Maybe it’s a case of saturation. Maybe it’s a case of wanting to return to the office somewhere, somehow — just to get a glimpse of other humans in person and get a cup of coffee in person, rather than virtually.

And maybe the exotic locales beckon to work from somewhere other than the home office.

But: slowing growth is slowing growth.

PYMNTS’ data shows that since the toughest days of the pandemic, with the huge tailwinds underpinning working from home, keeping that momentum would be a challenge, to put it mildly.

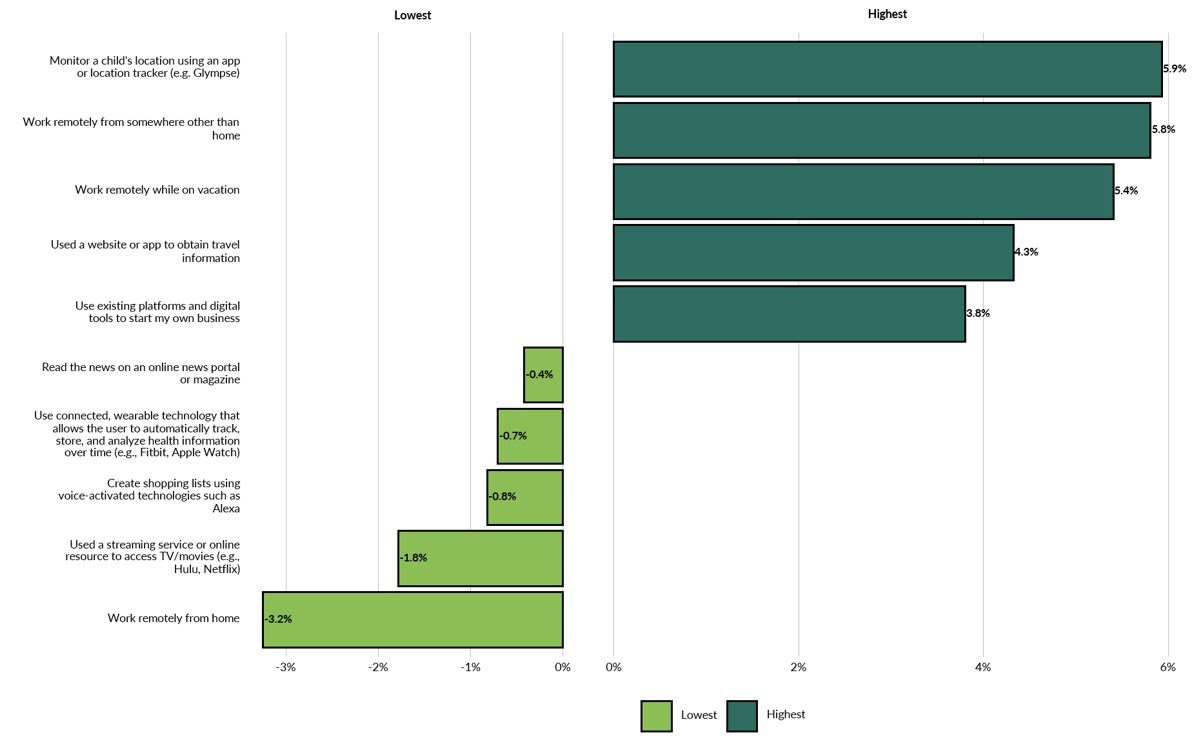

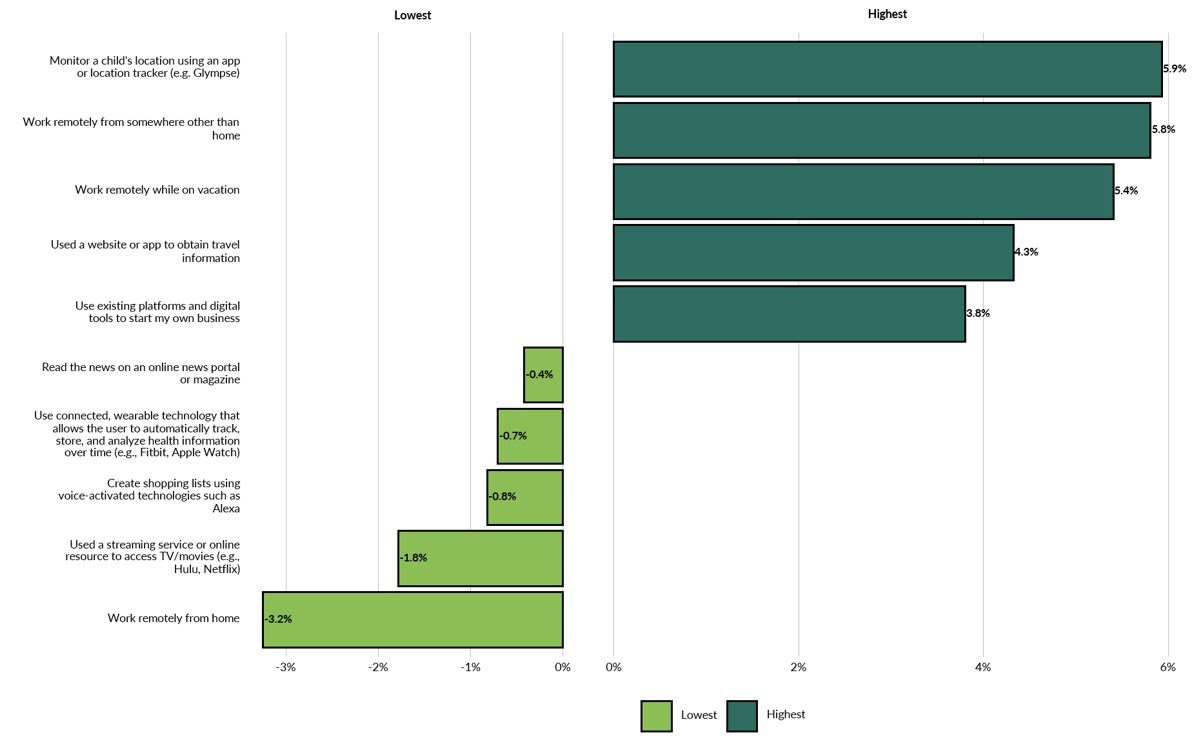

In fact, as detailed in recent research, and among the 5 activities that more than 2,700 consumers have added or removed from their daily online routines — measured from November 2021 to July 2022 — working remotely from home slipped 3.8%.

Working remotely from somewhere other than home gained 5.8%.

Advertisement: Scroll to Continue

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Percentage Change in Daily Online Engagement (Nov. 2021 to July 2022)

The read across here, connecting those data points, is that, give or take a few percentage points, is growing only a bit. The other read across is that online activity itself, overall, is slowing (we can see from the chart above that even use of streaming media has slipped a bit over the past eight months).

Zoom’s results, released Monday after the market close, shows other evidence of negative impact from the dollar, yes, but also a slowdown from its larger enterprises, and looks for a downright decline in the Online business, which is the segment that is focused on smaller businesses and the consumer, the individuals and the families that use the service to call one another. The online business has seen lower new subscriptions, said management on the call.

Headwinds in the Online (Consumer) Business

That business, management said on the earnings call to discuss results, should see a decline of as much as 7% to 8% in the current year. In addition, sales to larger enterprise customers will grow by more than 20% this year.

“We’ve moved beyond the pandemic buying patterns,” said Steckelberg, and she noted that the enterprise business has returned to a “pre-pandemic” linearity.

Greg Tomb, Zoom’s president, said that larger transactions are seeing “extra sets of eyes” and deals go through, with the implication that firms are examining their tech spending a bit more closely in the current macro environment, and at least some spending is getting deferred. Earnings supplementals from the company show that total enterprise customer accounts came to 204,100, which equates to 18% growth year over year, down from 160% seen five quarters a year ago.

But by guiding to roughly flat revenues in the current quarter and 7% growth for the remainder of the year (at the midpoint of guidance), Zoom is signaling that customer behavior is changing.

Add as Preferred Source

Add as Preferred Source