Credit unions (CUs) continue to attract members based on their community involvement, cost-effectiveness and helpful staff, but current and potential members are also looking for digital banking tools and innovative financial products. In response to that growing expectation, 14% of CUs in a PYMNTS study reported that beating their competitors to market with digital banking products is a priority. The study found that CUs are focused on innovations in loyalty and rewards, customized product offerings, security and authentication and planning and budgeting tools.

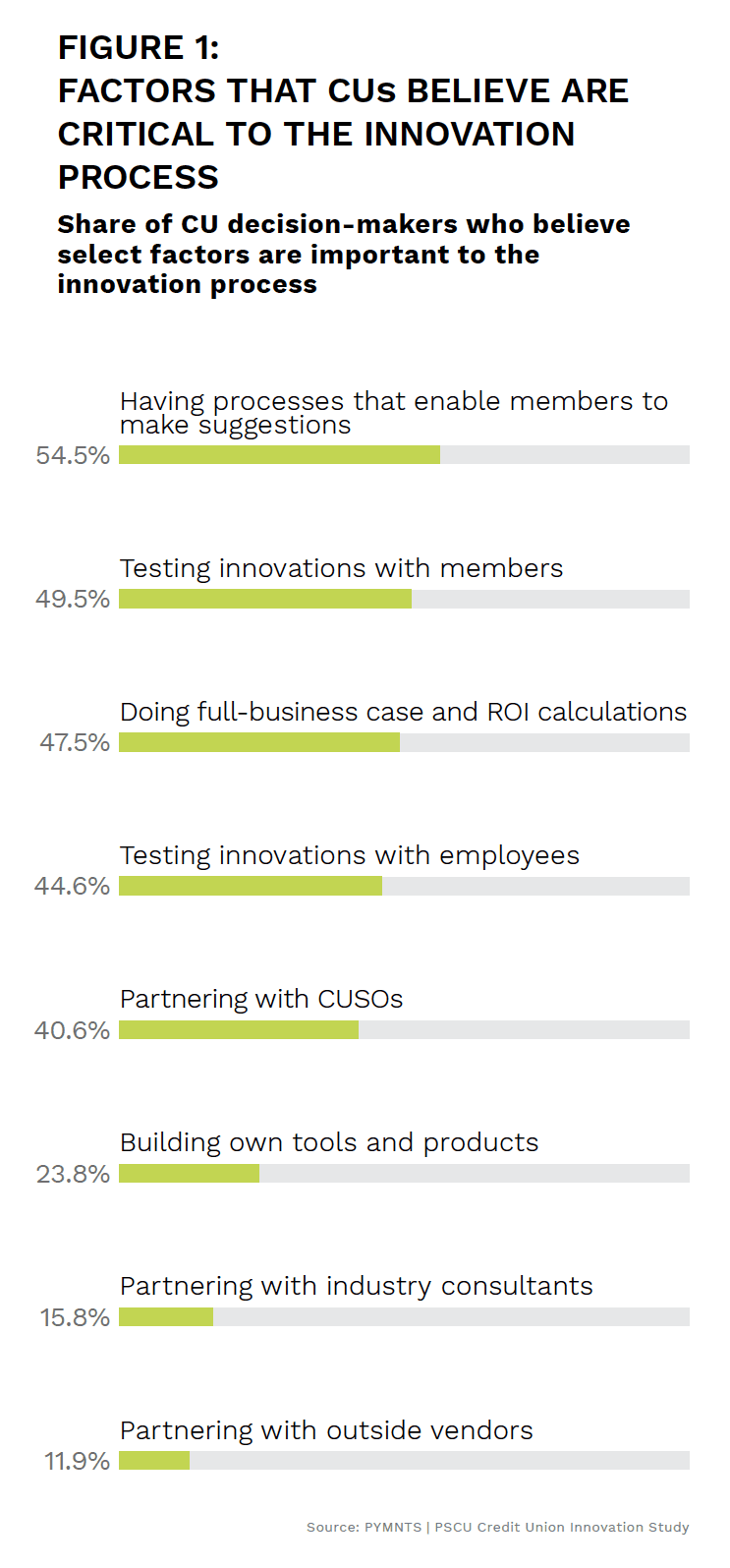

With this emphasis on quickly deploying new products while still guarding the cost savings that members value, many CUs have found that the road to innovation is easier to navigate with a partner. PYMNTS’ research revealed that 41% of CUs see partnerships with credit union service organizations (CUSOs) as crucial to innovation, while 16% say the same about industry consultants and 12% look to outside vendors for this assistance. This month, PYMNTS examines the relationships between CUs and their FinTech partners and how those partnerships can save both time and money.

Putting FinTech Solutions to Work for CUs

CUs most commonly work with FinTechs as technology vendors, as FinTechs’ turnkey solutions can often fit neatly into CUs’ existing procurement processes. FinTechs, for their part, are increasingly positioning themselves to compete with traditional technology vendors, providing not just security and authentication tools or other technology enhancements, but also services to meet members’ needs surrounding financial literacy and peer-to-peer (P2P) payments.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Six in 10 CU executives in a new study said digital platform vendors have significantly assisted their digital transformations, and CUs expect that contribution to grow. The study found that 36% of CU executives intend to seek more value from technology vendor relationships in 2022, such as through automating more internal processes, deploying application programming interfaces (APIs), implementing chatbots and robotic process automation and taking advantage of artificial intelligence (AI) offerings. Wherever there is a potential to develop new digital products or services, FinTech solutions can be an asset to CUs.

Working With FinTechs to Offer Cryptocurrency Solutions

Providing member access to cryptocurrency markets has been an untapped area for CUs, but new guidance from the National Credit Union Administration (NCUA) suggests this as another valuable CU-FinTech partnership opportunity. A recent study found that among consumers who already own cryptocurrency, 40% would consider switching financial institutions (FIs) for better crypto offerings. Consumers new to this market also expressed a preference to work with their FIs if they were to purchase cryptocurrencies.

One-quarter of CU executives said their organizations are planning to offer investment and trading opportunities in cryptocurrencies in the coming years, 17% said they would be looking to offer custody and safekeeping services and 6% are even considering lending services that employ cryptocurrencies. As with other digital banking tools, FinTechs are developing cryptocurrency products and services that CUs can extend to their members. Such solutions make it possible for CU members to purchase and spend cryptocurrency from within their existing accounts rather than funneling money out of CUs and into currency exchanges.

Controlling Costs Through FinTech Partnerships

Offering the latest in digital banking solutions is essential for both attracting and retaining CU members, but cost savings remain one of the most important factors that members consider in their choices of where to bank. From lower fees and interest rates to special plans for specific purchases, 54% of CU members who turn to different FIs for financial products do so in part to save money. Keeping costs low and passing the savings on to members is thus a significant way to help ensure member retention.

CUs that partner with FinTechs rather than developing solutions in-house can save money directly by not having to duplicate work that someone else has already done. They can also realize faster deployments, saving both time and associated costs. CUs do not have to go it alone when seeking out those partnerships, though. CUSOs and core providers can create a vetted and pretested path for partnering with FinTechs to take advantage of the latest technology and digital offerings. By exploring the options available, CUs can have the cost-savings and technology their members want without taking on excessive risk.