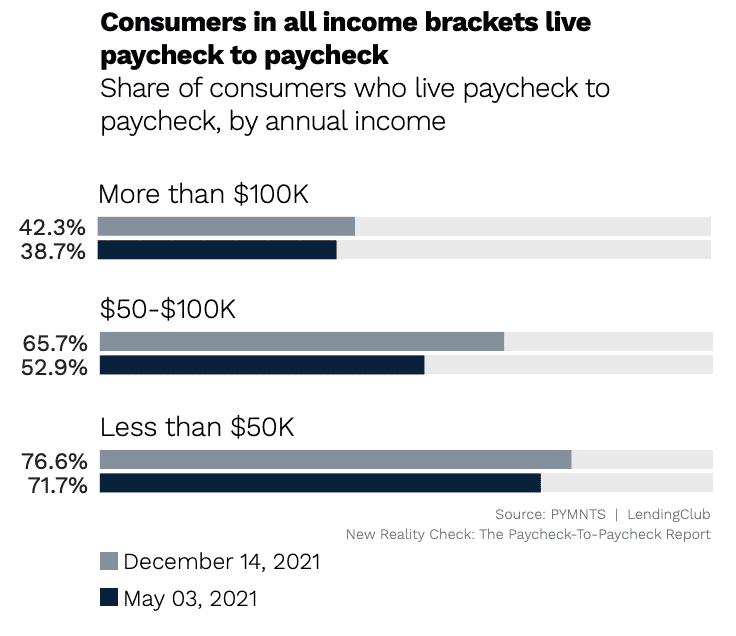

Research from the latest edition of “The New Reality Check: The Paycheck-To-Paycheck Report,” a PYMNTS and LendingClub collaboration, which drew on insights from a survey of more than 3,000 U.S. consumers conducted in December, found that, at the end of the year, 61% of the U.S. population were living paycheck to paycheck. This share is a significant increase from the 54% that lived paycheck to paycheck in May.

See more: 61% of the US Population Living Paycheck to Paycheck

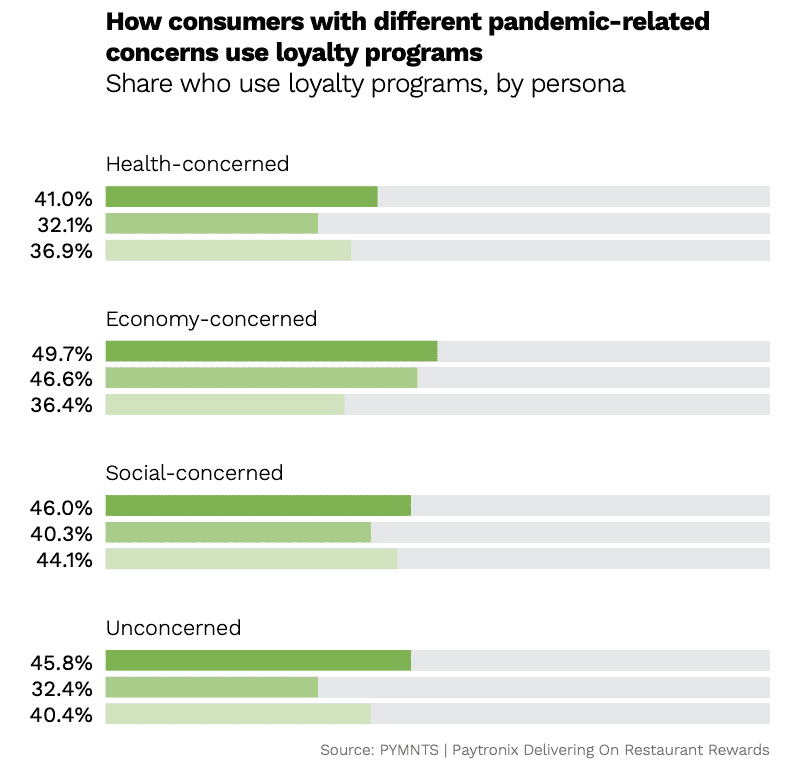

These economic anxieties pose an opportunity for restaurants to drive adoption of their loyalty programs. The May edition of Delivering On Restaurant Rewards, a PYMNTS and Paytronix collaboration, which drew on the results of a census-balanced survey of more than 2,200 U.S. consumers on what worries them most about the ongoing pandemic, found that those whose primary concerns related to their financial situation were more likely than other consumers to use restaurants’ loyalty programs.

These economic anxieties pose an opportunity for restaurants to drive adoption of their loyalty programs. The May edition of Delivering On Restaurant Rewards, a PYMNTS and Paytronix collaboration, which drew on the results of a census-balanced survey of more than 2,200 U.S. consumers on what worries them most about the ongoing pandemic, found that those whose primary concerns related to their financial situation were more likely than other consumers to use restaurants’ loyalty programs.

Read more: 4 In 10 Restaurant Customers Concerned About Health

Fifty percent of these economy-concerned consumers reported using at least one restaurant’s loyalty program, with 47% using that of a restaurant with table service and 36% using that of a quick-service restaurant (QSR). Interestingly, these financially anxious consumers were the only ones more likely to use loyalty programs at table-service establishments than at QSRs.

Additionally, paycheck-to-paycheck consumers are looking forward to getting back to indoor dining. Research from the November edition of the Paycheck-To-Paycheck Report, which was based on a census-balanced survey of 2,211 U.S. consumers conducted in September, found that roughly a third of those who live paycheck to paycheck plan to dine indoors more often once the health crisis is over, and 27% plan to dine outdoors more.

See more: End of Pandemic Could Kick off Spending Spree for Paycheck-to-Paycheck Consumers

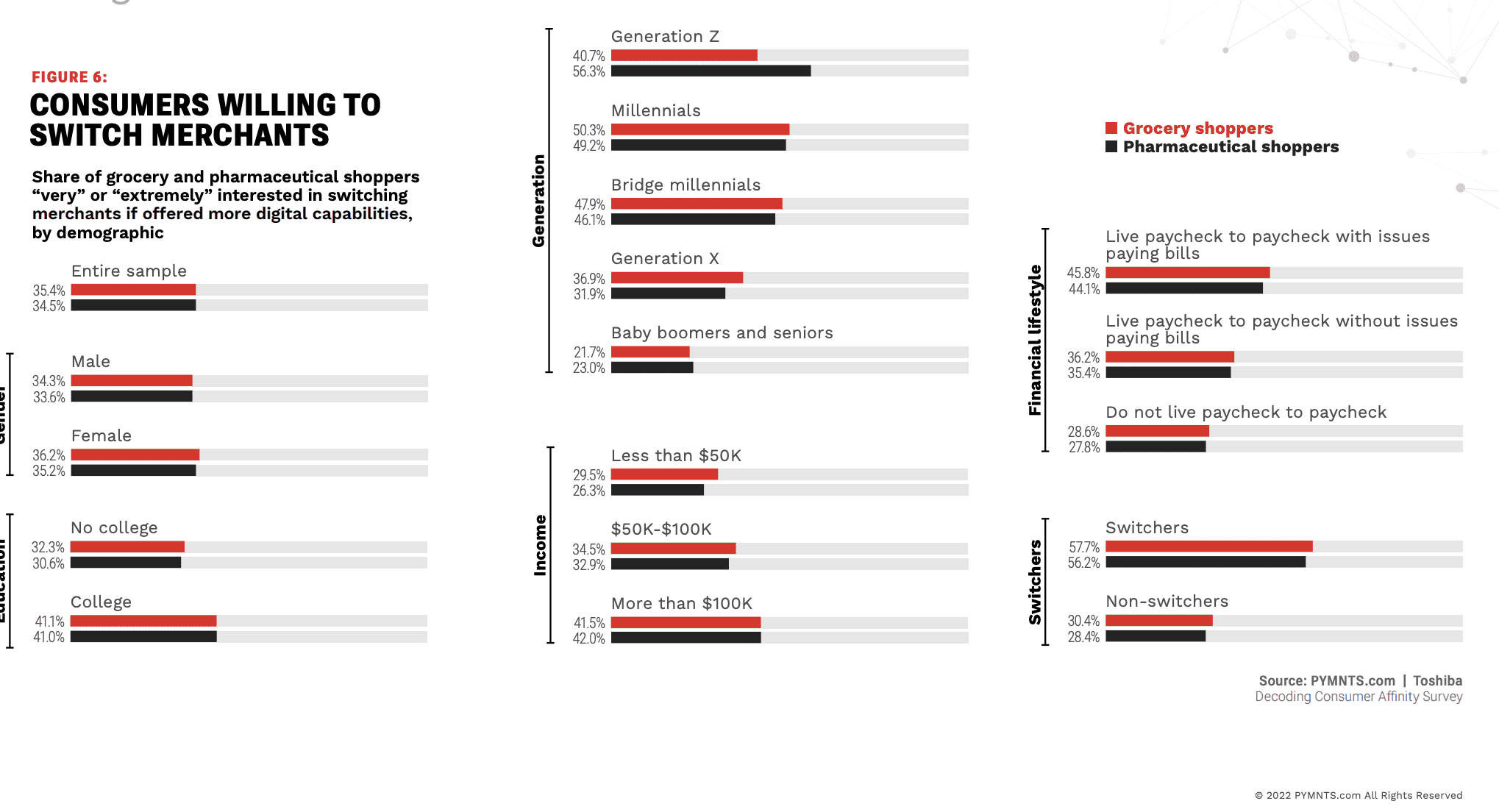

For grocers, these financial concerns provide the opportunity to win new customers while posing the risk of alienating existing customers, according to data from PYMNTS’ study “Decoding Customer Affinity: The Customer Loyalty to Merchants Survey 2022.”

Get the report: The Customer Loyalty to Merchants Survey 2022

The report, created in collaboration with Toshiba Global Commerce Solutions, which featured the results of a census-balanced survey of more than 2,000 U.S. consumers, found that 46% of grocery shoppers living paycheck to paycheck with issues paying bills are willing to switch merchants if they are offered more digital capabilities. This figure is markedly larger than the 36% living paycheck to paycheck without issues paying bills and the 29% of those who do not live paycheck to paycheck who said the same.

The report, created in collaboration with Toshiba Global Commerce Solutions, which featured the results of a census-balanced survey of more than 2,000 U.S. consumers, found that 46% of grocery shoppers living paycheck to paycheck with issues paying bills are willing to switch merchants if they are offered more digital capabilities. This figure is markedly larger than the 36% living paycheck to paycheck without issues paying bills and the 29% of those who do not live paycheck to paycheck who said the same.

Notably, these paycheck-to-paycheck consumers span all income brackets, although unsurprisingly, lower-income consumers are more likely to fall into the category than higher-income, the most recent edition of the Paycheck-to-Paycheck Report found. Still, 42% of those earning over $100,000 a year live paycheck to paycheck, and about a quarter of those earning less than $50,000 do not.