Well, that’s no fun.

If there are some “connected economy” themes shaping up as earnings season gets fully underway, depending on where you look, try these on for size:

Consumers are spending money, yes — and they want to feel connected, surely, to the various activities of daily life. However, increasingly, as economies open and travel sees a snap back, we may be disconnecting, at least somewhat, from the screens and content that kept us enthralled during the pandemic.

That spells trouble, at least near term, for the streaming services and platforms that enable us to get our various media fixes. To that end, investors fled the “Have Fun” pillar, sending the group down more than 11%. The pillar, like all of the CE100™ pillars, are made up of individual names.

Netflix’s disastrous slide this past week, down more than 36%, stands out as a microcosm of why investors have been skittish on the “connected” theme in recent days. Netflix, as has been widely reported, lost 200,000 subscribers in its latest reported quarter, and management has guided for 2 million losses in the current quarter.

“Our revenue growth has slowed considerably,” Netflix said in its letter detailing results. “Covid clouded the picture by significantly increasing our growth in 2020, leading us to believe that most of our slowing growth in 2021 was due to the Covid pull forward.”

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Also a possibility, as discussed on that same call: A lower priced offering that is supported by advertising.

Read more: Don’t Look Down: Slump in Netflix Subscribers Bucks Connected Economy’s Rise

Other Platforms Take a Hit, Too

For evidence that platform names have had a tough time of it, look to Spotify’s 19% loss on the week, and Roblox’s 18.9% dip.

We’ll know more as earnings season progresses, and of course, the 2.6% plummet in the tech-heavy Nasdaq on Friday also helped knock the “Have Fun” pillar for a loop. Then again, it might make sense that “pandemic” plays might sputter a bit, as going outside moves beyond novelty to entrenched reality.

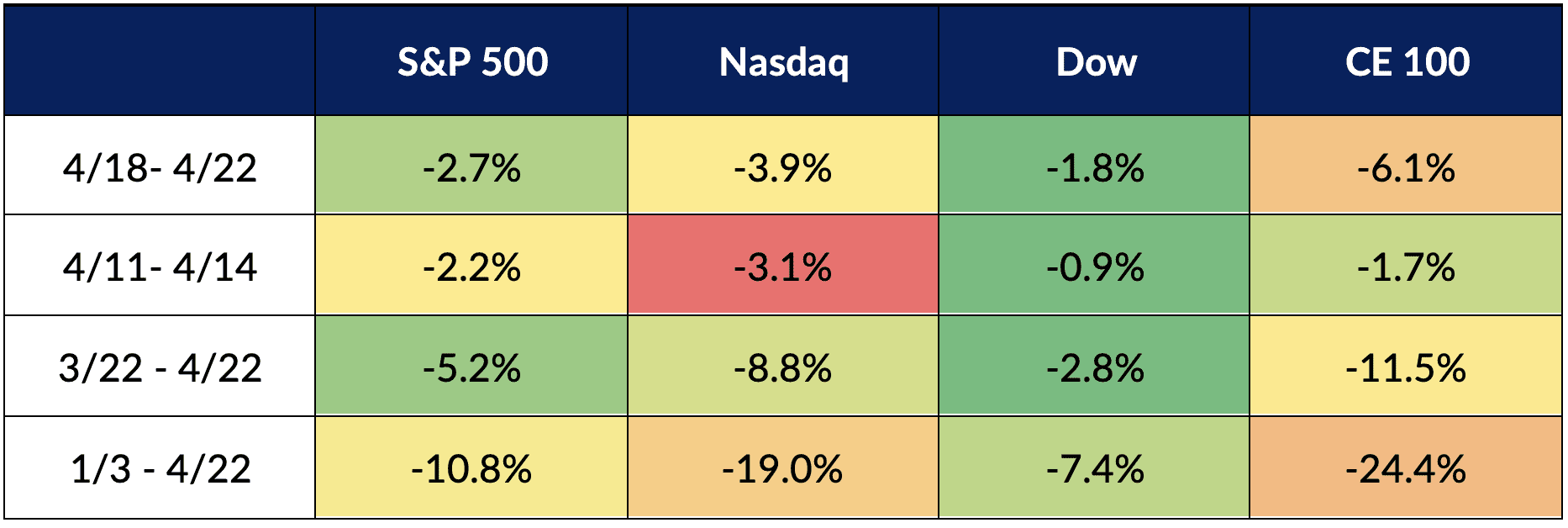

To that end, the Index slipped 6.1%, far outpacing the declines seen in the Nasdaq, which declined nearly 3.9%.

CE100 Performance vs. Broader Indices

Source: PYMNTS

Source: PYMNTS

And lest you think that the “fun” names were isolated in their misery, all pillars fell — to the point where the best performing pillars were “only” a few basis points lower than they had been just a few days ago. As such, the banking names, as a group, were down three basis points, and the Move index slid 80 basis points.

The reeling “Have Fun” pillar was trailed only slightly by the shopping stocks, which lost 11%. This latter group — the “Shop” pillar — ranks among the worst performing of all pillars, year to date, off a whopping 42.7%.

Shopify was a key culprit in the most recent week, as shares crashed 20%. As noted in this space, Amazon’s Buy With Prime will allow select Amazon merchants to sell their listed merchandise directly from their own websites, and the new perk makes Amazon’s payments and fulfillment services available at checkout. The competition is becoming even more heated between Amazon and Shopify, and Shopify is reportedly ramping up its last mile efforts.

See also: Amazon Takes on Shopify With ‘Buy With Prime’