Consumers are turning to innovative banking solutions as they never have before, with more saying they would switch or consider switching financial institutions (FIs) specifically to access innovative financial products, such as tools that offer personalization. Consumers want their FIs to innovate — but in a highly personalized way. Data-driven insights are the solution.

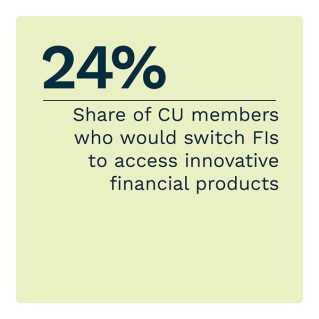

Nearly one-quarter of CU members say they would switch FIs to access innovative products and services. Another 50% want these innovative products but would not move to a new FI for this reason — yet. However, as the industry changes, an increasing number of consumers are eyeing innovation when deciding where to bank.

This edition of the “Credit Union Tracker®” explores how credit unions are using data to generate insights for personalization and innovation of member experiences.

Around the Credit Union Space

Twenty-eight percent of consumers who recently changed banks said they would recommend a credit union to a friend, while 21% would suggest a FinTech. This puts CUs almost on equal footing with traditional banks, as only 30% of customers who switched in the last five years would recommend opening a traditional bank account. Given a growing shift in sentiment toward both CUs and FinTechs, some banking leaders believe this places both in a position to challenge the dominance of traditional banks. Many consumers see credit unions as a more trustworthy alternative to banks — especially now that CUs can offer modern, dynamic digital banking services.

Forty-four percent of consumers in a recent survey said they wished their banking service was more personalized. The personalization trend is one for FIs to watch, as 75% of their customers say they are drawn to challengers such as FinTechs. Fifty-two percent of consumers said their current banking experiences were not “fun,” and 48% said they lacked emotional connection with their banks. Enhanced data governance can enable FIs to collect proprietary customer data. Combining that with artificial intelligence (AI) and machine learning (ML) will allow FIs to build personalized strategies to identify, retain and engage consumers.

For more on these and other stories, visit the Tracker’s News and Trends section.

We’d love to be your preferred source for news.

Please add us to your preferred sources list so our news, data and interviews show up in your feed. Thanks!

UNIFY on Its Data-Driven Crypto Product

In a world awash in consumer data, credit unions have a unique opportunity. While selling this data to third parties is an often permissible and largely profitable endeavor, CUs have the option of using it another way: harnessing it to design, develop and release new product offerings tailored to members’ needs.

To get the Insider POV, we spoke with Greg Glawson, chief information officer at UNIFY Federal Credit Union, to learn more about harnessing member data for product design.

Member Data Fuels Personalized Innovation

Personalization has become the watchword in banking today. Most credit unions have realized the need for a data-driven strategy in decision-making, as efficient use of the data they already have can provide valuable insights into their members’ needs.

To learn more about how credit unions can use innovative tools to create stronger relationships with their members, read the Tracker’s PYMNTS Intelligence.

About the Tracker

The “Credit Union Tracker®,” a PYMNTS and PSCU collaboration, explores how credit unions leverage data to move toward offering the more engaging, personalized experiences that members now demand.