Real-time data. API-driven connectivity. Speedy analytics. The advantages of technology in the service of B2B activities — streamlining back office functions — are readily apparent.

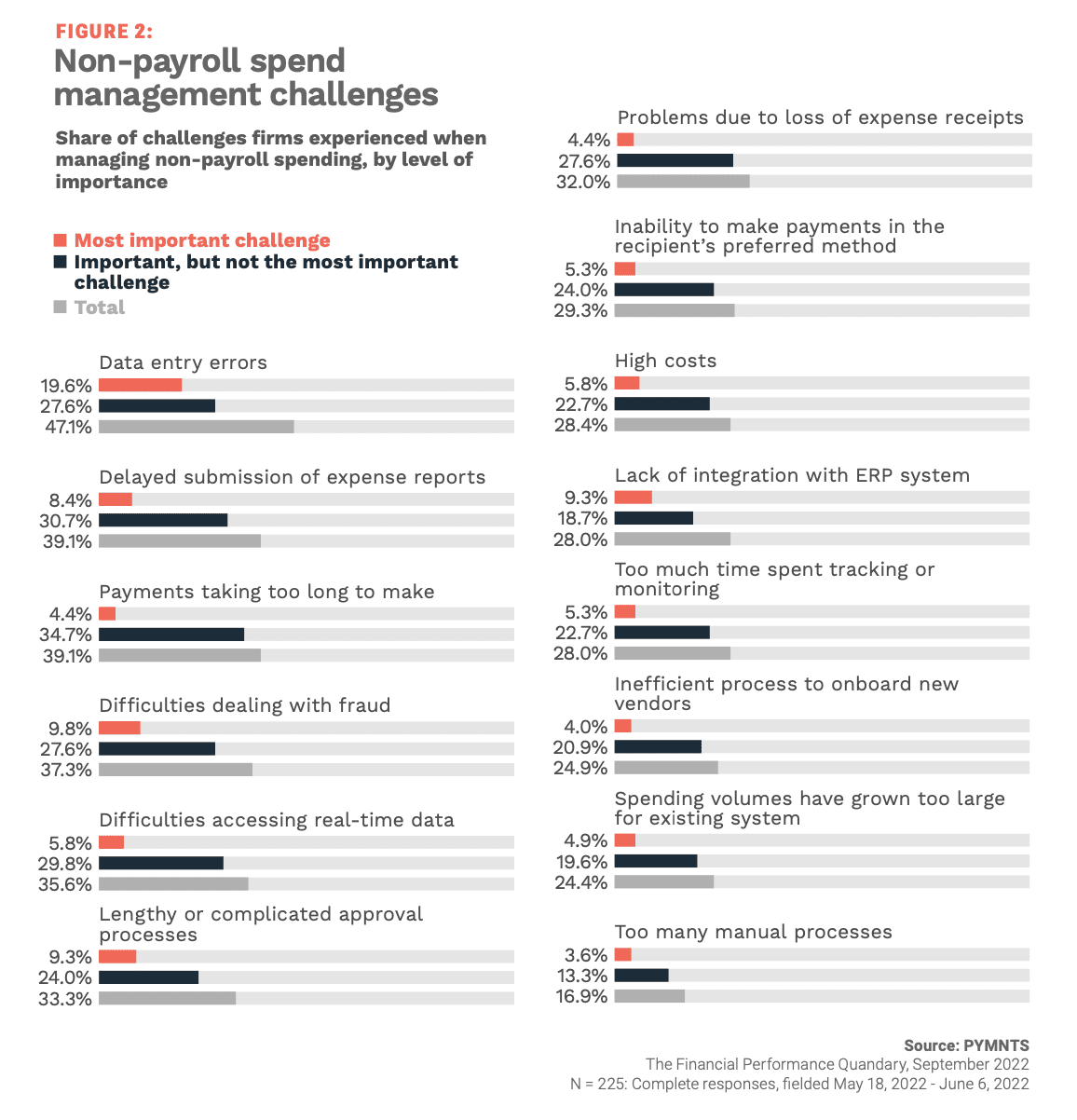

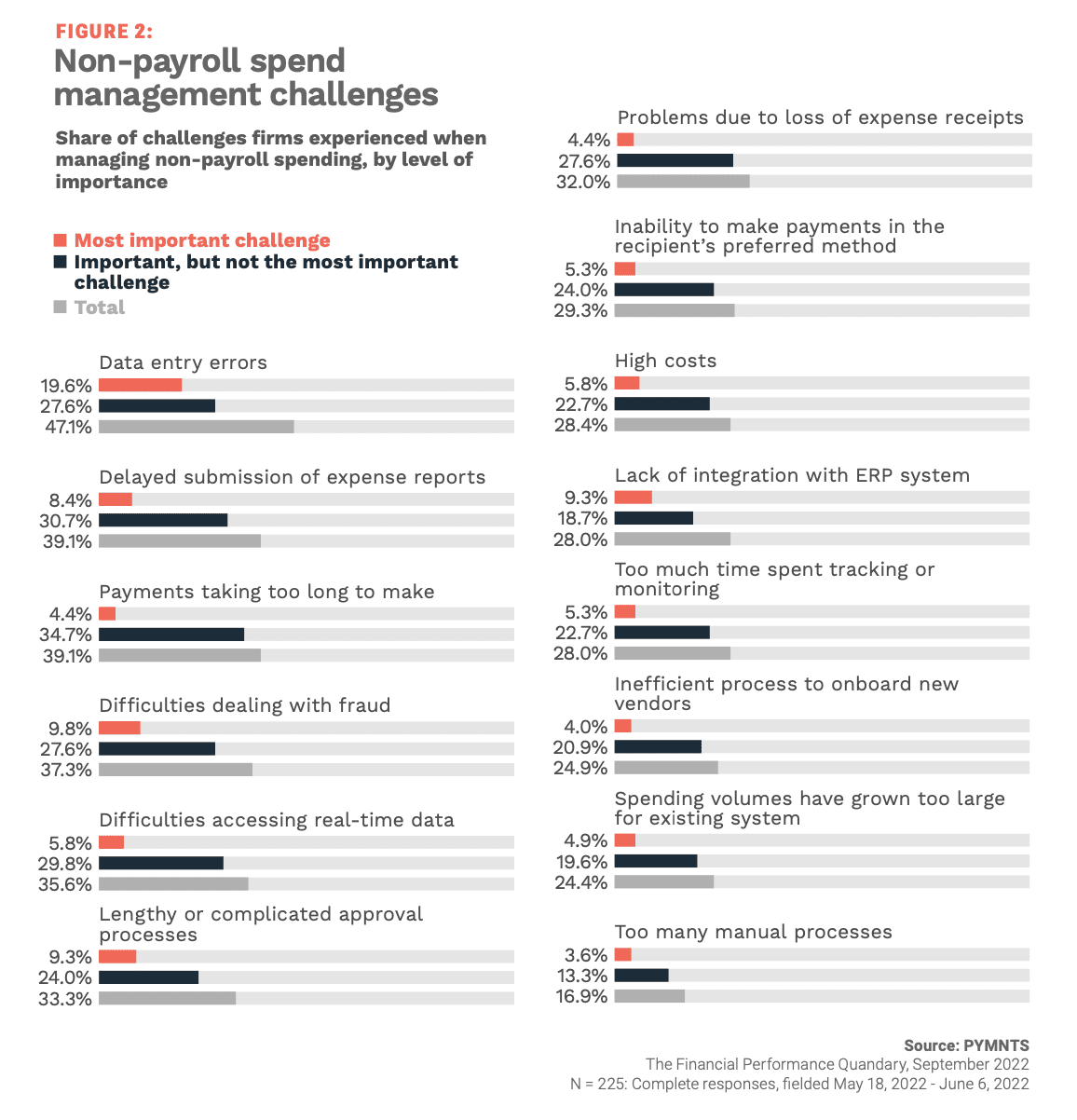

Especially when it comes to better managing non-payroll spending, as relayed by our joint survey of 225 Software-as-a-Service (SaaS) firm executives.

As noted in “The Financial Performance Quandary Report,” done in collaboration between PYMNTS and Airbase, technology allows finance teams to gain a better handle on the cash in and cash out of a firm, and gives, ultimately, a real-time view of how effectively resources are being deployed.

But visibility is a key hurdle, as the data show, where non-payroll spending, in particular, can be tough to manage. There is still reliance on manual data entry, which leads to data entry errors. The report shows 47% of firms currently face data entry errors when managing non-payroll spending, and 20% of executives cite it as the most important challenge. The problem especially bedevils 62% of small companies consider data entry errors to be a problem. Accounts payable (AP) teams must manage wasted spend, including zombie, unauthorized, unwanted, duplicative or unnecessary spending, which leads to less than optimal firm performance.