Despite in-store sales making a comeback in 2021, online spending continues to grow since the pandemic’s onset in 2020.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

eCommerce sales in the United States alone rose 14% year over year to reach $871 billion in 2021. Moreover, a surge in online and mobile payments adoption throughout the Asia-Pacific region and Europe is expected to help drive 18% annual growth in cashless transactions worldwide through 2025.

As digital payments become more prevalent, lawmakers have moved to develop regulations to keep transactions secure from fraudsters, money launderers and other malicious actors. Businesses seeking to accept an expanding variety of digital payment methods must keep pace with these rules, including Payment Card Industry Data Security Standard (PCI DDS) and 3D Secure requirements for credit and debit data, as well as the Strong Customer Authentication (SCA) standard taking shape in the European Union and the United Kingdom.

Compliance with an ever-increasing number of payments regulations can prove costly, however. The cost of achieving Level 1 PCI DSS compliance, for example, can range from $50,000 to $70,000 for larger entities, threatening to place an increasing strain on companies as they attempt to recover from the pandemic’s economic impacts as well as putting a strain on development teams as they look to refocus on core values. This month, PYMNTS Intelligence analyzes the growing regulatory burden that eCommerce businesses face and how merchants can reduce the cost of compliance by implementing a payments orchestration layer.

Understanding Compliance’s Complexity

As digital becomes the preferred transaction channel for a growing number of consumers and companies, lawmakers worldwide have subjected companies’ practices for the sharing and storage of online data to greater scrutiny. The PCI DSS data security standards came into place in 2006 in response to expanding online credit card sales. EU regulators soon followed by drafting the SCA standards as part of the Payment Services Directive (PSD2) regulation — rules designed to provide another layer of authentication to digital transactions exceeding a specific limit.

Navigating this shifting regulatory environment can be difficult for eCommerce merchants, as it means maintaining compliance with complex, often overlapping security and privacy rules and keeping payments seamless and convenient for customers. April 2021 PYMNTS research revealed that up to 58% of consumers would abandon online purchases if their payments were declined, making it clear that swift, convenient transactions are necessary for today’s digital shoppers.

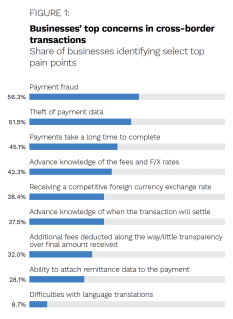

Another recent PYMNTS study found that regulatory barriers were one of the major challenges preventing migration to digital B2B payment solutions for 47% of U.S. and Canadian merchants. The April 2021 PYMNTS report also found that 56% of companies said payments fraud was the top worry in cross-border transactions. As online customers continue to do more shopping outside their native countries, businesses looking to support easy, convenient cross-border payments will need to maintain regulatory compliance in multiple markets.

Implementing a payments orchestration layer is one way for companies to remain compliant with multiple regulations without introducing undue customer friction into the payments process. Payments orchestration can offer businesses a competitive edge by aggregating all payment relationships in one place, simplifying the overall payments process and reducing the confusion caused by diverse compliance needs.

Payments orchestration has many advantages for eCommerce merchants seeking to expand into new markets or target new customer bases to benefit from the ongoing digital boom. Finding the right payments orchestration partner could substantially reduce businesses’ regulatory burdens, allowing them to reserve valuable resources to create innovative products and services for customers.