Modernizing a $4 trillion slice of the U.S. economy totaling about 20% of GDP is an ambitious task, to say the least.

But while “curing healthcare” has long stood as one of the most complex and costly projects on the nation’s to-do list, the size of the prize — both monetarily and societally — is so massive and enticing that many marquee names in the platform space are lining up for a slice of the transformation.

Among a raft of highly visible players, Amazon in particular has again upped the ante in the overhaul process, all at a time when many thought it might be having second thoughts on the sector.

A Need for Speed

The drive to consumerize the sector comes as the digital shift is changing the ways in which we pay, as is the desire for consumers to have a speedy and streamlined experience in navigating their daily financial lives.

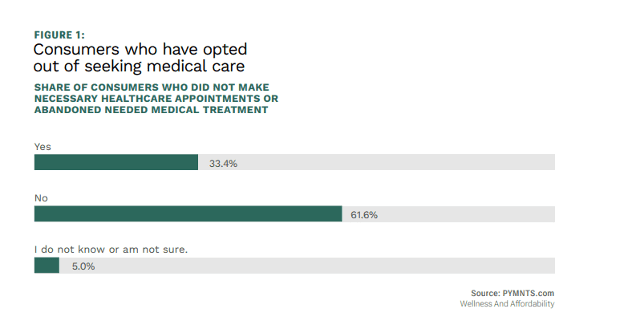

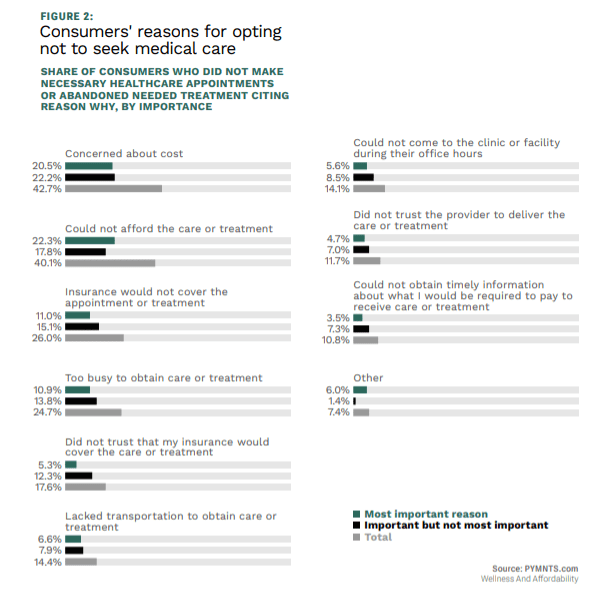

As detailed earlier this year in the “Wellness and Affordability” report done in conjunction between PYMNTS and CareCredit, a significant percentage of consumers are putting care on the back burner, daunted by cost. The chart below shows that a third of consumers opted not to receive the medical care they needed. Roughly 21% of consumers have said that cost was the most significant reason.

As many as 22% of consumers said that they outright could not afford the treatment itself; a smaller percentage said they weren’t able to receive timely information about what they would need to pay.

Thus, affordability and transparency remain top of mind for patients. And the platform model may be able to address both issue across online and offline channels, as it is the vehicle that can bring patients and providers together, with some payments flexibility in the mix.

Installment Options

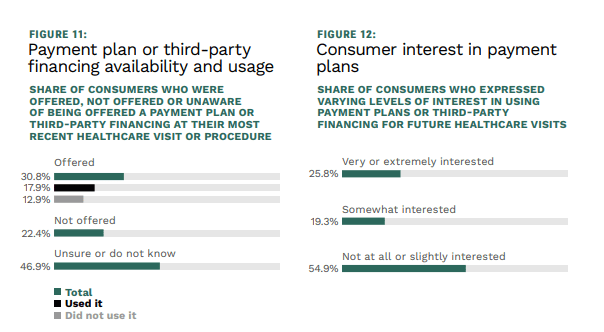

Consumers are becoming more attuned to installment plans, with that option offered at the point of checkout in commerce. The model extends naturally to healthcare, where the out-of-pocket costs are usually considerable. About half of consumers say they’d interested in taking on payment plans. And yet only a third of consumers have been offered them.

The sunsetting of the Amazon Care initiative, which the company announced earlier this week, paves the way for faster payments. And for installment plans, too, through its ongoing partnership with Affirm. The eCommerce and technology giant has reportedly been eyeing a bid to acquire home healthcare provider Signify Health, which would bring care more fully into the home health setting. At the same time, it realizes that the world has gone omnichannel, so its $3.9 billion buy of One Medical gives immediate presence in 200 locations nationwide for on-site care.

As for the omnichannel jockeying between large commerce firms, Walmart has physical presence with more than 4,000 stores in the U.S. — logical anchors for an ever-growing number of pharmacies and clinics.

The need to bring some flexibility into the healthcare realm comes as inflation continues to roar, and as consumers continue to throttle back on what they spend their funds on.

As found in our recent report “Consumer Inflation Sentiment: July 2022 — Consumers Pull Back and Prepare for the Long Haul,” 70% of consumers told us they will be paring back on retail purchases. In the paycheck-to-paycheck economy, data this past week from PYMNTS showed that 46% of customers that could not access traditional credit options used BNPL offerings to make purchases they could not have afforded otherwise. We’d augur that healthcare would fit nicely into that mix.