While cryptocurrency’s popularity has not skyrocketed as quickly as was expected in some early predictions, it has experienced steady growth, and that trend is not likely to abate.

A PYMNTS survey of United States crypto owners found that 30% had used crypto for online purchases in the past month, while 21% used crypto for purchases in physical retail locations in the same time period.

Still, crypto purchases at brick-and-mortar stores are unlikely to be made with direct cryptocurrency transactions, instead often employing Mastercard- and Visa-branded crypto cards or third-party processors such as Cash App and PayPal. Seventy-four percent of in-store crypto purchases were made using digital wallets, compared to 66% made using debit or prepaid cards. Even for online purchases, the specific rails on which crypto payments are made vary. Among the 30% of surveyed crypto owners who said they used it for online purchases, 70% used digital wallets while 54% used debit or prepaid cards.

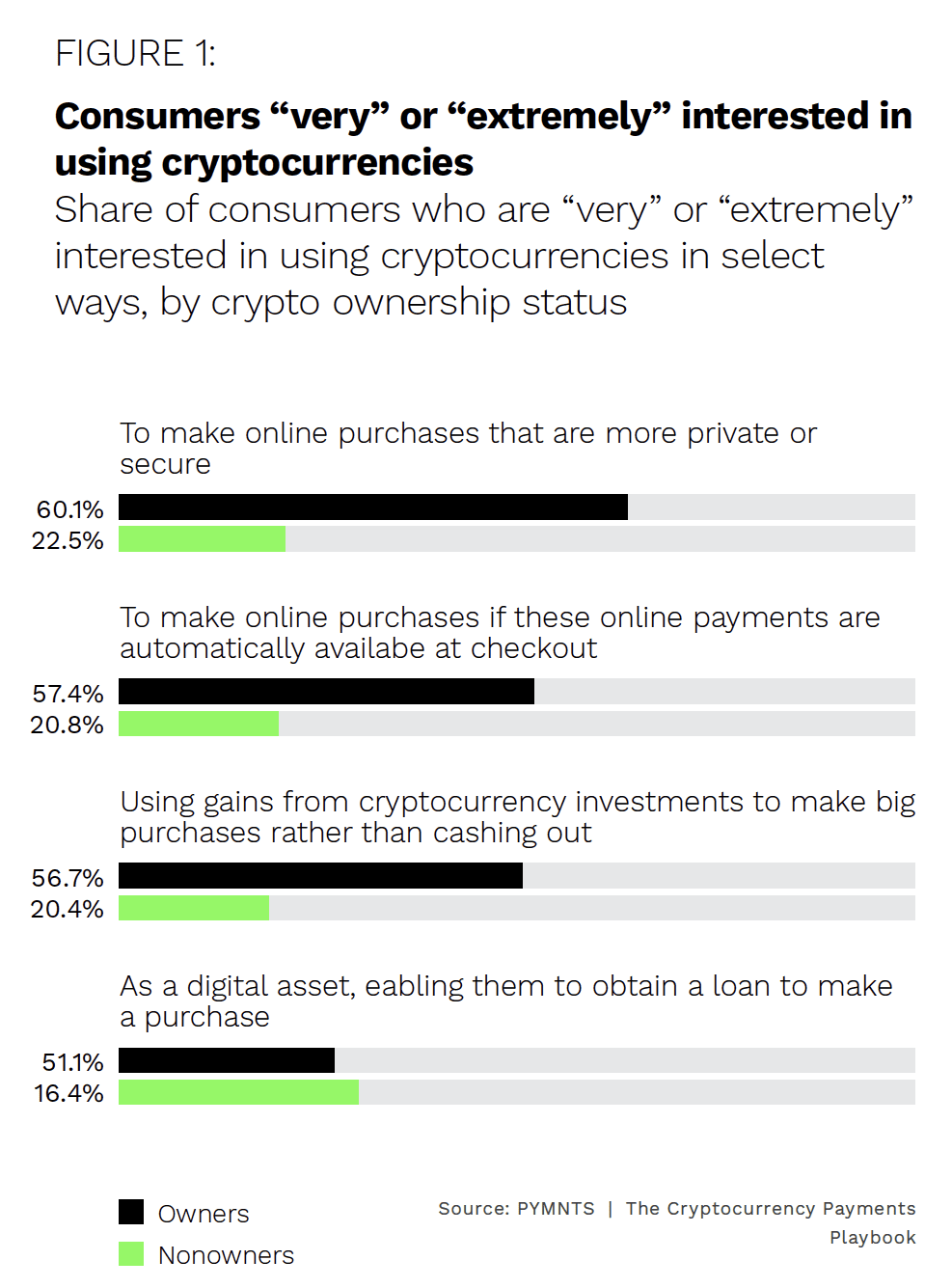

Regardless, interest in direct crypto payments is growing for a variety of reasons. Among surveyed consumers, just over 42% said they would be interested in using cryptocurrency to make financial services transactions more secure, while more than 40% said the same for real estate transactions.

Meanwhile, more than 39% said they would be interested in using crypto to make clothing and accessory purchases more efficient, and 37% cited the same reason for using crypto in travel and leisure purchases. Other consumers see crypto as a way to eliminate third parties from their transactions, and 40% said they would want to use crypto for real estate purchases to cut out “middlemen” — the highest percentage citing that reason.

As consumer demand for crypto payments evolves from a preference to an expectation, an understanding of cryptocurrencies and blockchain technology is quickly becoming a necessity for businesses involved in payments at all levels. This month, PYMNTS looks at the basics of blockchain and the cryptocurrency payments ecosystem, examining the challenges and opportunities they present for payment speed, security and reliability.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Breaking Down the Blockchain

While first-generation blockchain and distributed ledger technologies (DLTs) proved the feasibility of cryptocurrency trading, clearing and settlement, early approaches to the technology were energy-intensive, impractical to scale and slow, with each transaction taking 10 minutes or longer to complete. Early iterations also lacked cross-platform standards and were limited to simple transfers of value, without conditional transactions or contingencies. Many of the limitations of blockchain and DLTs have been tied to the proof-of-work consensus mechanism, which relies on involved and resource-intensive computations to ensure transactions’ legitimacy. This is the source of the high energy costs often associated with cryptocurrency transactions as well as the significant amount of time each transaction can take to complete.

As with any technology as it matures, various stakeholders, from academic institutions to entrepreneurs, are aggressively addressing the limitations of blockchain and DLT platforms. This has led to significant, ongoing innovation, resulting in greater usability and speed as well as more efficient cryptographic verification processes that consume fewer resources while still creating a high level of security that keeps data private. In addition to the environmental benefits and faster transaction times that come from that, improved verification processes have also enabled lower transaction fees.

By using more efficient approaches such as proof-of-stake protocols, it is possible to reduce the environmental impact of crypto transactions while also making improvements to their speed without sacrificing security. Speeding transactions and making them more efficient actually lowers the quantity of resources required, and as efficiency goes up, transaction fees go down. Additionally, newer-generation protocols permit greater scalability, adding to the technology’s usability by both businesses and individuals.

Building Consensus on the Blockchain

Among surveyed cryptocurrency owners, 68% said that crypto transactions are faster than other payment methods and 58% said they believe blockchain payments are also safer. Nevertheless, while 91% of surveyed United States consumers said they have some awareness of cryptocurrency, those who have never owned crypto do not share owners’ level of faith in its benefits. Only 40% of all consumers surveyed consider crypto a viable currency for making purchases, and approximately half of all respondents expressed concerns that crypto might be too risky. One-third even said cryptocurrencies are too complicated to become mainstream, yet all respondents’ concerns appear to correlate with a lack of having owned crypto.

On businesses’ part, concerns related to regulation and demand influence willingness to offer crypto payment options. As regulations related to crypto transactions begin to solidify and demand continues to rise, incentives will grow for businesses to offer crypto payments.

Proliferation of crypto payments throughout various marketplaces is also likely to spur growth in third-party solutions that make integration more feasible for a wider range of businesses. As a result, blockchain and other DLTs are anticipated to generate additional business opportunities and use cases, with 80% of survey participants saying they expect their industries to see new revenue streams related to blockchain, digital assets or cryptocurrency solutions.