Credit unions (CUs) have long branded themselves as having a people-oriented mission that has gained them a high place in consumers’ regard, with CUs traditionally enjoying higher satisfaction rates than other financial institutions (FIs). For the third year in a row, however, CUs have lagged behind banks, according to the most recent American Consumer Satisfaction Index. CUs earned an overall satisfaction score of 76 on a 100-point scale in 2021, compared to banks’ score of 78. This difference may not seem large, but the CU satisfaction score dropped 1.3% from 2020, bringing it to an all-time low, while banks’ score held steady.

CUs received their highest ratings for courtesy and helpfulness of staff, speed of financial transactions in branches and the quality of their mobile apps — but all these scores declined from 2020 levels. National banks, meanwhile, received their highest marks for the quality of their mobile apps, first and foremost, followed by courtesy and helpfulness of staff and website satisfaction. Of particular significance, the mobile app findings are consistent with changing consumer priorities about FIs’ technology offerings.

A growing preference for digital features would seem to signal an end to the days of in-person banking for which CUs are best known, but the battle for FI consumers’ hearts and minds is not over yet, with data suggesting that CUs have won consumers’ trust more than other FIs. This month, PYMNTS Intelligence examines how CUs are uniquely poised to gain business by striking a balance between in-person and digital services.

Sources of Member Satisfaction/Dissatisfaction

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

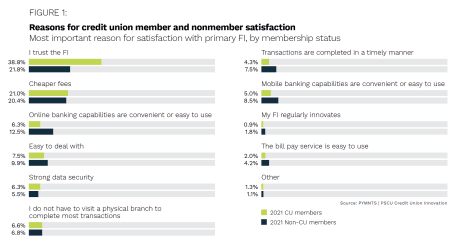

The mainstreaming of digital products means that CUs are under growing pressure to roll out new services to retain members. Non-CU members are almost twice as likely to report ease of use with their online banking and account management capabilities, with 13% saying this is their top reason for satisfaction with their FIs.

Credit unions lag in this area, with only 6.3% of CU members citing online banking capabilities as a primary reason for satisfaction. Digital products and services are of such weight to some CU members that they would switch FIs to obtain them, with 35% or more saying they would switch from their CUs if they did not offer such features as mobile check deposit, digital cards, peer-to-peer (P2P) payments, digital wallets and cardless cash withdrawals.

The good news is that CUs maintain higher consumer trust than other FIs. Trust is the greatest reason members are satisfied with their CUs, with 39% indicating this in 2021. Only 22% of non-CU members rated trust as the most important reason for satisfaction with their FIs.

What CUs Can Do to Improve Member Satisfaction

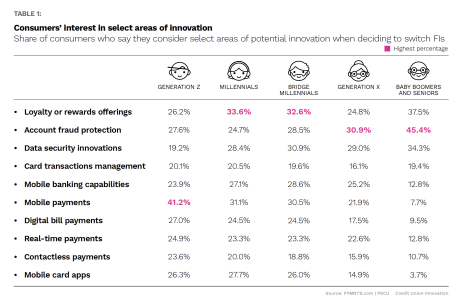

In-person banking will inevitably shrink as digital engagement grows, but many banking services require a more consultative approach and will continue to occur face-to-face. Credit unions need to leverage their trust factor by striking a balance between in-person services and full digital integration. That includes making digital investments to attract new members while highlighting their traditional strengths, such as their not-for-profit status. That alone could draw considerably more Generation Z members, who tend to distrust for-profit institutions and recently expressed a greater interest in credit unions than millennials did.

Credit unions can also play to their strengths by investing in solutions that help improve experiences for all members, both digital and in-person, as well as across generations. Some consumers still prefer a highly personalized process, particularly older CU members. Partnering with third-party innovators can yield automated solutions that improve processes across channels, such as easing the lending process by reducing the need for time-consuming paper-based procedures. Simplification of processes can drive efficiency and allow more time for member engagement, ultimately increasing revenue.

The most successful FIs will be those achieving a balance between digital and human interactions, which requires a blend of technology and a well-trained member services team. Credit unions may wish to launch education initiatives to raise awareness of both their unique in-person value proposition and the new technologies they have to offer.