“Mobile banking apps are no longer about simple transactions and balance checks. They need to provide users with end-to-end banking capabilities, including everything from money movement [and] opening accounts to full-service interactions with bankers. [As if that were] not difficult enough, [they need to offer] a seamless, easy-to-use experience.”

Eric Brandt, strategic market analyst, NCR

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

Consumers Increasingly Want to Use Banking Apps to Handle All Aspects of Their Financial Lives

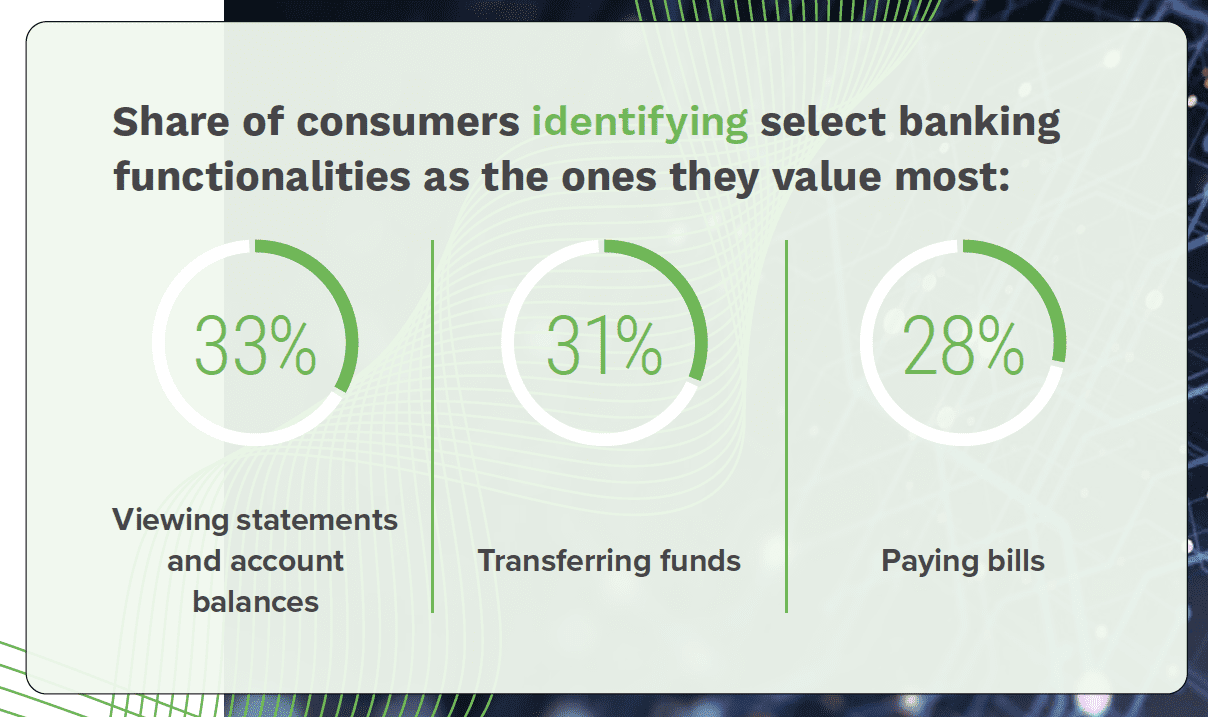

Consumers are using their banks’ mobile banking apps to handle a diverse range of their banking needs. Unsurprisingly, consumers are using these apps to handle the bulk of their day-to-day banking needs. When asked what mobile app features they value most, a plurality of respondents identified standard banking practices.

Consumers are using their banks’ mobile banking apps to handle a diverse range of their banking needs. Unsurprisingly, consumers are using these apps to handle the bulk of their day-to-day banking needs. When asked what mobile app features they value most, a plurality of respondents identified standard banking practices.

The desire for mobile banking apps is so great that many consumers select their banking partners based on the banks’ mobile and online banking capabilities, with 40% of consumers saying this is the most important factor. In contrast, only 27% of respondents referenced the convenience of a physical branch as the most important factor.

Consumers want to use mobile banking apps to do more. While consumers want to use their banking apps to handle standard banking needs, there is a marked interest in using these apps to do much more than just simple banking.  A growing share of consumers want to use their banking apps to handle almost all their financial needs, including making peer-to-peer (P2P) payments, finding ATMs and budgeting and tracking their finances.

A growing share of consumers want to use their banking apps to handle almost all their financial needs, including making peer-to-peer (P2P) payments, finding ATMs and budgeting and tracking their finances.

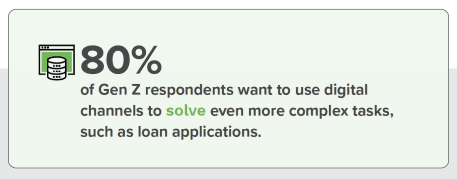

Mobile banking apps should offer consumers dynamic, personalized experiences. There is an overwhelming desire for mobile banking apps that provide a more dynamic and personalized experience to handle many complex financial tasks. For example, 93% of consumers want personalized financial assessments from their banks, while 15% are frustrated they cannot complete a loan application using their banks’ messaging services, according to one survey. In addition, 63% want their financial services providers to proactively help them manage their finances, according to a separate survey. The desire for personalized mobile banking experiences to handle more complicated banking needs is more pronounced among younger generations.

while 15% are frustrated they cannot complete a loan application using their banks’ messaging services, according to one survey. In addition, 63% want their financial services providers to proactively help them manage their finances, according to a separate survey. The desire for personalized mobile banking experiences to handle more complicated banking needs is more pronounced among younger generations.

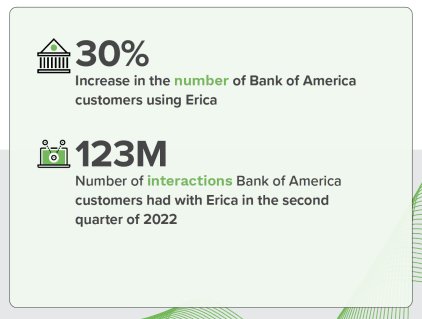

Banks should provide chatbots and virtual assistant capabilities. In effect, consumers increasingly want their mobile banking apps to function as digital assistants of sorts. Consumers who have grown more accustomed to using virtual assistant tools such as Siri or Alexa in recent years are now expecting similar experiences when conducting their financial affairs. The use of Bank of America’s virtual assistant app, Erica, for example, has skyrocketed since 2021.