Buy now, pay later (BNPL) is a growth industry that is already worth more than $125 billion, with projections to grow to $3.3 trillion by 2030. Some of that growth is expected to come simply from more consumers gaining awareness of the payment option, but economic pressures and aversion to high-interest rates associated with other credit products also fuel its growth. That is not to say BNPL only appeals to those coping with economic uncertainty. Many high-income earners with good credit and no concern over their financial stability are turning to BNPL as a way to make large-denomination purchases without running up interest-bearing debt.

Many BNPL users see it as a budgeting tool, and that is often cited as a reason by those with multiple credit options for why they choose BNPL. That interest in budgeting also accompanies a desire to avoid interest payments. At the same time, 99% of BNPL users say they understand the terms and conditions associated with BNPL, and 92% reported that they have not had any problems making payments on time.

With many of those budget-conscious consumers possessing high credit limits but concerned about using that credit due to interest payments, one solution has become for the BNPL provider to place a hold against a credit card for the full amount, but only charge the installment payments, reducing the hold as the payments are made. This approach removes the need for credit checks and can shorten the BNPL application process while permitting consumers to benefit from the high credit limits they have earned without the downside of interest payments.

The “Buy Now, Pay Later Tracker®” examines the impact of consumer behavior on BNPL — and vice versa. As BNPL options continue to diversify, both merchants and providers will need to be aware of new trends and potential use cases to stay on the cutting edge.

Around the BNPL Space

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

The global BNPL market is forecast to experience a 44% compound annual growth rate (CAGR) through the end of the decade. At the end of 2020, the online segment was the largest for BNPL purchases, and North America is currently the most active region globally, but BNPL is becoming more common with in-person retail environments, and growth in the Asia Pacific region is outpacing that in North America, fueled in part by continuing price increases for home appliances.

The global BNPL market is forecast to experience a 44% compound annual growth rate (CAGR) through the end of the decade. At the end of 2020, the online segment was the largest for BNPL purchases, and North America is currently the most active region globally, but BNPL is becoming more common with in-person retail environments, and growth in the Asia Pacific region is outpacing that in North America, fueled in part by continuing price increases for home appliances.

Even as BNPL experiences significant growth in its current form, providers are preparing to roll out BNPL 3.0. The evolving forms of BNPL and the increasing variety of purchases for which consumers can use it could position the payment method to take a more prominent role in how consumers make purchases. Additionally, white-label offerings from BNPL providers could both enable other financial services, such as banks and credit unions, to more easily offer BNPL as a credit option, while at the same time encouraging consumers to engage with BNPL by associating it with a trusted brand.

For more on these stories and other BNPL developments, check out the Tracker’s News and Trends section.

Vestiaire Collective on Powering Sustainable Purchasing With Resale Platforms, BNPL

Faced with a global health crisis and accompanying economic pressures, consumers of luxury and couture fashion have turned to the financial flexibility of BNPL to continue to keep up with trends.

In this month’s Feature Story, Pedro Bennasar, head of payment for Vestiaire Collective, talks about how BNPL is making luxury fashion more accessible to a wider range of customers across the global marketplace.

PYMNTS Intelligence: Consumer Buying Behavior Is Shaping Itself to BNPL

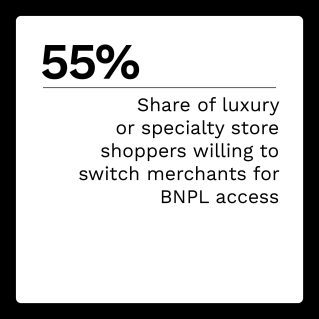

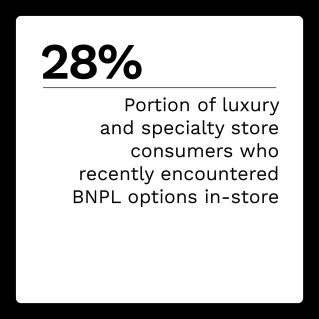

In-store purchases with BNPL are on the rise, and one of the main barriers to wider adoption may only be a lack of availability of in-store BNPL options. Out of all surveyed age groups, Millennials expressed the strongest interest in using BNPL at luxury and specialty stores, with almost 70% saying they are “highly” interested. In fact, luxury and specialty store use was the market segment where all age groups said they were “highly” interested in using BNPL. To take advantage of that interest, merchants will need to ensure they have quick and simple BNPL options available both online and in-store.

This month’s PYMNTS Intelligence looks at how a maturing BNPL marketplace is shaping consumer purchasing habits and the evolving opportunities it provides to merchants.

About the Tracker

The “Buy Now, Pay Later Tracker®,” a PYMNTS and Splitit collaboration, examines the latest trends and developments shaping the BNPL space and how BNPL is maturing into a more ubiquitous payment option seen as a no-interest credit option and budgeting tool by consumers.