The quip “give the people what they want” aptly describes global shopper behavior as new research finds that the right digital features smartly deployed are winning worldwide.

As we find in The 2022 Global Digital Shopping Index, a PYMNTS and Cybersource collaboration and the latest edition in this multiyear research project, merchants who walk the digital talk and align with consumer desires are pulling well ahead of those with less considered strategies.

Get the study: The 2022 Global Digital Shopping Index

Satisfaction and loyalty are byproducts of experience, according to the new data, and getting the feature mix right by region and retail category are proving decisive, as is awareness.

Buy now, pay later (BNPL) is a prime example. As more merchants respond to consumer wishes by adding this option, research reveals an awareness gap that needs to be solved.

Per the study, “44% of the consumers in the six nations we studied are aware that the merchants from which they made their most recent purchases accepted BNPL payments, for example, while 57% of the merchants provide at least one such option.”

Advertisement: Scroll to Continue

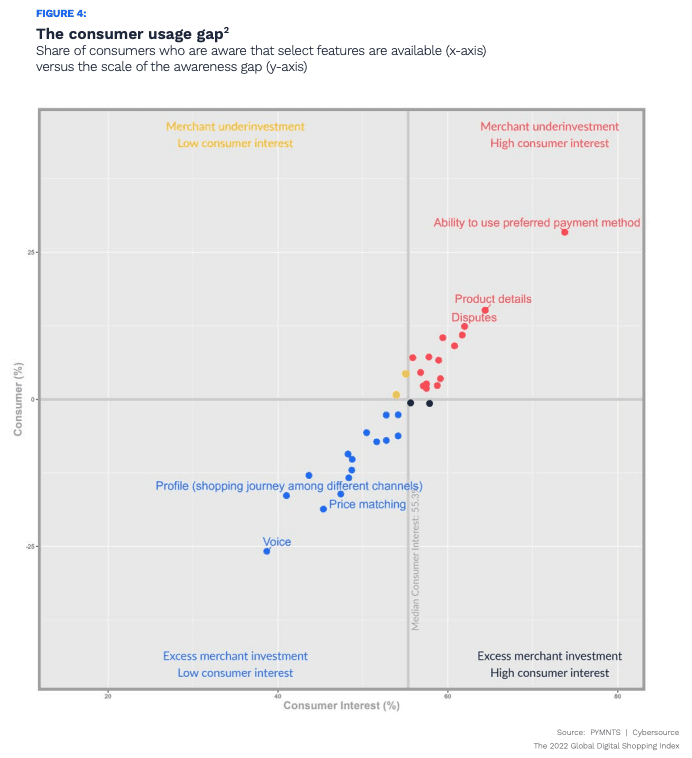

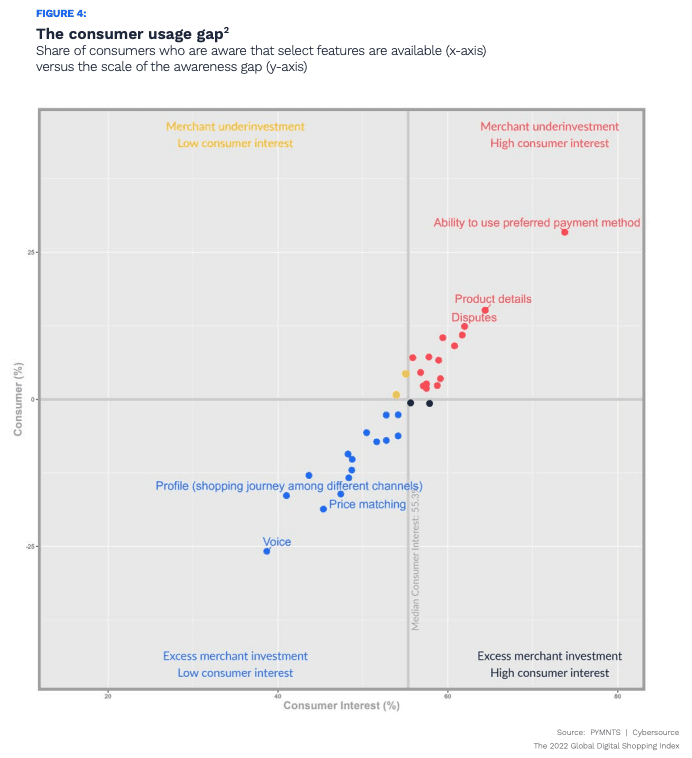

A 13-percentage-point spread between BNPL availability at checkout and consumer awareness of the option indicates that many retailers still have work to do around communicating the presence of in-demand shopping and payment features — ideally before the journey starts.

Regional variance is apparent. For example, nearly 6 in 10 Brazilian consumers are aware of BNPL and prefer shopping where it’s offered — which is only in 41% of local merchants. In the U.S., conversely, 40% of consumers know about BNPL and 55% of merchants offer it.

From this, the study concludes that “Brazilian consumers are roughly 50% more likely than U.S. consumers to realize that BNPL options are available. U.S. merchants therefore appear to be either overinvesting in BNPL options, or — more likely — they are not implementing BNPL options in a way that makes it apparent to their customers that such options are available.”

PYMNTS finds a similar situation with voice-enabled commerce.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Looking at Brazil, for example, “76% of its merchants offer voice-enabled shopping options, but only 33% of its consumers use them. This contrasts sharply with the U.S., where 54% of merchants offer voice-enabled purchasing options and 43% of their shoppers use them.”

Another comparison in the study looks at differences in consumer sentiment between Mexico and the United Arab Emirates (UAE), where the impact of awareness is keen.

Another comparison in the study looks at differences in consumer sentiment between Mexico and the United Arab Emirates (UAE), where the impact of awareness is keen.

Both countries are new to this study series and provide insights into how merchants in different markets are responding to digital shopping and payments trends during the pandemic.

With an average of 103.7 UAE merchants compared to 83 in Mexico, the study states that “UAE merchants’ secret to success lies not in offering more features than Mexican merchants but rather in implementing them in a way that makes them readily available and easy to use.”

The takeaway?

“Simply offering more features is not always enough,” according to the study. “Merchants must also make those features easy to find and convenient to use to enhance their customers’ shopping experiences.”

Get the study: The 2022 Global Digital Shopping Index

Get the study: The 2022 Global Digital Shopping Index

Consumers don’t necessarily think “omnichannel,” but that’s how they’re shopping now.

More buying journeys are starting online and finishing in-store while the physical world continues reopening with a renewed sense of optimism. Merchants whose feature sets best match up are indexing higher and seeing the payoffs of shrewd digital investments.

As new technology appears almost daily, merchants who understand the underlying reasons that people use (or don’t use) certain features and services helps inform feature decisions.

To simplify this, the latest Global Shopping Index devised a taxonomy of digital features addressing the “why” behind feature appeal. The “how” is then easier to figure out.

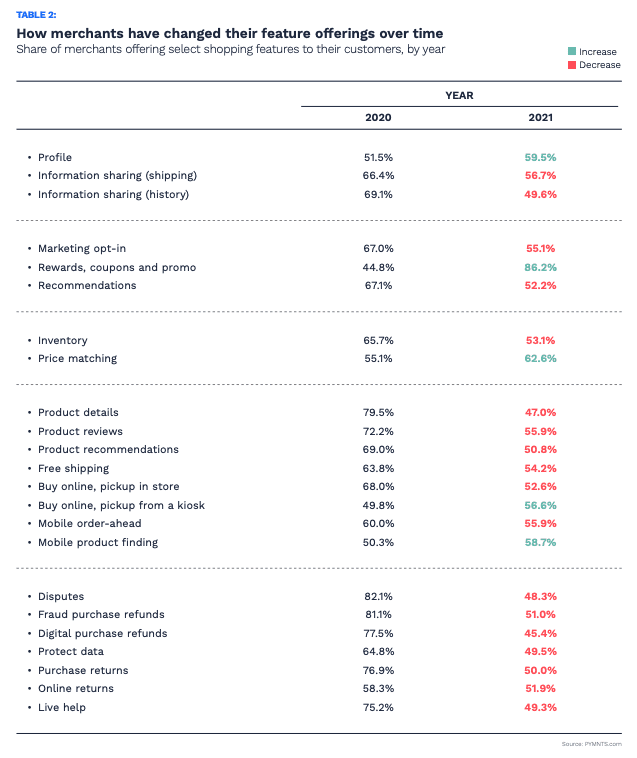

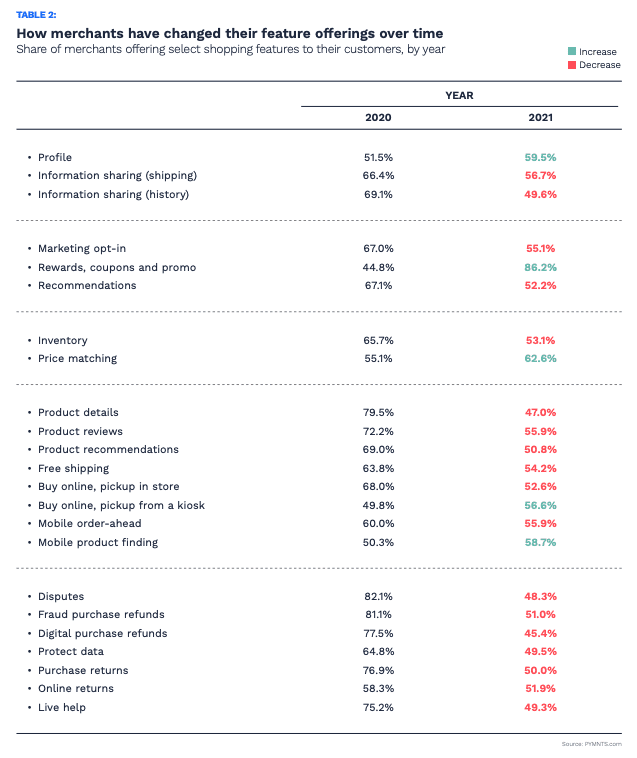

The study categorizes roughly three dozen digital features into five overarching consumer themes, including “Know Me,” which is about preference and personalization; “Value Me,” which revolves around rewards and loyalty; “Do You Have What I Want,” which is self-explanatory; “Make It Easy for Me,” which pulls in delivery, curbside pickup and actually getting products; and “Protect Me,” which shields consumer’s identities and card credentials with refund assurance.

Get the study: The 2022 Global Digital Shopping Index

Get the study: The 2022 Global Digital Shopping Index

Add as Preferred Source

Add as Preferred Source

Another comparison in the study looks at differences in consumer sentiment between Mexico and the United Arab Emirates (UAE), where the impact of awareness is keen.

Another comparison in the study looks at differences in consumer sentiment between Mexico and the United Arab Emirates (UAE), where the impact of awareness is keen. Get the study:

Get the study:  Get the study:

Get the study: