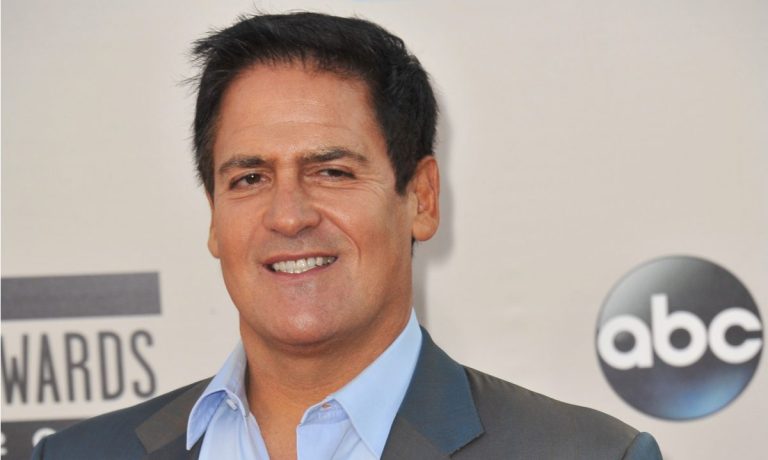

Billionaire Mark Cuban is being sued over allegations that he misled investors to put money into now-bankrupt crypto lender Voyager Digital, a class-action lawsuit filed in Miami states, calling the platform “a massive Ponzi scheme.”

“The Deceptive Voyager Platform is based upon false pretenses, false representations, and is specifically designed to take advantage of investors that utilize mobile apps to make their investments, in an unfair, unsavory, and deceptive manner,” the 92-page complaint against Cuban and co-defendant Stephen Ehrlich, the founder and CEO of Voyager, alleges.

In addition, the suit describes the saga that ultimately cost investors an estimated $5 billion as “a house of cards, built on false promises and factually impossible representations that were specifically designed to take advantage of the cryptocurrency craze to the direct detriment of any ordinary investor.”

In answer to PYMNTS’ emailed request for a response sent to Cuban’s office in Dallas, Scott Tomlin, VP of Basketball Communications for the Dallas Mavericks, said the team had no comment.

For its part, Voyager filed for bankruptcy in July as one of the biggest casualties to emerge from the 6-month slump of bitcoin and the cryptocurrency markets that wiped out an estimated $2 trillion in valuation since last November when the market peaked.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Voyager’s troubles stemmed from a $650 million loan it made to Three Arrows Capital, which defaulted on a loan in June and was subsequently forced to go into liquidation and suspend deposits and withdrawals, leaving it unable to pay back the debt.

Advertisement: Scroll to Continue

After Voyager filed its own bankruptcy protection in July, last week a New York bankruptcy judge said Voyager could return $270 million in cash to its customers from crypto assets and other holdings that are now tied up in court.

Read more: Bankruptcy Court Says Voyager Digital Can Return $270M to Customers

According to the report, Voyager told the court it had $1.3 billion in crypto assets on its platform, along with another $350 million at the bank where it held the deposits and $110 million in its own cash and crypto assets.

Prior to that, the Federal Deposit Insurance Corporation (FDIC) issued a stern warning to Voyager in late July telling the crypto platform to stop “making false or misleading representations” to its customers that their funds were FDIC insured.

For all PYMNTS crypto coverage, subscribe to the daily Crypto Newsletter.

Add as Preferred Source

Add as Preferred Source