Engaging and retaining the loyalty of younger consumers such as millennials and Generation Z is becoming a top priority for the world’s financial institutions (FIs) and retailers as these generations come to capture wider spending power. One recent study found Gen Z consumers within the United States alone now control more than $150 billion in collective buying power, making capturing their attention critically important for today’s banks, merchants or other such businesses.

Matching the needs and expectations of these digital-first generations — who often anticipate speedy and personalized online experiences — is becoming especially key for entities in Latin America as the region’s online banking and payment ecosystem becomes rapidly more saturated. Younger consumers within the region are increasingly turning to contactless or other virtual tools to make more of their daily purchases, with one recent study finding 37% of Brazilian Gen Z consumers are now tapping mobile wallets for their transactions.

In the latest Digitizing Payments In Latin America Playbook, PYMNTS examines how the payment and banking needs of Latin American millennials and Gen Z consumers are changing and why keeping pace with such changes is critical for the region’s banks and merchants.

Around the Latin American Payments Space

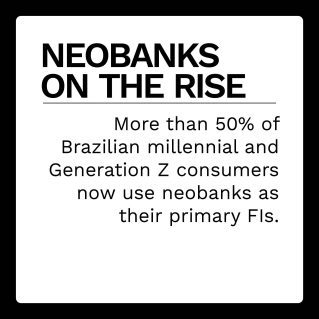

Figuring out how to engage and retain millennial and Gen Z consumers is becoming more critical for Latin American FIs, especially as the region’s digital financial ecosystem grows increasingly saturated. Consumers in these younger demographics are still largely turning toward legacy FIs to meet their banking needs for the present moment, with one recent report finding 77% of millennials and Gen Z consumers in the region overall currently bank with such institutions, while 28% cited they used neobanks. Yet there are countries where this trend appears to have reversed — such as Brazil, where more than half of the country’s millennials and Gen Z consumers are now tapping digital-first banks to meet their financial needs. Figuring out how to capture and keep the attention of these younger consumers is therefore key for FIs of all sizes.

Younger consumers’ adoption of online banking channels and solutions also drives wider usage of such tools forward throughout Latin America. More and more consumers in the region are experimenting with emerging payment methods such as mobile wallets or QR codes rather than cash — for example, one recent study found 94% of Peruvians now have access to payment methods other than cash. The study also found 40% of payments within the country are now occurring via contactless methods, indicating they are rapidly becoming part of the mainstream payment environment. Banks and other key financial players must move swiftly to ensure they can offer such methods.

Younger consumers’ adoption of online banking channels and solutions also drives wider usage of such tools forward throughout Latin America. More and more consumers in the region are experimenting with emerging payment methods such as mobile wallets or QR codes rather than cash — for example, one recent study found 94% of Peruvians now have access to payment methods other than cash. The study also found 40% of payments within the country are now occurring via contactless methods, indicating they are rapidly becoming part of the mainstream payment environment. Banks and other key financial players must move swiftly to ensure they can offer such methods.

For more on these and other stories, visit the Playbook’s News and Trends.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

How Millennial, Gen Z Consumers are Shaping Latin America’s Digital-First Banking Future

Emerging payment methods, including digital and mobile wallets, have rapidly become more popular since the start of the global health crisis. For example, Latin American millennials and Gen Z consumers are more likely to reach for their phones to conduct financial tasks than ever before. This rising availability and comfort with digital-first banking channels and tools means the regions’ FIs must work quickly to ensure they can match younger consumers’ growing expectations or risk losing their businesses, Neudson Freitas, head of small and medium-sized enterprise customer success for Banco do Brasil, said in a recent PYMNTS interview.

To learn more about how millennial and Gen Z consumers are driving forward the future of Latin American banking and how its FIs can prepare, visit the Playbook’s Feature Story.

To learn more about how millennial and Gen Z consumers are driving forward the future of Latin American banking and how its FIs can prepare, visit the Playbook’s Feature Story.

How Merchants are Meeting Latin American Millennial, Generation Z Consumers’ Payment Preferences

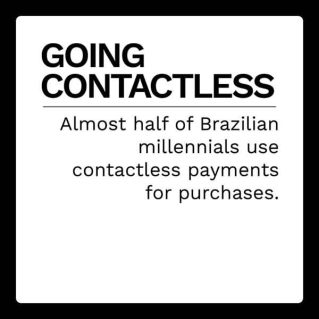

Contactless and other digital-first payment tools have seen especially rapid growth within the Latin American region, a trend driven by millennial and Gen Z consumers seeking easy and effortless payment experiences. Forty-six percent of Brazilian millennials are now paying for their goods or services with digital wallets, for example. This indicates a growing need for the regions’ banks — but also crucially, its merchants — to keep these generations’ payment needs and wants in mind to stay competitive.

To learn more about why meeting millennial and Gen Z preferences is critical for Latin American merchants, visit the Playbook’s PYMNTS Intelligence.

About the Playbook

The Digitizing Payments In Latin America Playbook, done in collaboration with Kushki, examines the latest digital payments developments in Latin America, including how payment services providers can support consumer demands and gain a foothold within the region.