Personalization Becomes Competitive Advantage for Digital-First Banks

The importance of digital banking is about to grow. Spurred by the closure of almost 3,000 physical branches in the United States in 2021, customers say they expect 61% of their banking business to be digital by 2024, with the biggest increases consisting of more ATM- and mobile-facilitated transactions.

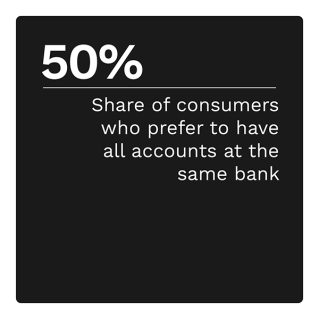

Personalization of the banking experience can play an important role in helping to win consumers over to digital-first and mobile banking. While the branch is unlikely to disappear altogether, digital banks have a major opportunity to win consumers’ trust by becoming more customized and experience-oriented. Simply put, consumers want highly personalized banking experiences.

The “Digital-First Banking Tracker®” explores how personalization and automation tools are changing how we do business and how these tools can help keep small companies afloat.

Around the Digital-First Banking Space

Banks are rolling out personalized insights and customized app dashboards for online and mobile banking users. These new dashboards display up-to-date

account information and allow for quick navigation to frequently used features, making the mobile customer experience easier and more useful. Additionally, banks are using notifications to help keep their customers on top of things, with 29% of banks already sending proactive notifications to let customers know if they have low cash balances or are at risk of overdrafts. For those looking to track their spending habits or income sources, nearly half of the mobile apps allow consumers to break down their cash flow.

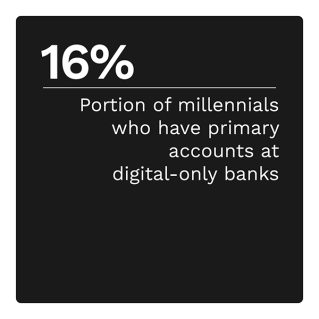

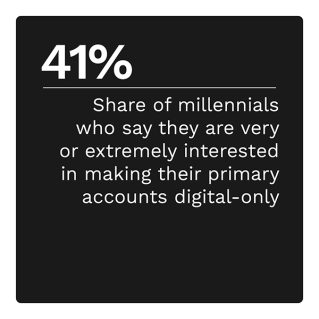

A recent PYMNTS study found that while just one in 10 consumers banks primarily at a digital-only FI, interest is rising for several demographics who find these entities better aligned with their needs. More than half — 57% — of millennials and bridge millennials say they are very or extremely interested in using digital banks in the next 12 months. Moreover, the consumers most likely to make digital-only banks their primary FIs were millennials and bridge millennials, small- to mid-sized business (SMB) owners and consumers experiencing financial hardship. Lower costs, faster transfers and more convenient, easier transaction experiences comprised the biggest reasons for consumers’ interest in switching to digital banks.

For more on these and other stories, visit the Tracker’s News and Trends section.

Keeping Small Businesses Afloat with Personalization and Automation

Small businesses are often forced to make do with limited resources, but tools such as personalization and automation can help level the playing field.

To get the Insider POV, we spoke with Grant Sahag, executive vice president at Novo, to learn more about how personalization trends are helping small businesses.

Personalized Digital Banking Builds Consumer Trust and Loyalty

With banks having closed 9% of their branches in 2021, the importance of digital banking to manage tasks once done in person has grown. Most consumers are at least curious about digital banking. Fifty-nine percent of consumers say they are at least somewhat interested in trying digital banking over the coming 12 months to explore the conveniences it offers.

To learn more about how personalized digital banking is enhancing the relationship banks have with their customers, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “Digital-First Banking Tracker®,” a PYMNTS and NCR collaboration, explores how personalization and automation tools are changing how we do business and how these tools can increase customer loyalty to grant SMB owners peace of mind.