Consumer interest in buy now, pay later (BNPL) options is growing at breakneck speed, creating a massive opportunity for market entrants to gain a foothold.

In fact, 1 in 5 consumers have used BNPL in the last year, according to “BNPL, Banks And The Trust Factor,” a PYMNTS and Amount collaboration based on a survey of 2,237 U.S. consumers.

Get the report: BNPL, Banks And The Trust Factor

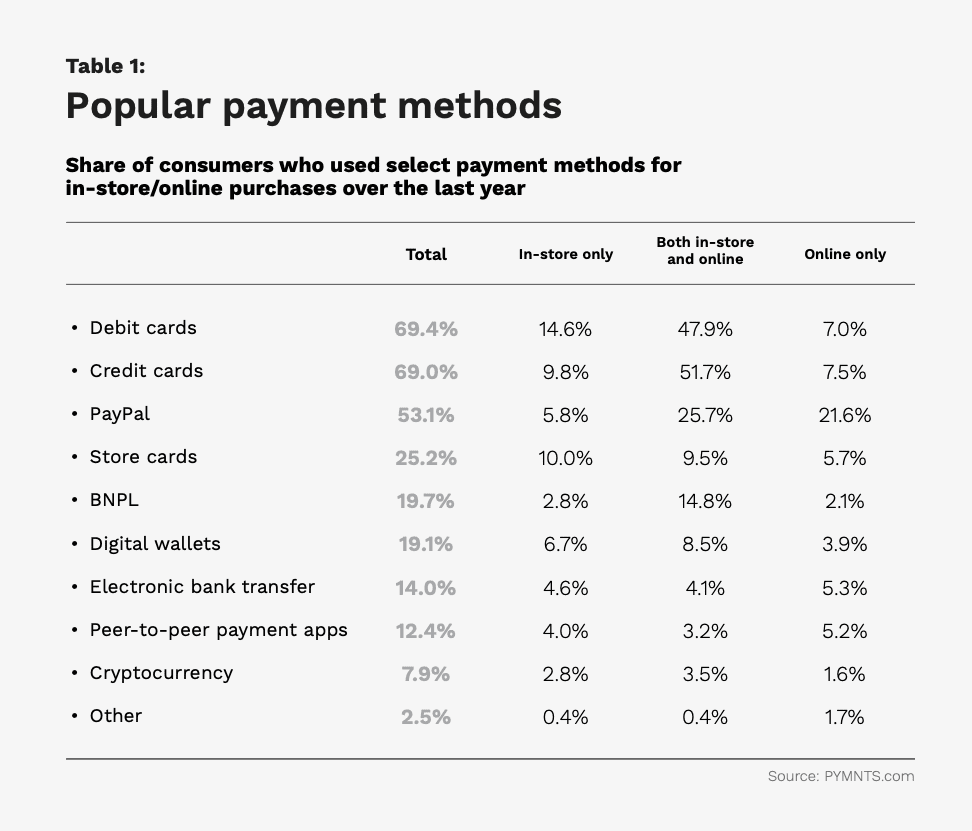

Two percent of consumers have used BNPL online only, 3% have used it in-store only and 15% have used it both in-store and online.

Among those who have not used BNPL, 36% of consumers would use bank-backed BNPL options.

The survey identified several demographic groups that are the most interested in bank-backed BNPL options.

Younger generations of consumers are the most interested. Among those who are not BNPL users, 53% of millennials, 48% of bridge millennials and 45% of Generation Z consumers say they are interested in using bank-issued BNPL plans.

Interest in bank-issued BNPL plans is fairly strong across the three categories of financial lifestyles tracked in the survey. Among the BNPL nonusers, consumers who live paycheck to paycheck and have issues paying their bills expressed the most interest at 46%.

In addition, among the three income levels defined in the survey, consumers who are earning more than $100,000 annually show the most interest. Among the consumers in that income level who do not use BNPL, 39% are interested in bank-issued BNPL plans.

The large share of consumers who are interested in giving BNPL a try highlights the opportunity that exists for banks, which are uniquely poised to compete in this rapidly growing market.

By leveraging the longstanding relationships they have with their clients and offering the flexible payment options that appeal to most BNPL users, banks can position themselves for success in the BNPL market.