A few words sum up the state of fraud and the challenges facing financial institutions (FIs): rising at a fast clip.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

In the report “The State of Fraud and Financial Crime in the U.S.,” a PYMNTS and Featurespace collaboration, 200 executives from a range of FIs with assets of at least $5 billion revealed heightened awareness about money laundering and other financial fraud — and the need for innovation to detect and prevent it.

Ninety-five percent of AML executives said they consider it a “high priority” to use advanced technologies in those efforts. But as many as 85% of those queried also expressed some concerns about the challenges of embracing those same technologies.

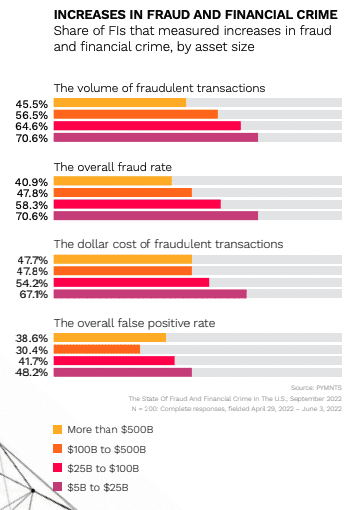

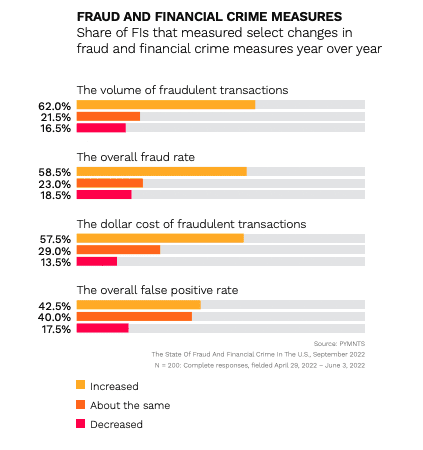

The study found that losses from fraud average about 1.29 basis points per transaction. Overall, 59% of the firms that were surveyed said they had experienced an overall increase in fraud rates in the past year. Small firms were hardest hit, with a full 71% reporting an increase. Meanwhile, only 23% of respondents said they had experienced fraud rates that were “about the same” — hardly an encouraging sign.

Dollar amounts lost to fraud — and the false positives raised by their in-place processes — are on the rise too.