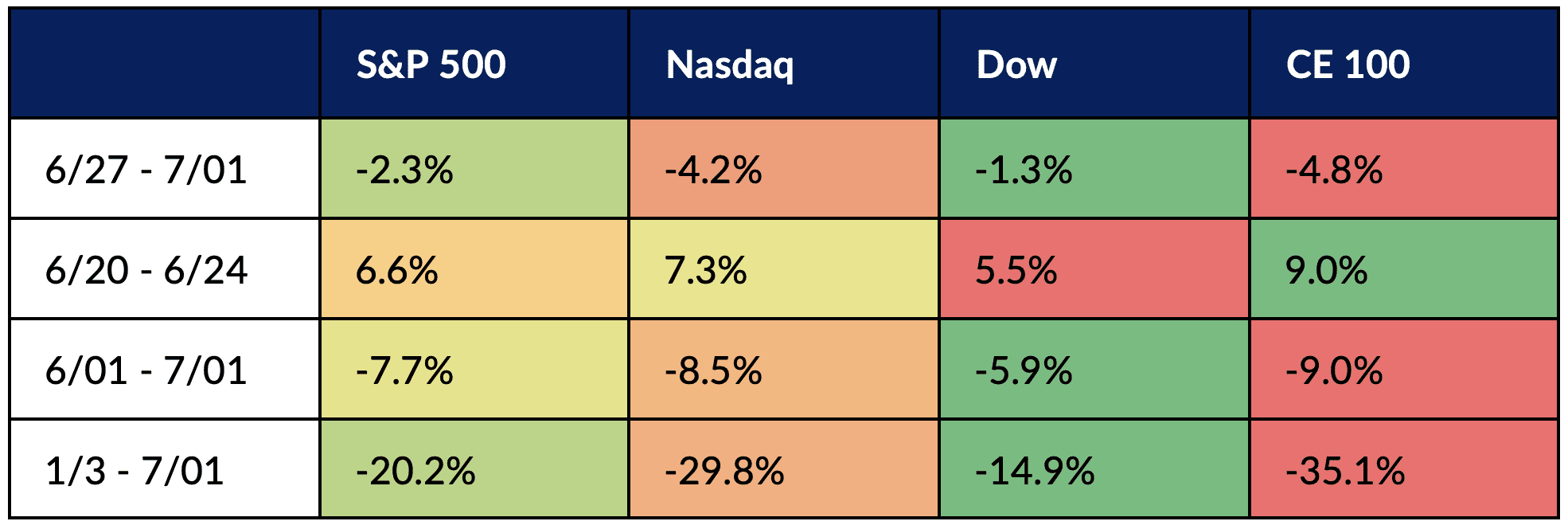

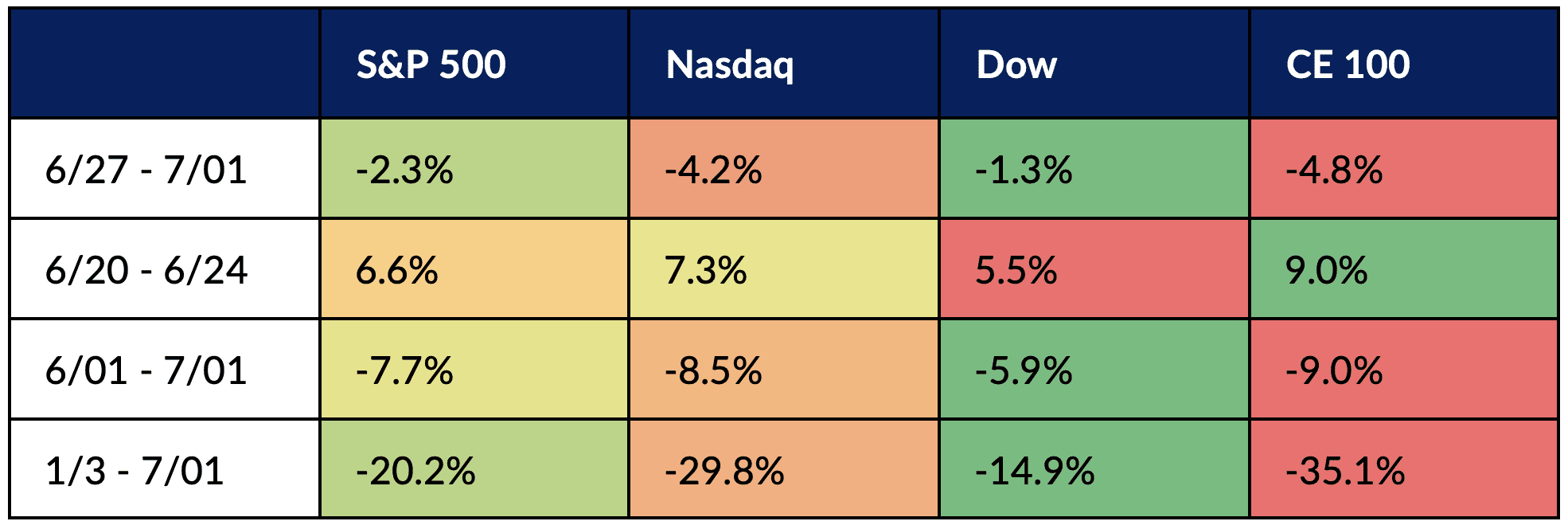

The Connected Economy 100 Stock Index (CE100 Index™) wound up closing out the second quarter, and the year to date, with a performance that far outpaced its benchmark, broader index brethren.

But now, the downside.

To get a sense of how bad it really was, consider the fact that for the week headed into the end of the quarter, the index declined 4.8% through the week, outpacing the Nasdaq’s 4.2% slide — and six months in, we can say this is a year that many investors would look to forget.

CE100 Relative Performance

Source: PYMNTS

Source: PYMNTS

All pillars decreased on the week, but we can see that the “Eat” pillar was down “only” 10 basis points, which in this environment might be tantamount to a breather — at least from the seemingly inexorable down trend.

Advertisement: Scroll to Continue

Olo gained 4% on the week and YUM Brands gained 2%, which helped to blunt other declines seen in the vertical.

Work-Related Names Hit Hard

The worst performers were in the “Work” segment, which plummeted 7.3%, followed by the communications group, which lost 6.8%.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

WeWork was the most notable decliner in the most notably declining (work) group, having given up about 19.7% for the week. That came despite the fact that earlier in the month, Credit Suisse initiated coverage on the name with an outperform rating and an $11 price target.

DocuSign lost 11% on the week, having been buffeted by news that CEO Dan Springer would be resigning from that role. That C-suite move comes in the wake of a prolonged decline in the stock price and the fact that, per the latest earnings report, DocuSign sees 8% billings growth in the works, a marked decline from the 15% growth rate that had previously been forecast.

Within the communications names, Snap, well, snapped a bit, losing more than 10%. The company announced this past week that the Snapchat picture-based texting app is launching a subscription service that will essentially be an enhanced version of its traditional advertising-funded platform.

The service will be called Snapchat+, and it will make “a collection of exclusive, experimental, and pre-release features available in Snapchat,” according to a company press release. While standard Snapchat accounts are free, Snapchat+ will cost $3.99 per month.

See also: Snap Launches Snapchat+ Subscription Service

Moving beyond any single sector’s performance, Affirm was off more than 26%. Inflation continues to be a concern in a world where taking on debt and more financial obligations — as consumers are ever-more stretched — may signal trouble ahead. Apple, of course, remains a formidable emerging competitor.

Shopify lost 18.5%, in a week that followed a busy month of news headlines regarding new products and services. Among the latest examples, the company is introducing tools — including those for B2B — to compete with Amazon.

Read more: Shopify Enters B2B eCommerce Market to Compete with Amazon

Additionally, through its partnership with Twitter, Shopify merchants are now able to display their wares in Twitter profiles, displaying as many as 50 items. Twitter also has a sales channel devoted to Shopify merchants.

Source: PYMNTS

Source: PYMNTS Add as Preferred Source

Add as Preferred Source