The Data Point: 47% of Firms Say Growth Is Being Slowed Due to Fraud Fears

More business is going into digital channels and will continue to, and that fact is driving historic spikes in online fraud that are holding businesses back and costing opportunity in the process.

For the study “Reframing Anti-Fraud Strategy: Developing A Proactive Approach To Fraud Risk Management,” a PYMNTS and TreviPay collaboration, we surveyed 150 executives at companies annual revenues between $10 million and $1 billion to gauge to the problem in B2B commerce.

According to the study, “A staggering 98% of B2B businesses reported fraud attacks in 2021, losing 3.5% of their annual sales revenues on average. Small businesses lost even greater shares — as much as 5% — due to fraud-related issues and concerns.”

That summary gives a sense of the size and scope of the issue, and the study contains several approaches companies are taking to keep B2B sales flowing and free of fraudsters.

Get your copy: Reframing Anti-Fraud Strategy: Developing A Proactive Approach To Fraud Risk Management

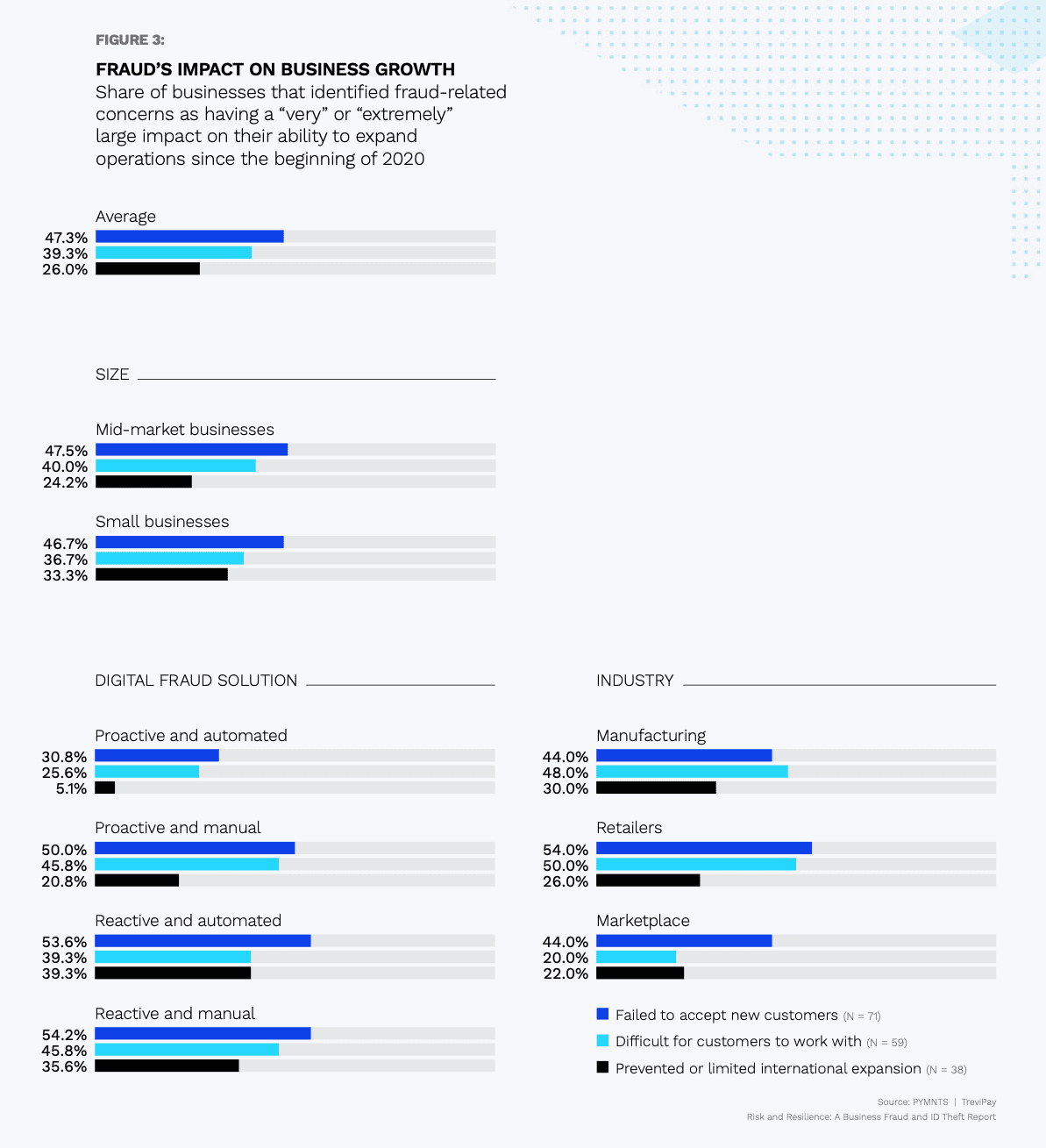

- 47% of B2B businesses chose not to onboard new clients due to a fear of fraud attacks

With fraud rings well equipped and too often successful, B2B fraud fears are warranted. The study notes that 47% of B2B businesses “chose not to onboard new clients due to a fear of fraud attacks,” adding that “it was not that these businesses had no strategy in place — worse, they were certain that their existing anti-fraud measures would be insufficient.”

On this point the study said, “Old methods of verifying identities may not be well-suited for the age of embedded commerce, as fraud attacks may happen on and through an array of new platforms and devices. To avoid scaling financial losses, retailers, marketplaces and brands must take a modern approach to fighting B2B payments fraud.”

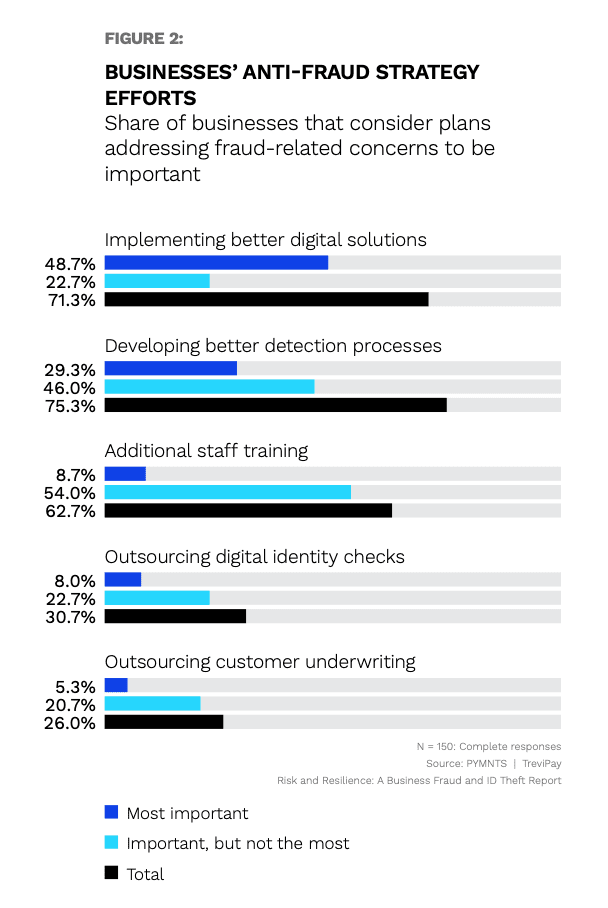

- 71% of firms are planning to add better digital solutions for fraud prevention

In this climate, more B2B operations are taking modernization seriously, planning aggressive investments in the kinds of digital platforms that fraud rings find hardened targets.

Our research found that 71% of B2B firms plan to utilize more advanced digital solutions for fraud prevention, “and almost 50% consider it the most important plan to implement to prevent fraud-related issues.”

“A strategy model represents an organization’s approach to fraud monitoring and risk management. Manual, reactive strategy models tend to cost businesses more over time, so risk management approaches with the speed of innovation — with strategies and risk management policies adjusted according to fraud threats’ evolution — is key to developing efficient anti-fraud practices,” the study states.

- For 49% of firms, finding a better digital solution is primary fraud prevention plan

Our research found that legacy tools, limited resources and internal knowledge gaps make the DIY approach risky and fraught for many companies, which leads them to seek expertise.

In fact, nearly half (49%) 49% say finding a better digital solution for fraud prevention is their primary fraud prevention plan.

In addition to more B2B firms now partnering with third-party anti-fraud specialists, the study states that companies using “proactive, automated solutions … were the least likely to be impacted by fraud-related concerns.”

Partner and solution choice matter beyond the obvious, as “the wrong anti-fraud toolset also impacts user experience: Survey respondents reported that fraud-related concerns caused customers to report that it was difficult to maintain business relationships with them — an additional concern for companies banking on user experience to drive growth.”

Get your copy: Reframing Anti-Fraud Strategy: Developing A Proactive Approach To Fraud Risk Management